The Energy Consulting Group

Management consultants for upstream oil and gas producers and service companies

Ukraine At Risk: An Oil and Gas Perspective

Maps and Graphs Illustrating the Crisis in the Ukraine

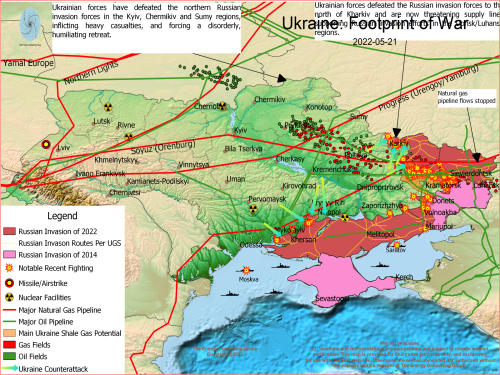

Russia Invades Ukraine: The Footprint of War Please contact us at insight@energy-cg.com for a georeferenced version of this map. For Larger, Higher Resolution View, Click Image |

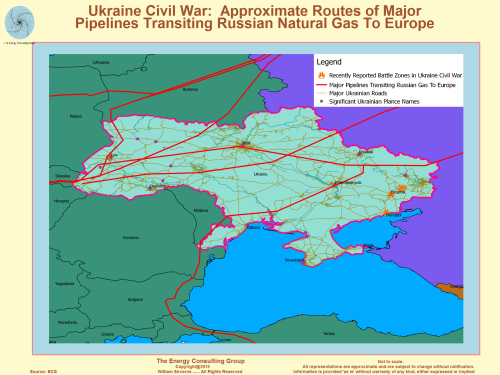

The

footprint of the Russian invasion of the Ukraine cuts across all but

one of the major natural gas pipelines transiting the Ukraine to

take gas from Russia to Europe. The infrastructure, such as

compressor stations, that support these lines, as well as the lines

themselves, are easily damaged, so given the proximity of combat, a

major disruption of service is quite possible. Collectively, these

pipelines - the Soyuz, Progress, and the part of the Northern Lights

pipeline that transits the Ukraine - handle about 1/3 of the gas

shipped by Russia each year to Europe. Given this importance to

European, and, therefore, world energy markets, we are tracking

where the fighting is relative to these lines. As presented in the

map above, the military situation has evolved such that it appears

that the risk to the Soyuz amd Progress lines has been reduced after Russian forces

were pushed out of the northern Ukraine. Though still at risk from

missile or air strikes, the threat of combat directly on

or adjacent to the lines in and around the Kyiv and Sumy areas appears to

be low. Now, the greatest threat of combat damage appears to have

shifted to the eastern Ukrainian portion of the Soyuz line, which

carries gas from Orenburg/West Siberian fields. That said, it is

being reported that the heaviest fighting between

Ukrainian/Russian forces is to the southwest of the line, so is not

coincident with the line, reducing the risk of combat related

damage. For earlier Ukraine related energy news go here. |

|

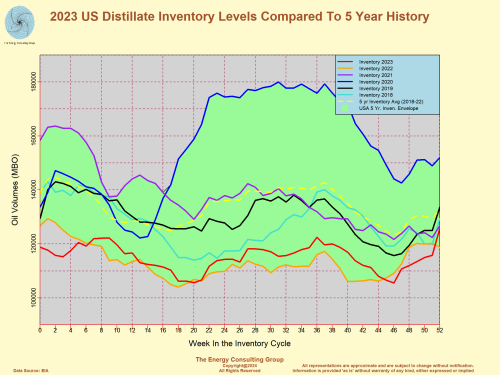

US Distillate Inventory Levels Compared with 5 Year History For Larger, Higher Resolution View, Click Image |

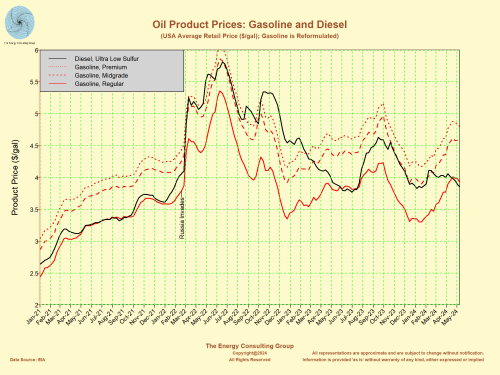

US Oil

Product Retail Prices: Gasoline and Diesel For Larger, Higher Resolution View, Click Image |

