The Energy Consulting Group

Management consultants for upstream oil and gas producers and service companies

|

E&P News and Information Scandinavian International and National International Energy

Agency Department of Trade and Norwegian

Petroleum Ministry of Industry

and E&P Project Information |

|---|

(Demand, Production, Imports, Exports, and Price)

|

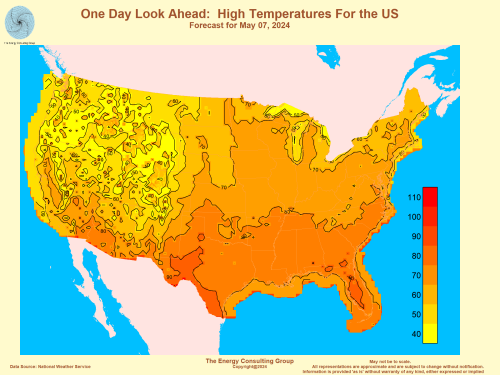

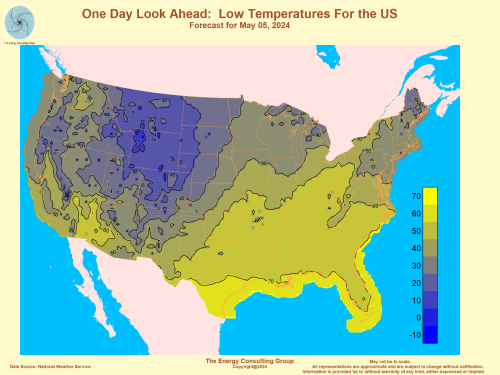

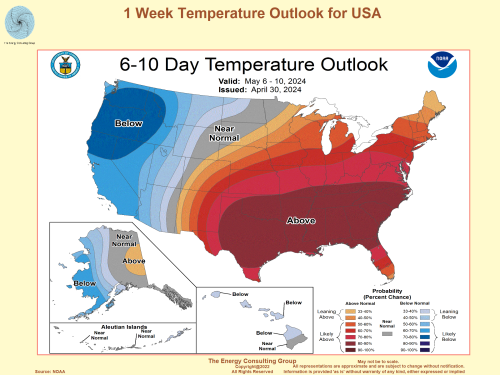

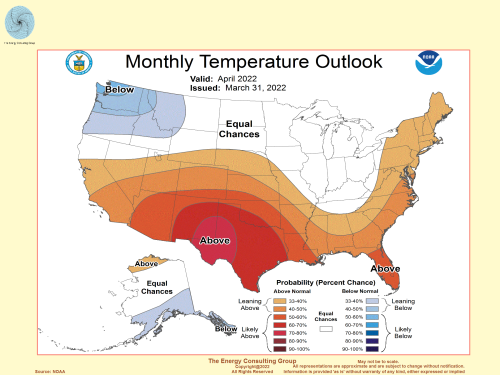

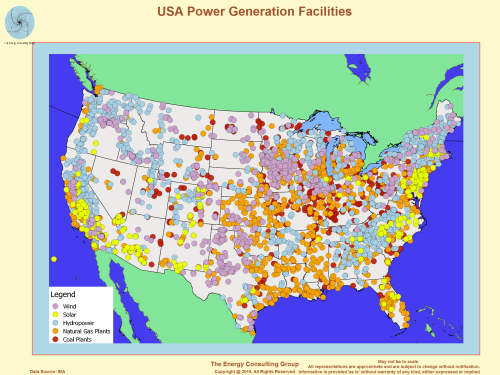

Web Page Table of Contents US Natural Gas: Storage Levels (Current, and Historical) US Temperature Outlooks (day, week, month) US Natural Gas: Supply Summary US Natural Gas: Demand Summary US Natural Gas: LNG and Pipeline Export Summary US Natural Gas: Drilling Activity Summary Role of Natural Gas in Power Generation and Demise of Coal North American Natural Gas Pricing: Historical, Future and Recent (Spot at Select Hubs) Shale Gas Technology: Drilling and Well Productivity Trends Amount of Natural Gas Elon Musk's LNG fueled Starships will Consume With Each Launch and Potentially Across a Fleet of Such Rockets |

|

| The North American Natural Gas Market Contact us at insight@energy-cg.com if you have questions about the North American natural gas market. |

