Permian Basin Overview

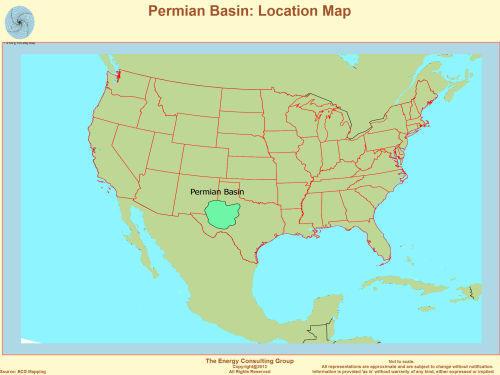

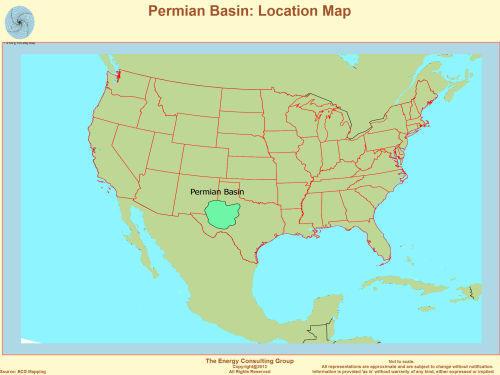

The Permian Basin is located in west Texas and southeastern New Mexico, and has been producing oil commercially since 1921. To date it has produced over 29 billion barrels of oil and 75 trillion cubic feet of gas,

and it is estimated by the industry to contain recoverable oil and natural gas

resources exceeding that which has been produced since that first well.