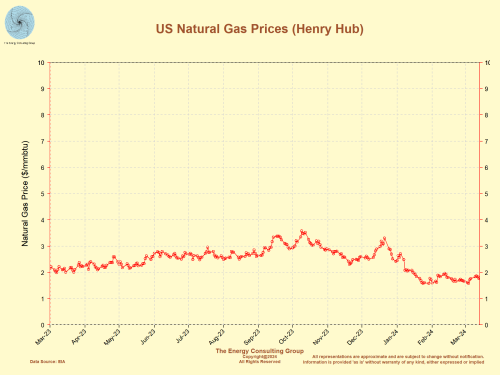

Recent US Henry Hub Natural Gas Prices For Larger, Higher Resolution View, Click Image |

|

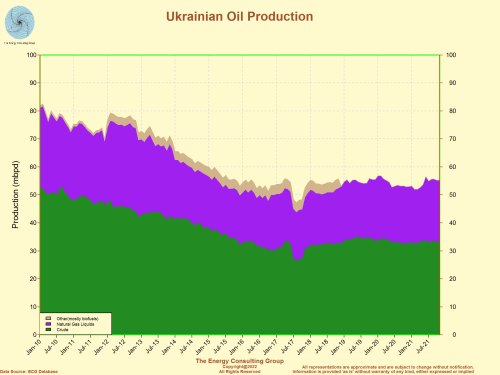

Ukraine Oil Production  For Larger, Higher Resolution View, Click Image |

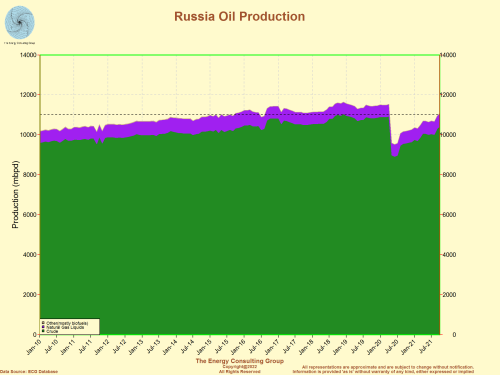

Russian Crude Oil, Condensate, NGL's, and Biofuels Production  For Larger, Higher Resolution View, Click Image |

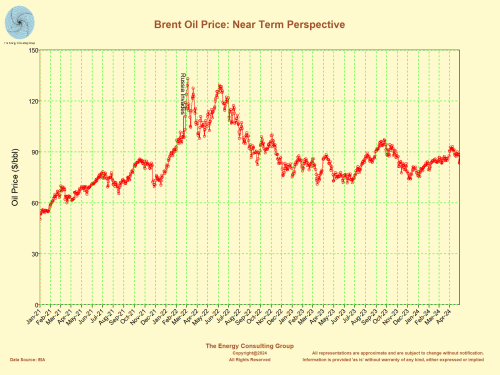

Brent Oil Price and the Invasion of the Ukraine  For Larger, Higher Resolution View, Click Image |