|

|

|||||

|

|

|||||

|

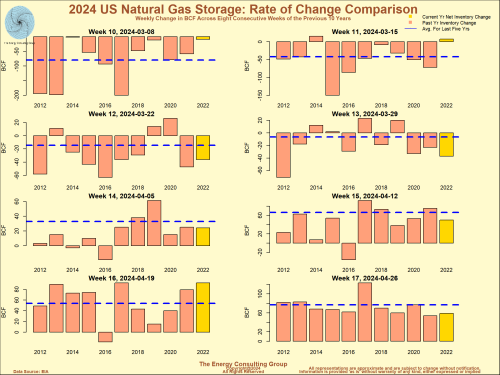

US Natural Gas Storage Levels

(Latest USA natural gas storage information) |

Add a comment or question. | ||||

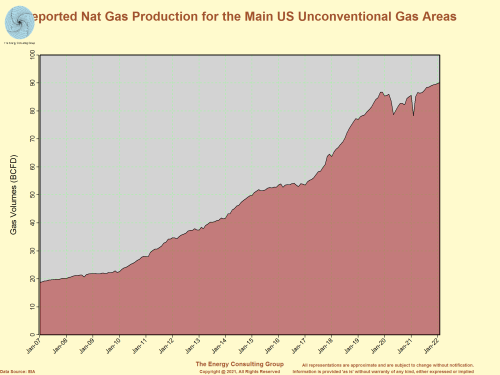

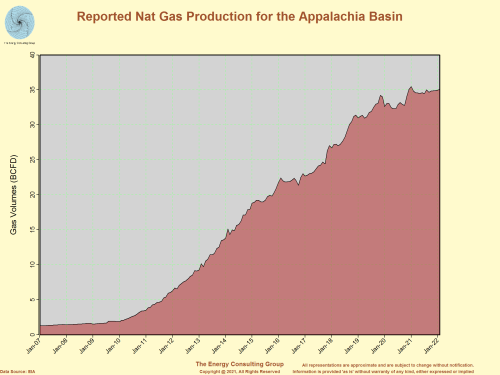

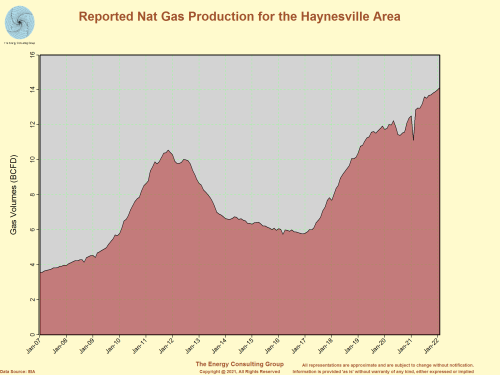

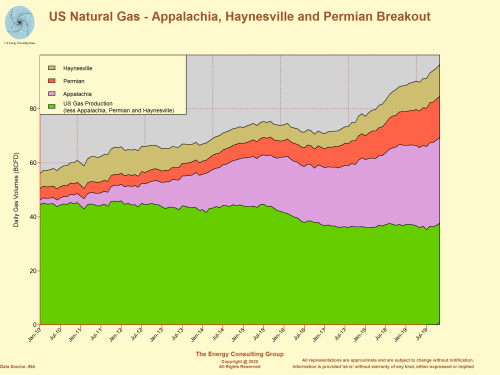

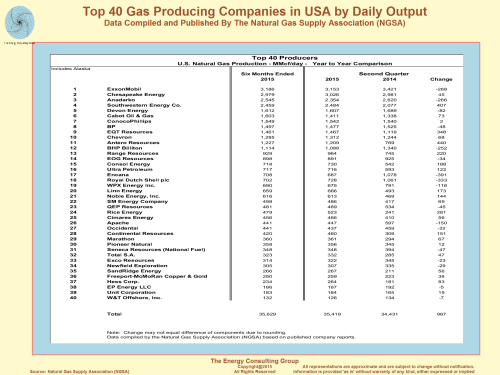

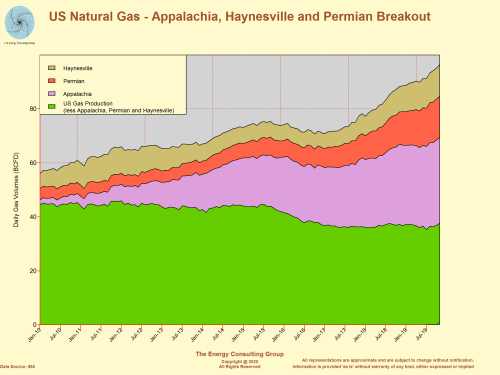

Reported Production for Main US Non-Conventional Regions For Larger, Higher Resolution View, Click Image |