Permian Basin Index Map

Click For Larger Image |

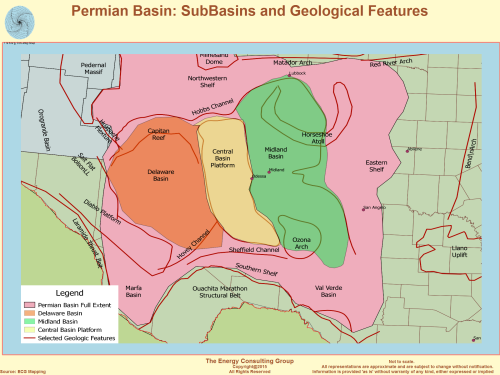

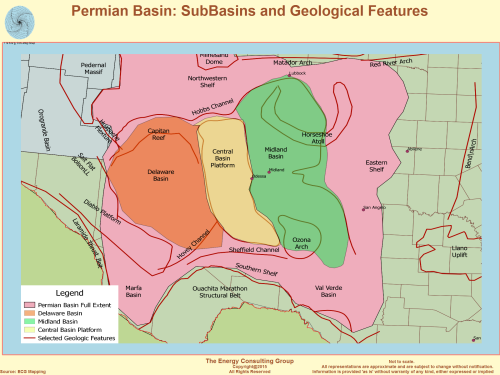

Permian Basin: SubBasins and Geological Features

Click For Larger Image |

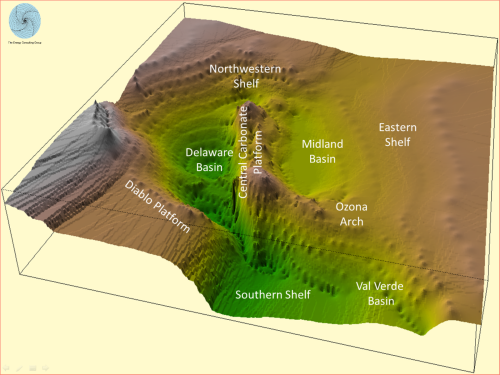

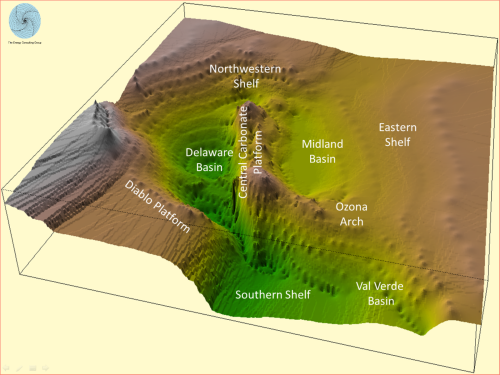

Permian Basin: Deep Structure Map

Click For Larger Image |

The map to the left provides a sense of the subsurface relief that

underlies many of the names the industry uses for different parts of

the Permian Basin. This particular map is a deep structure map,

but as is evident in the maps of the nonconventionals Wolfcamp below,

much of this relief is conserved at shallower depths. |

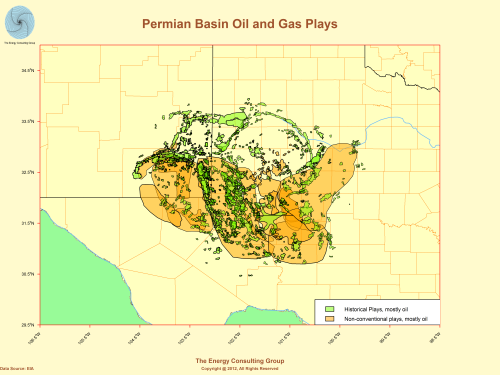

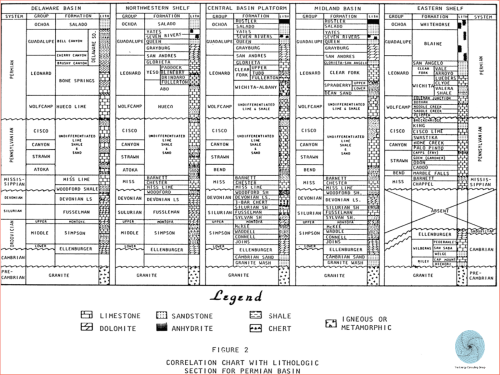

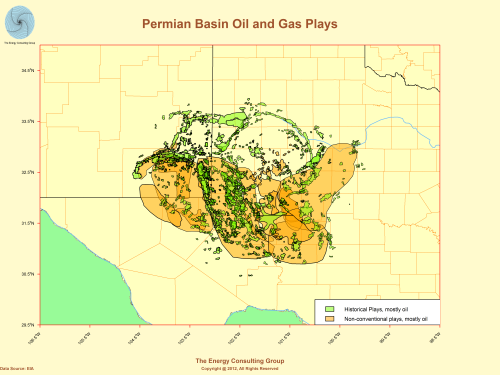

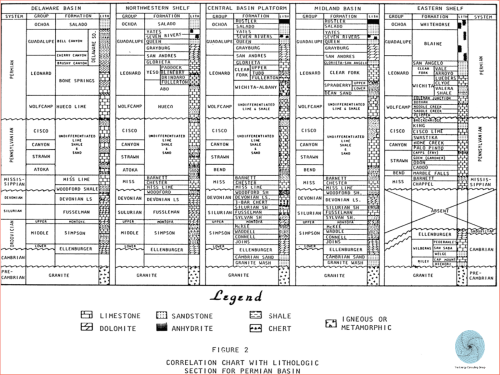

The oil and gas is contained in hundreds of distinct plays and produced from

over 7000 oil and gas fields and (some of which are shown on the map

titled, "Permian Basin Oil and Gas Plays"). For reference, we also include

a regional stratigraphic chart.

Click For Larger Image |

Click For Larger Image |

| |

|

Click For Larger Image |

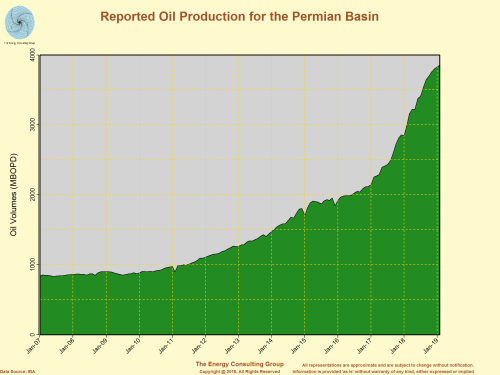

However, despite

the impressive volumes of oil remaining to be recovered from these fields, in the last decades of the 20th century Permian oil production was

flat to declining.

But, operators have successfully developed, tested and applied new technologies

to stem and reverse this trend, and are even now taking oil production to new

heights. |

Click For Larger Image |

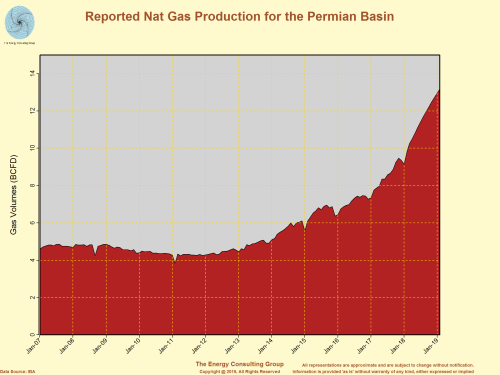

The growth in natural gas output has been just as impressive. |

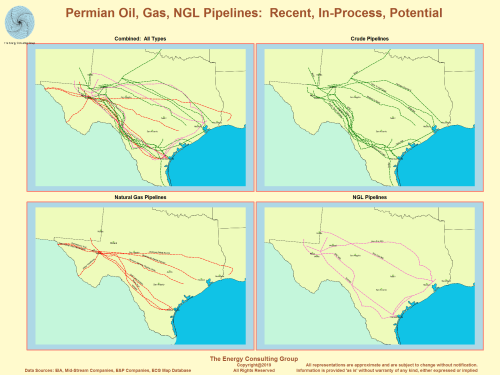

Permian Oil, Gas, and NGL Pipelines: Recent, In-Process, and

Potential

Click For Larger Image |

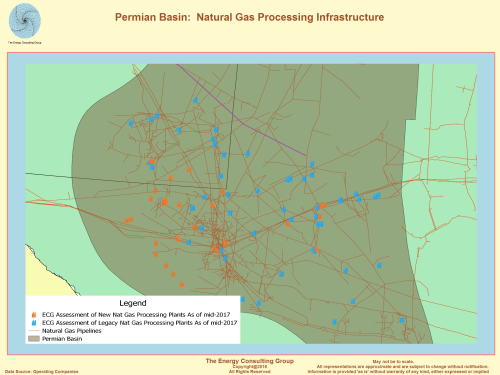

Permian Basin: Natural Gas Processing

Infrastructure

Click For Larger Image |

The rapid, voluminous growth of both oil and gas output has led to a

major infrastructure buildout to gather, process and transport the

commodities to markets. The markets are primarily on the Gulf

coast and increasingly beyond in Europe and Asia. To the left is a

map showing the various pipelines that have either been recently put in

service, are being constructed, or are being proposed.