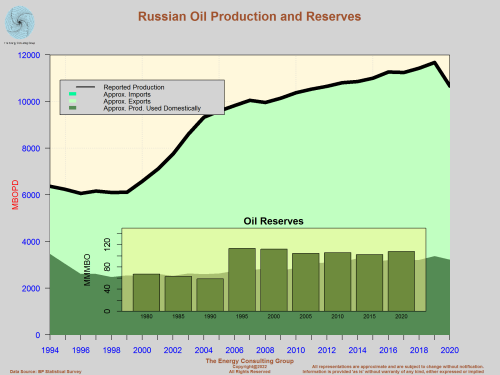

Russian Oil Production, Exports and Reserves

Click on the image for full size version. |

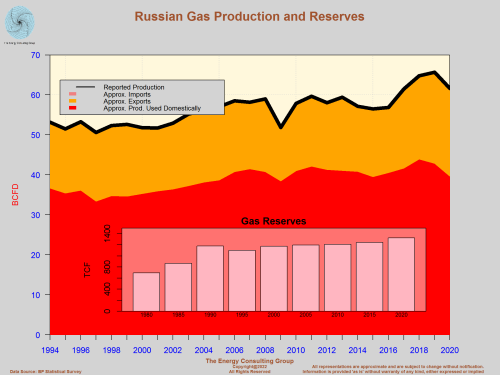

Russian Natural Gas Production, Exports and

Reserves Click on the image for full size version. |

Click

here to go to a multidimensional map of the Crisis in the Ukraine This is an interactive map, so we've found it helpful to use "Layers" to allow us to focus on what it is we want to study. For example, if one wants to see the map unhindered with the names of the cities, simply go to Layers in the upper right hand corner and click on the tirangle; go to Ukraine_UrbanAreas_BigLables, click on the triangle; and then uncheck visible. The city names will then no longer be shown. Online 3D Map Controls: to rotate, press left mouse button and move the mouse, to zoom in/out, press down on the mouse wheel and move the mouse, and to roam, press down on the right mouse button and move the mouse. |

| Go here to visit prior status maps starting February 27, 2022 | ||

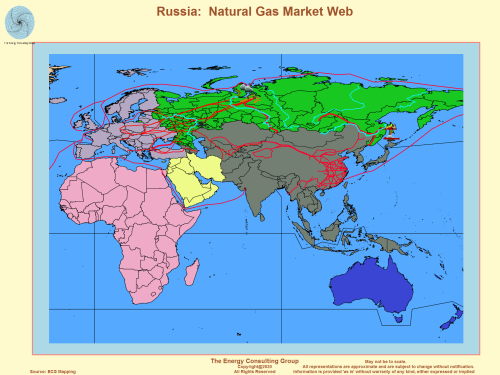

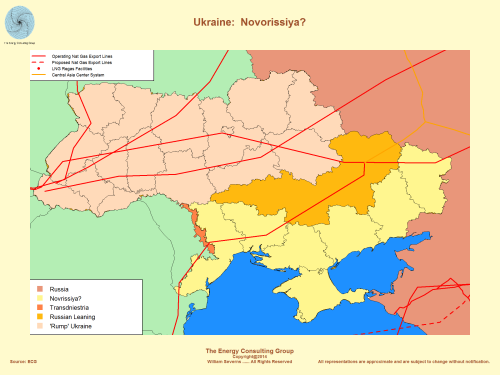

Russia has been strategically developing its natural gas resources to isolate Ukraine and to make it more difficult from an economic perspective for the Unitied States and its allies to assist.  Click on the image for full size version. |

Though many focus on Nordstream I and II as

key to the effort to economically isolate the Ukraine, it's actually

of a piece with Russia's LNG strategy (Arctic and Sakhalin), and the

buildout of the southern

Turkstream and Blue Stream export lines. Click on the image for full size version. |

|

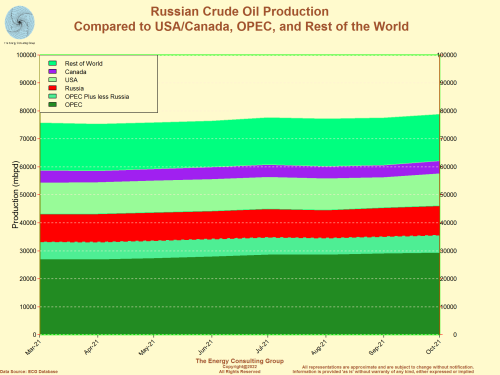

Russian Crude Oil Production In Comparison

to Production of USA, Canada, OPEC, and Rest of World Click on the image for full size version. |

The Ukraine conflict is centered on the differences between the eurocentric area in western Ukraine, and the Russian centric area in the eastern Ukraine. These differences were dramatically illustrated when the Russian friendly prime minister was deposed by pro-European protestors in early 2014. Concerns over this change in political leadership led Russia to annex the Crimea, and to support a rebellion by the eastern Ukraine provinces that have majority pro-Russian populations.