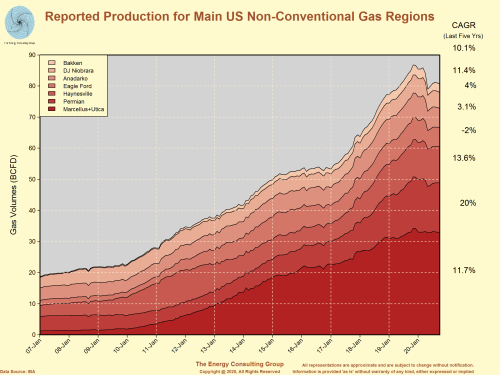

US Natural Gas Production with Marcellus, Utica, and Eagle Ford Breakout  For Larger, Higher Resolution View, Click Image |

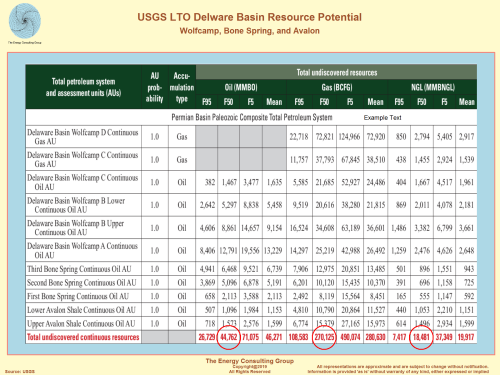

USGS Light, Tight Oil (Nonconventional) Delaware Basin Resource

Potential For Larger, Higher Resolution View, Click Image |

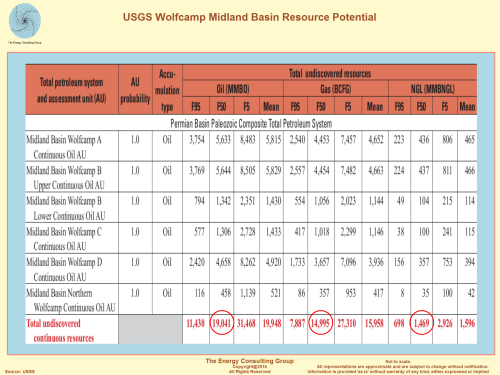

USGS Light, Tight Oil (Nonconventional) Midland Basin Resource

Potential For Larger, Higher Resolution View, Click Image |

|

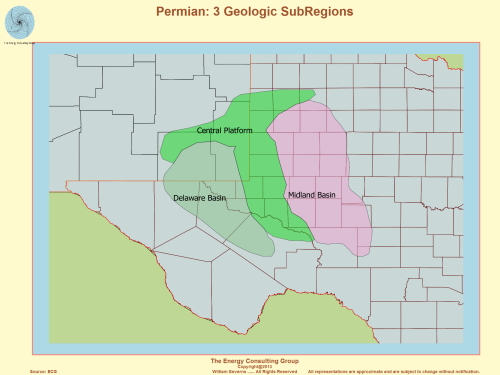

The Three Primary Regions of the Permian Basin  For Larger, Higher Resolution View, Click Image |

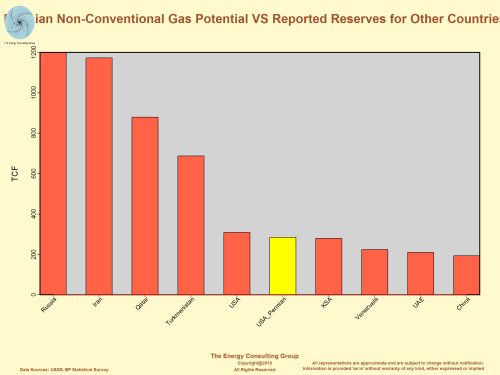

Where Would the Permian Basin Rank Globally in

Natural Gas Resources if It Were Considered a Separate Country? For Larger, Higher Resolution View, Click Image |