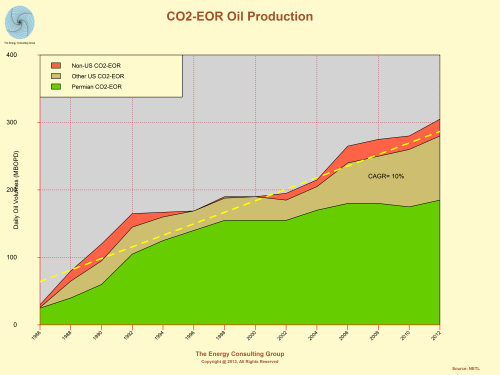

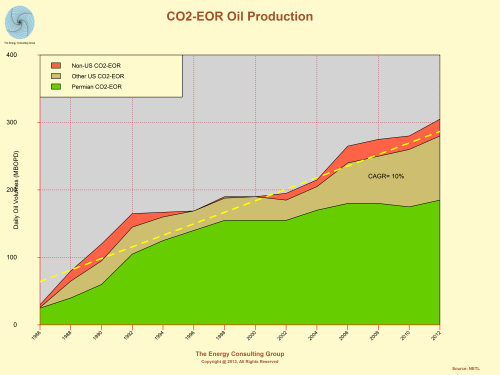

The two sets of defining technologies most responsible for returning fortune to the Basin are horizontal drilling/multistage fracing and CO2 EOR. The application of these two technological advances has not only halted the long term decline in oil production, but led to the dramatic oil production increase

apparent in the previous chart.

Return to Web Page Index

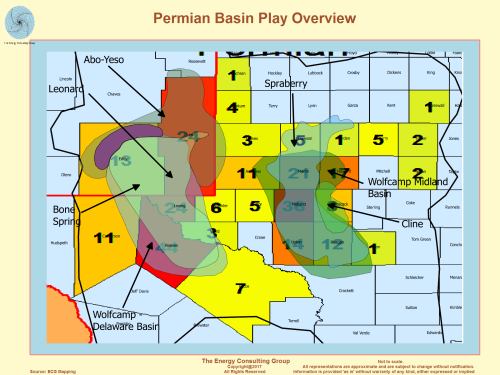

Nonconventional Plays: Permian Basin

Of these two technological forces, horizontal drilling/multistage fracing (hdmsf) is the one most responsible for the reversal of fortune. Over the past

several years, several significant horizontal plays have emerged.

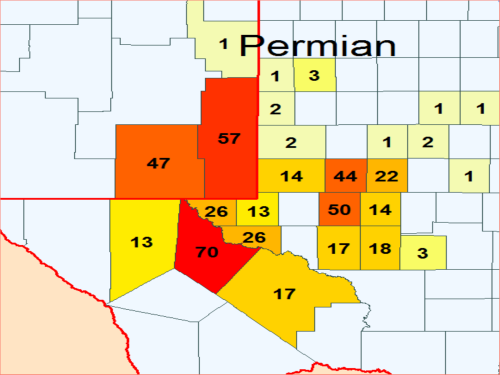

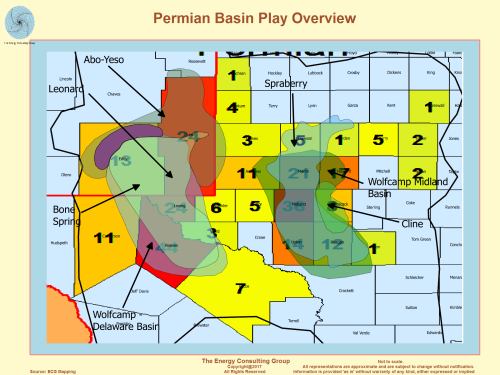

The figure to the right is a map, circa early 2017, of the Permian Basin with the estimated number

of rigs active at that time in each county listed in black. The large majority of

these rigs are drilling nonconventionals, tight oil wells, with the

more prominent of such plays outlined and labeled on the map. Of these plays,

the upper Wolfcamp in both the Midland and Delware subbasins is receiving the most attention. That said,

drilling for both the Spraberry and the Bone Springs is also quite active,

with local hotspots in both the Leonard and Avalon shales.

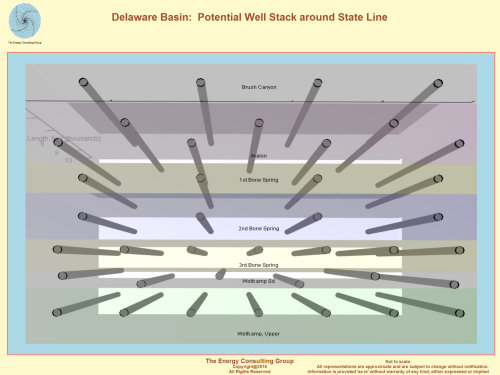

An attactive feature for the Permian shale oil industry is that in many areas,

the plays are stackable, meaning operators may be able to develop more that one

formation from a single well pad. The figure below left and titled, "Delaware

Basin: Potential Well Stack around State Line," is an illustrative 3D diagram

we developed to demonstrate the potential for stacking.