| Russia Accidentally Reveals Its Massive Ukraine Body Count | |

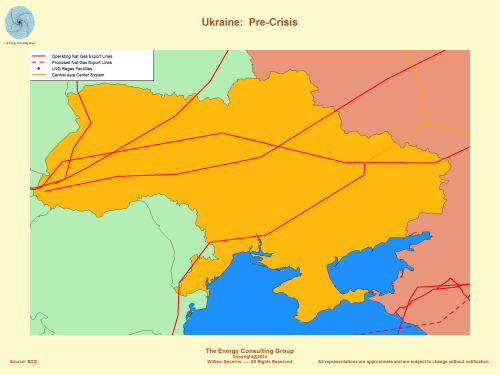

Ukraine Civil War: Pre-Crisis Base Map Click on the image for full size version. |

Ukraine Civil War: Approximate Route of Major Pipelines

Transiting Russian Natural Gas From Western Siberia to Europe Click on the image for full size version. |

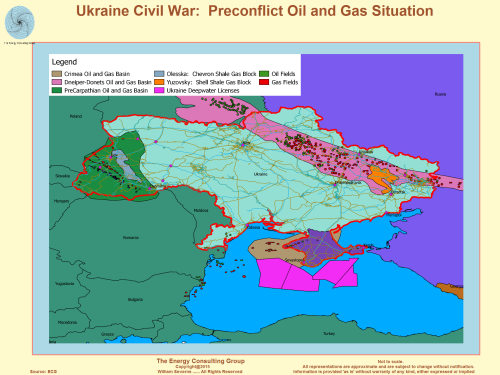

| Ukraine Civil War: Pre-Conflict Map Showing The Primary

Oil and Gas Producing Areas in the Ukraines. Also shown are the nascent shale development blocks. The two shale blocks are Yuzovsky (Shell) and Olesska (Chevron)  Click on the image for full size version. |

The map to the left

illustrates the Ukraine oil and gas situation before Russian annexation of the Crimea. We

created this map to provide perspective on where Ukrainian oil and gas regions are in

relation to the rest of the Ukraine. The primary onshore oil and

gas productive regions are the Dneiper-Donetsk and Pre-Carpathian Basins.

The primary offshore area, and the one most prospective for new, large

conventional oil and gas reserves, is the Black Sea-Crimea Basin. Also

presented on the map are the two large shale gas concessions previously awarded

by the Ukrainian government:

Olesska awarded to Chevron, and

Yuzovsky awarded to Shell. |

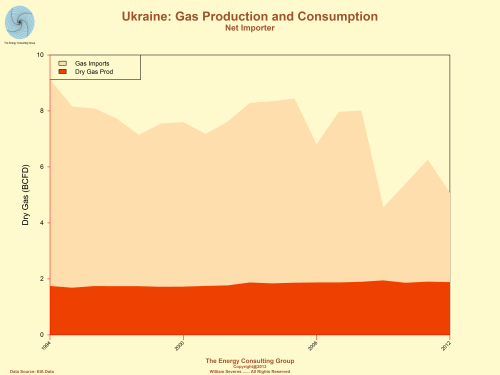

Ukraine Civil War: Ukranian Domestic Natural Gas Production

and Consumption  |

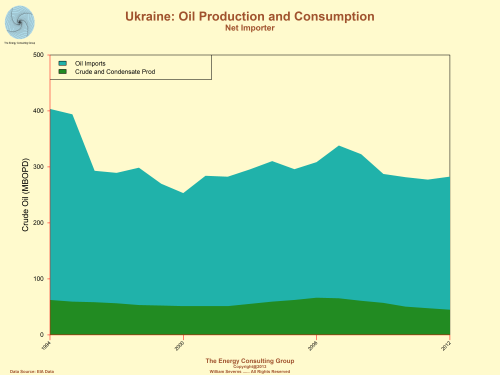

Ukraine Civil War: Ukrainian Domestic Oil Production and

Consumption |

The crisis in the Ukraine is obviously a humanitarian disaster, but it also threatens the Ukrainian government strategy of making the country less dependent upon Russia for its energy needs. As the below map illustrates, the annexation of the Crimea essentially transfered the most promising conventional (offshore) oil and gas region from the Ukraine to Russia, and the separatist movement in the eastern Ukraine threatens the Yuzovsky shale gas license. Indeed,Shell citing the violence in eastern Ukrain, has already suspended operations in the Yuzovsky license area.