|

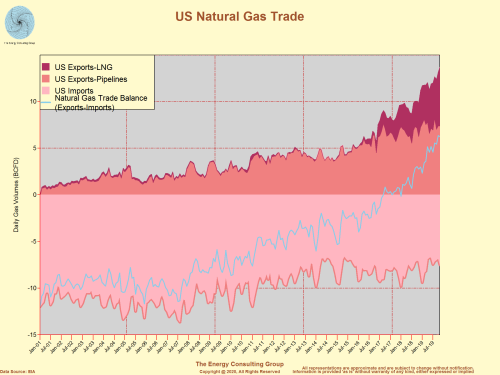

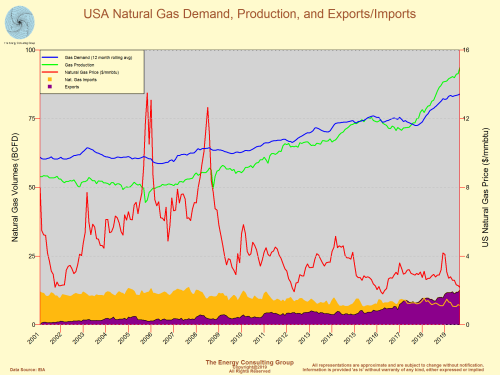

USA Natural Gas Demand, Production (Supply), Imports, Exports, and Price As reported by the EIA For Larger, Higher Resolution View, Click Image  |

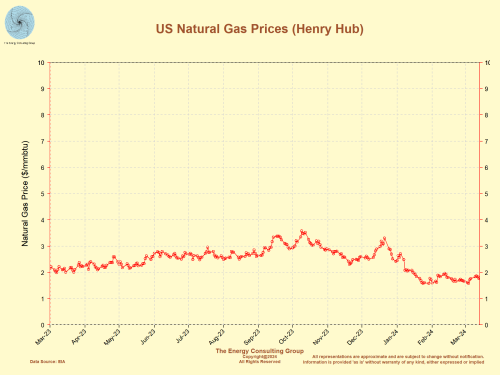

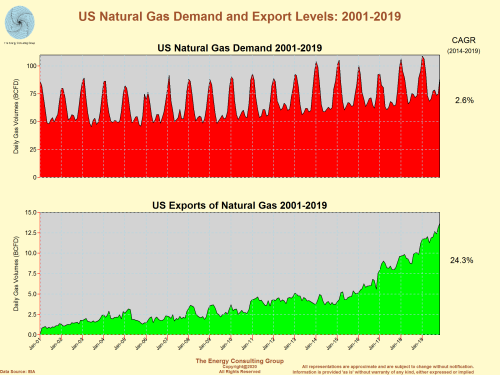

The chart to the left provides a single page reference for USA natural

gas market fundamentals. The obvious trends since the

advent of large scale shale gas drilling in the middle

of the previous decade are: 1) Lower natural gas prices 2) Increasing demand in response to the lower prices 3) Falling imports and growing exports. Go to this page for a discussion of the emergent Utica dry gas play, which might be the next "super" shale play. Operators have reported 24 hr IP's in excess of 70 MMCFD with flowing casing pressures (FCP) of 8000-10000 psi. Longer term, development of the deep Utica, super shale is starting to rev up. We currently estimate the resource potential of this play to be in excess of 400 TCF, a significant portion of which may be economic at less than $2/mmbtu. As a reminder, three early wells in the deep, dry Utica in sw PA tested at 59 MMCFD, 73 MMCFD, and 63 MMCFD. All three had flowing pressures of 8000 psi or higher. See the following links for more details: Scotts Run (73 MMCFD) well; Gaut4IH (63 MMCFD) well; and Claysville Sportsman's Club No. 1(59 MMCFD) well. |