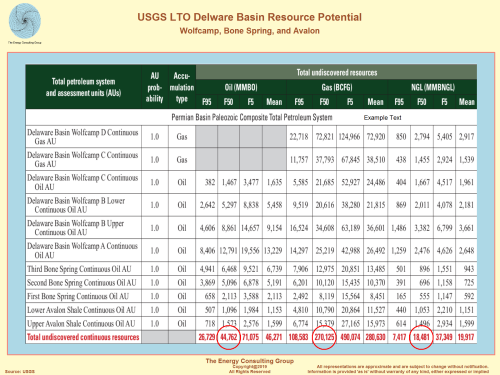

Delaware Basin: USGS Light, Tight Oil

Resource Potential

Click For Larger Image |

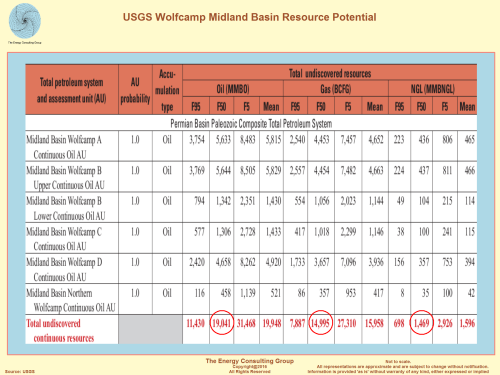

Midland Basin: USGS Light, Tight Oil

Resource Potential

Click For Larger Image |

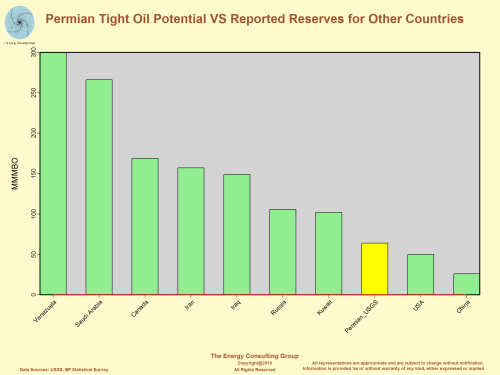

If the Permian Basin were a standalone county,

it's nonconventional oil resources would place it eighth in the world in

terms of its oil potntial.

Click For Larger Image |

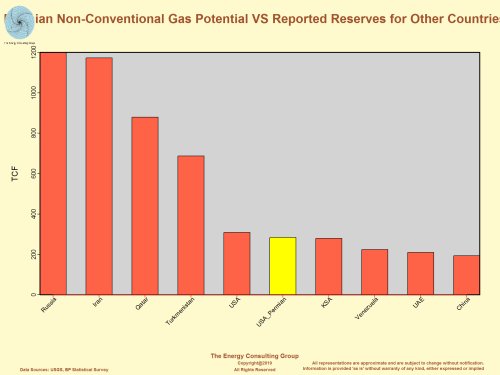

If the Permian Basin were a standalone county,

it's nonconventional gas resources would place it sixth in the world in

terms of its gas potential.

Click For Larger Image |

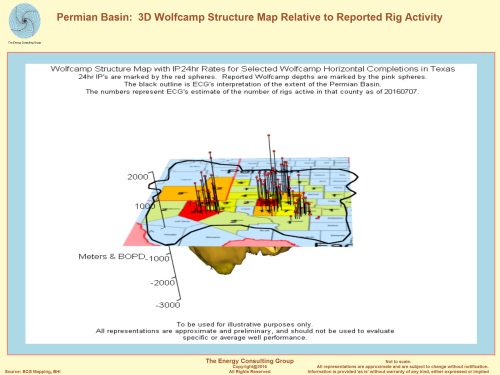

As mentioned previously, the Wolfcamp is currently the main nonconventionals

target in the Permian. To provide a sense as to the nature of the

formation, we developed a 3D map of the Wolfcamp structure, shown here.

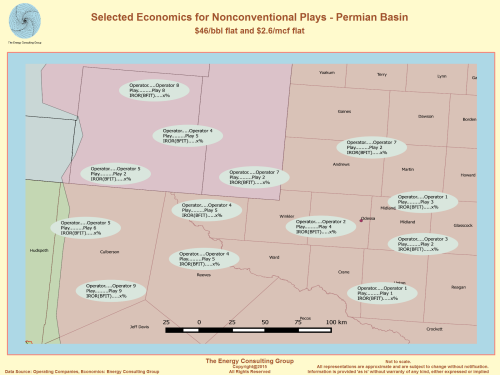

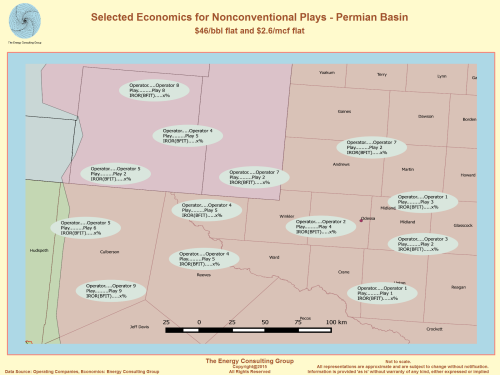

To

the left is an example of our economic comparison map. The well level

economics reflect well performance (IP's, decline curves and EUR) as

communicated by individual companies for different plays, which we analyzed

using EVAL, our proprietary economic analysis program. We have over 500 such

assessements for the Permian oil nonconventionals, starting in 2010, which provides detailed insights on not only the

economic performance of the nonconventional plays in the Permian Basin, but

also allow us to investigate questions regarding rig and well productivity

growth, impact of changes in technology, how much oil the basin is likely to

produce at different oil prices, and which firms are best positioned to exploint

the nonconventionals. And, yes, we do realize that many of the answers in

the map have been removed. If interested in the map with all the blanks

filled in please contact us at insight@energy-cg.com.