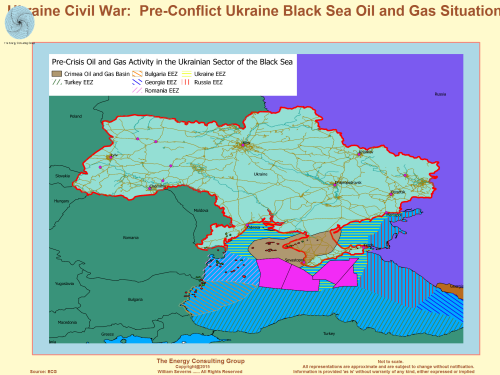

Ukraine Civil War: Pre-Crisis Map of Black Sea Exclusive Economic

Zone (EEZ) Click on the image for full size version. |

Ukraine Civil War: Pre-conflict Ukraine Black Sea Oil and Gas

Situation Click on the image for full size version. |

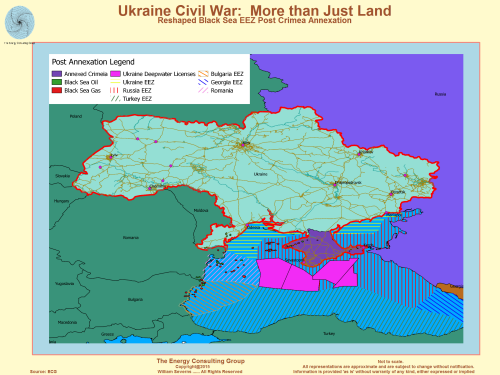

| Ukraine Civil War: More Than Just Land Potentially Reshaped Black Sea Exclusive Economic Zones (EEZ) Post Crimea Annexation  Click on the image for full size version. |

By annexing Crimea, Russia not only gains Crimea's land area, but adds large tracts of promising offshore oil and gas acreage via Crimea's offshore rights. Assuming the Crimea annexation holds up over time, Russia's Black Sea Exclusive Economic Zone would at least double, and encompass some of the most prospective oil and gas areas in the Black Sea, i.e. the deep water regions to the south of Crimea. These areas are on trend with the multi-TCF Domino discovery in Romanian waters to the west. |

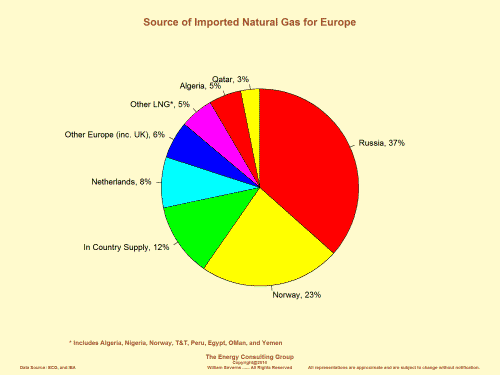

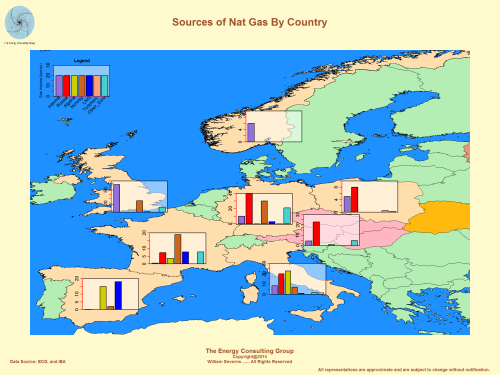

Europe beyond the Ukraine is also exposed to the crisis. The primary vulnerability is the potential for disruptions to Russian gas flows. Europe gets about 35% of its gas from Russia, with about 50% of that transiting the Ukraine. The degree of dependncy varies depending on the distance from Russia, As illustrated by the map below, the countries, several eastern European countries depend upon Russian gas for over 50% of energy needs.

Sources of Imported Natural Gas For Europe |

Sources of Natural Gas By Country |

Pre-Crisis Ukraine |

Russian Aspirations for Ukrainian Territory |

Click on the figures for a higher resolution version of the images.

Go to The Energy Consulting Group home page for more oil and gas related information.