To

the left is an example of our economic comparison map. The well level

economics reflect well performance (IP's, decline curves and EUR) as

communicated by individual companies for different plays, which we analyzed

using EVAL, our proprietary economic analysis program. We have over 500 such

assessements for the Permian oil nonconventionals, starting in 2010, which provides detailed insights on not only the

economic performance of the nonconventional plays in the Permian Basin, but

also allow us to investigate questions regarding rig and well productivity

growth, impact of changes in technology, how much oil the basin is likely to

produce at different oil prices, and which firms are best positioned to exploint

the nonconventionals. And, yes, we do realize that many of the answers in

the map have been removed. If interested in the map with all the blanks

filled in please contact us at insight@energy-cg.com.

A quick note about the economic analysis program we have developed, which

in essense is our Aries equivalent. This program provides us the

opportunity to quickly assess with a high degree of granularity, the economics

at different scales of development including, individual wells, projects, regions, companies etc. and cross compare against

different development concepts, e.g. incremental economics of 1000 lbs/ft of sand

vs going with 2000 lbs/ft. Over the years we have

used this tool to track the evolution of different technologies, such as the

migration of the domestic natural gas industry away from tight gas developments

and towards shale gas, or more strategically, whether it makes more sense

(economically) to invest in the shales vs deep water or oil sands, to hi-light

just two alternatives. As a result, we have literally thousands of economic runs of

different situations be it in the Marcellus, Permian, Canada tight gas or oil

sands,

deepwater Angola, North Sea, China shale gas, etc.

The sophistication of the program comes from its ease of use, scalability and

risk handling. Its ease of use is grounded in it being spreadsheet based,

which is familiar and intuitive, meaning a new user can be up and running in

minutes. Its scalability is associated with it being able to quickly be

configured to evaluate the economics of any size project, be it a single well, a

pad, a year long campaign of hundreds of wells, or an integrated deep water

development. The risk handling feature applies the assessed risk at the

appropriate point in the project life cycle, e.g. exploration, delineation, development and

carries that risk through to the expected economics.

Return to Web Page Index

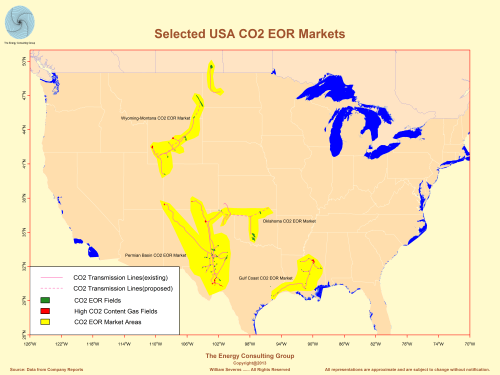

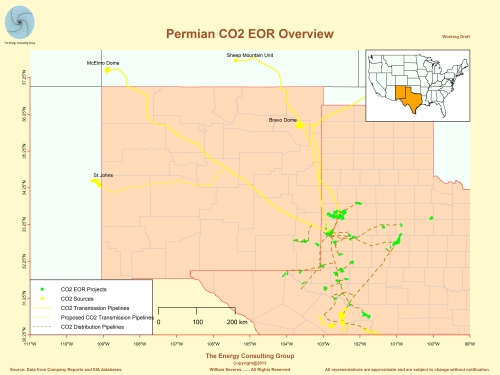

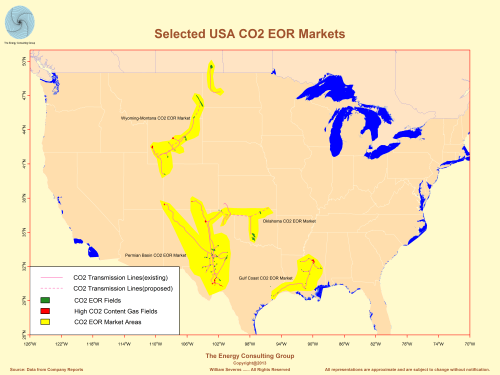

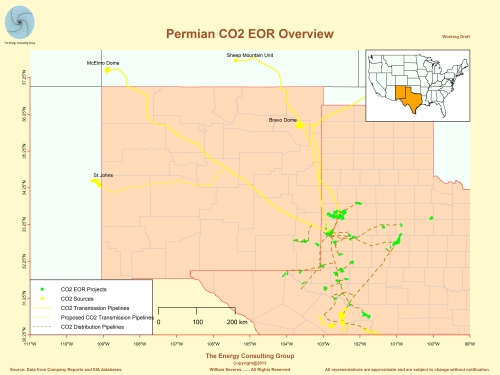

CO2 EOR: Permian Basin Overview

Selected USA CO2 EOR Regions

Click For Larger Image |

Permian

CO2 EOR Overview

>Click For Larger Image |

CO2 EOR Oil Production for the Permian Basin

Click For Larger Image |

|

Return to Web Page Index

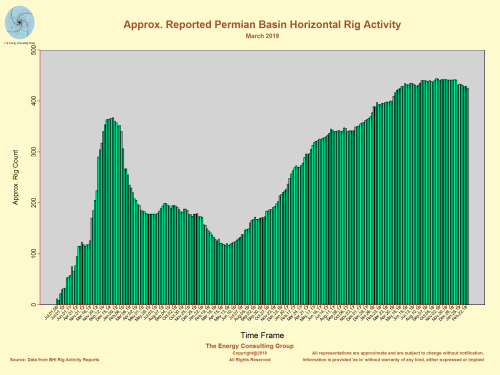

Permian Basin Drilling Activity Overview

Approx. Reported Permian Basin Horizontal Rig

Activity

Click For Larger Image |

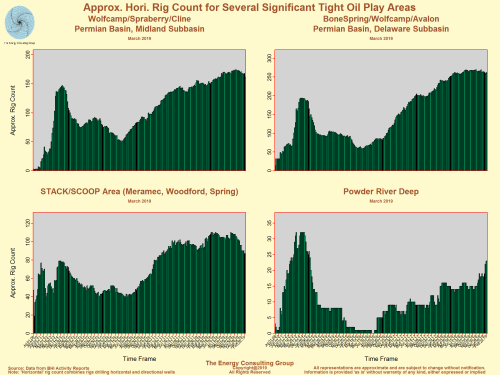

Approimate Horizontal Rig Count for Several Significant Tight Oil Play

Areas

Click For Larger Image |

Drilling Rig Activity In the Permian in March 2019

Click For Larger Image |

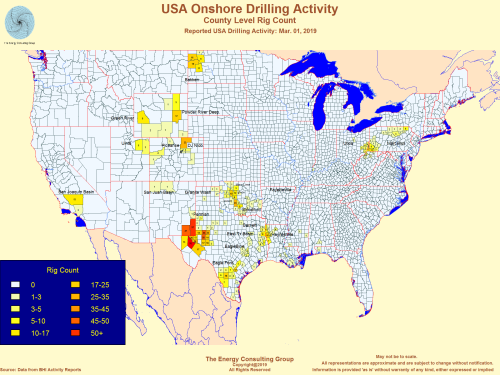

US Onshore Drilling Activity Heat Map (March 2019)

Click For Larger Image |

Click For Larger Image |

|

Return to Web Page Index

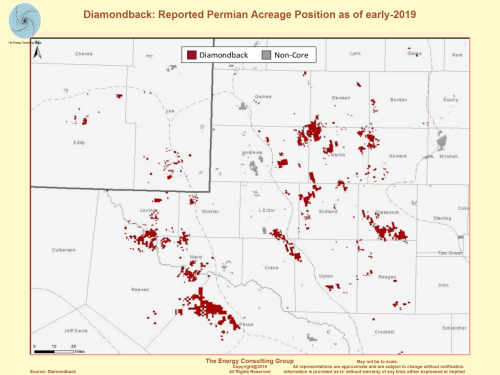

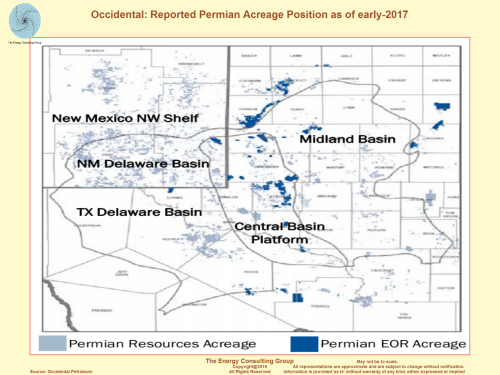

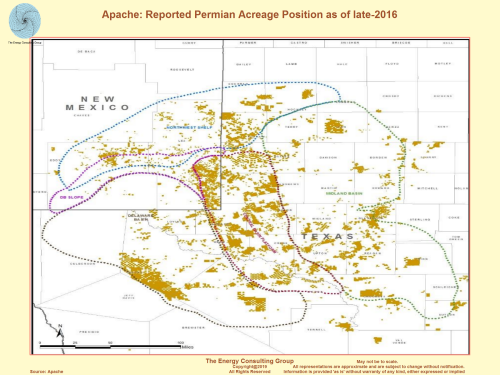

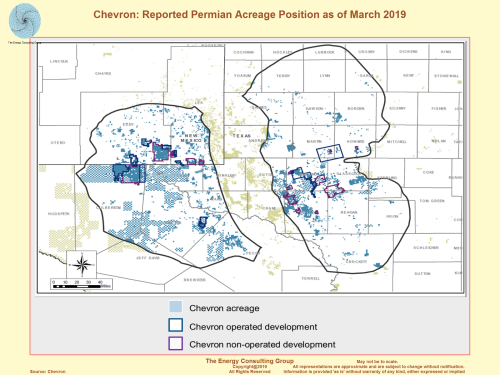

Acreage Positions As Reported By Operating Companies (The Energy Consulting Group makes

no representation as to accuracy)

Diamondback: Reported Permian Acreage Position as of

early-2019

Click For Larger Image |

Occidental: Reported Permian Acreage Position as of early 2017

Click For Larger Image |

Apache: Reported Permian Acreage Position as of late 2016

Click For Larger Image |

Chevron: Reported Permian Acreage Position as of March 2019

Click For Larger Image |

Return to Web Page Index

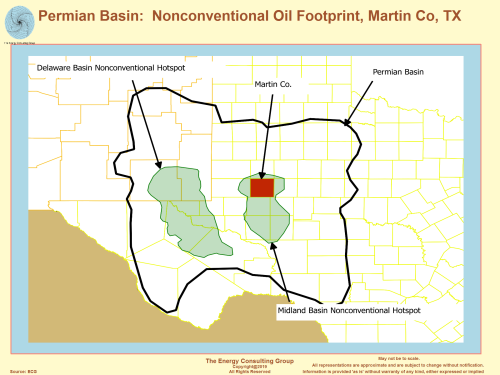

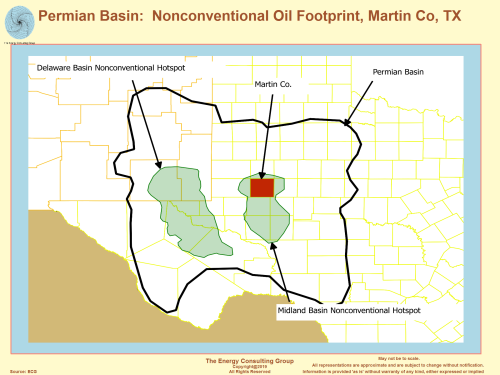

Example of a Large,

Nonconventional Development Project in the Permian Basin

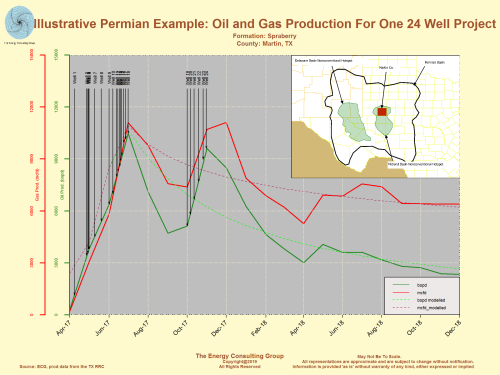

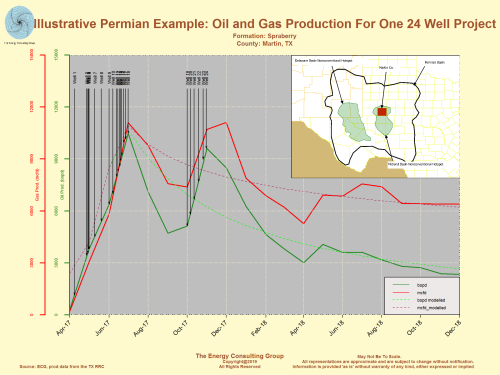

The wells in this example were drilled into the Spraberry formation in Martin

Co,, TX, which is at the northern end of the Midland Basin, nonconventional

development region.

Permian Basin: Nonconventional Oil Footprint, Martin Co, TX

Click For Larger Image |

Illustrative Permian

Example: Oil and Gas Production Performance For One 24 Well Project

Click For Larger Image |

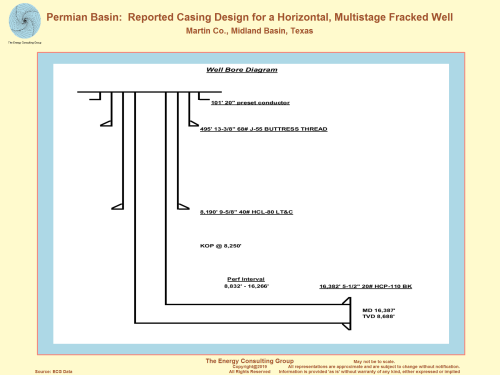

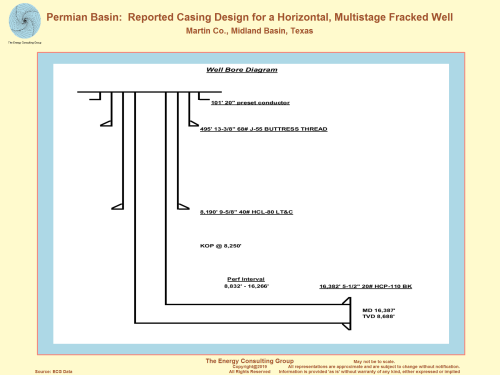

Permian Basin: Reported Casing Design for a Horizontal, Multistage

Fracked Well

Click For Larger Image |

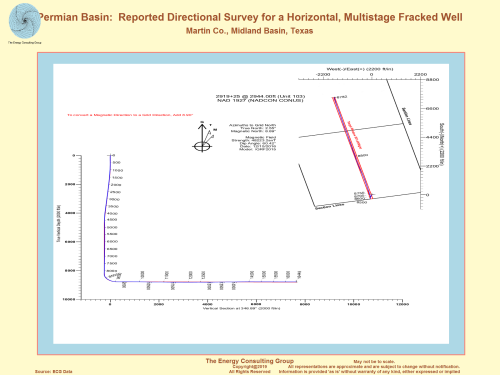

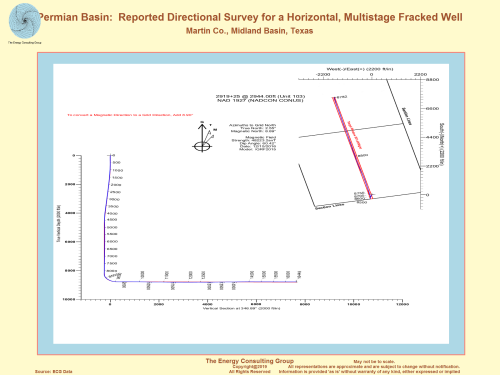

Permian Basin Reported Directional Survey for a

Horizontal, Multistage Fracked Well

Click For Larger Image |

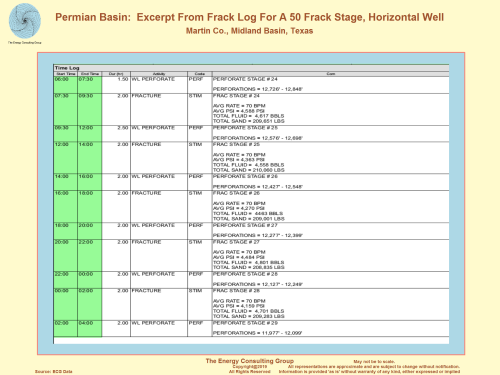

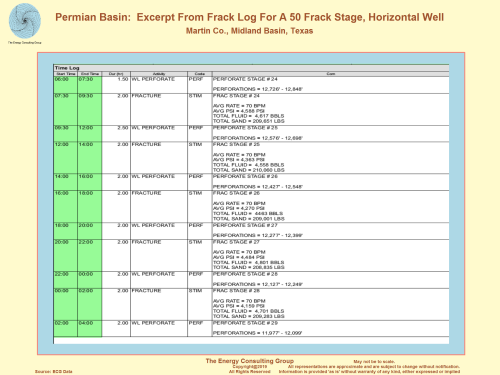

Permian Basin: Excerpt

From Frack Log For 50 Frack Stage Horizontal Well

Click For Larger Image |

Energy Consulting Group data includes the

operational, and performance history for literally thousands of wells

across the Permian Basin. As illustrated by this example, this

data includes casing designs, well tests, directional surveys,

drilling/completion costs (AFE and actual), production performance, and

detailed frack data (number of stages, perforation depths, frac volumes,

pressures, etc.)

The

full frack log from which we pulled the summary

to the left is at this link. |

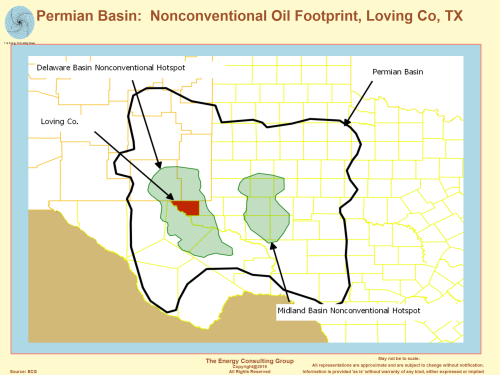

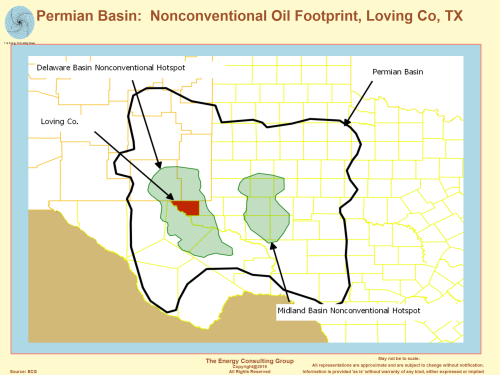

Permian Basin: Nonconventional Oil Footprint, Loving Co, TX

|

|

Return to Web Page Index

Go to The Energy Consulting Group home page for more

oil and gas related information.

To

the left is an example of our economic comparison map. The well level

economics reflect well performance (IP's, decline curves and EUR) as

communicated by individual companies for different plays, which we analyzed

using EVAL, our proprietary economic analysis program. We have over 500 such

assessements for the Permian oil nonconventionals, starting in 2010, which provides detailed insights on not only the

economic performance of the nonconventional plays in the Permian Basin, but

also allow us to investigate questions regarding rig and well productivity

growth, impact of changes in technology, how much oil the basin is likely to

produce at different oil prices, and which firms are best positioned to exploint

the nonconventionals. And, yes, we do realize that many of the answers in

the map have been removed. If interested in the map with all the blanks

filled in please contact us at insight@energy-cg.com.

To

the left is an example of our economic comparison map. The well level

economics reflect well performance (IP's, decline curves and EUR) as

communicated by individual companies for different plays, which we analyzed

using EVAL, our proprietary economic analysis program. We have over 500 such

assessements for the Permian oil nonconventionals, starting in 2010, which provides detailed insights on not only the

economic performance of the nonconventional plays in the Permian Basin, but

also allow us to investigate questions regarding rig and well productivity

growth, impact of changes in technology, how much oil the basin is likely to

produce at different oil prices, and which firms are best positioned to exploint

the nonconventionals. And, yes, we do realize that many of the answers in

the map have been removed. If interested in the map with all the blanks

filled in please contact us at insight@energy-cg.com.