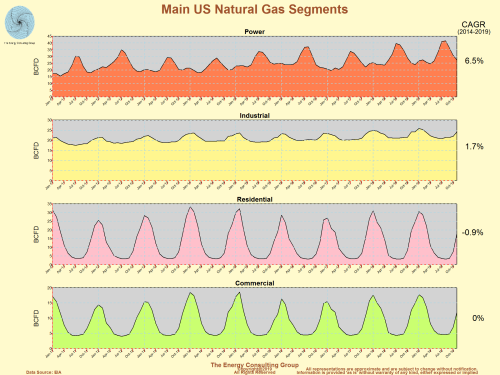

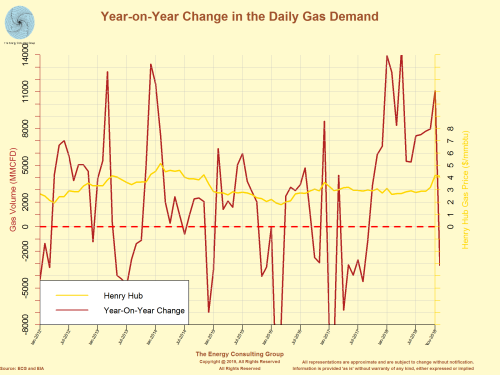

US Natural Gas

Demand Summary

In this

section we provide a brief overview of US natural gas demand situation. If

looking for updates on any of the provided charts or our current assessment of

natural gas demand, both for the USA and internationally, please contact us.

For Larger, Higher Resolution View, Click Image

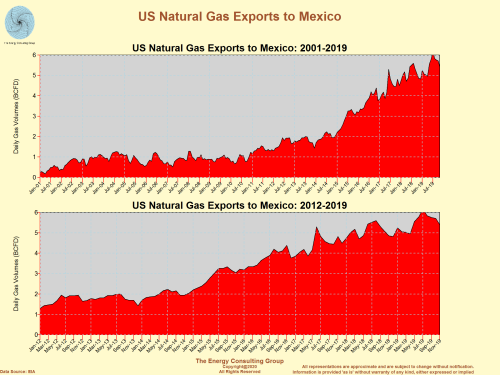

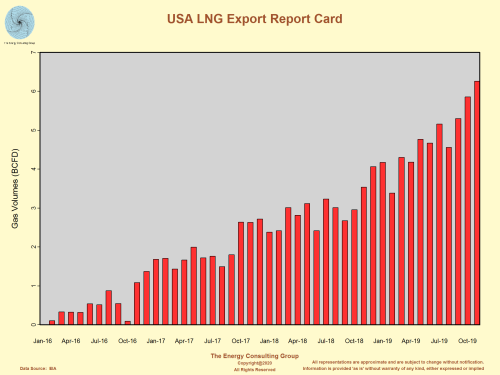

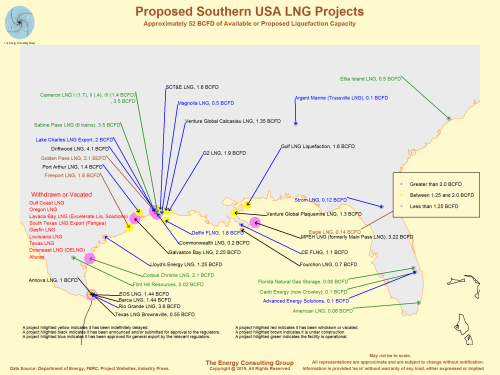

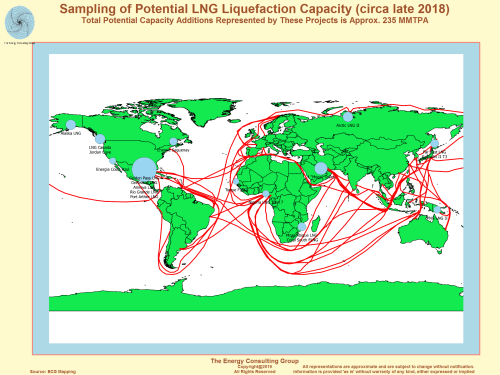

US Natural Gas LNG and Pipeline Export Summary

The daily estimates of pipeline flows to the right was sourced from the

useful

Natural Gas and the US Power Sector

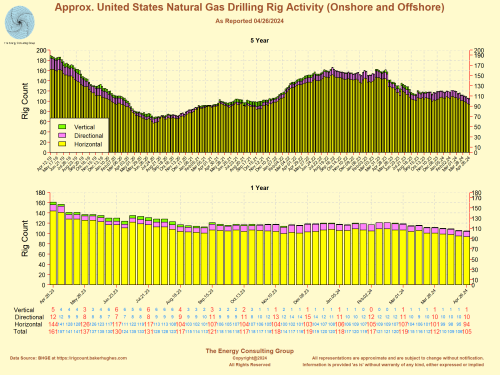

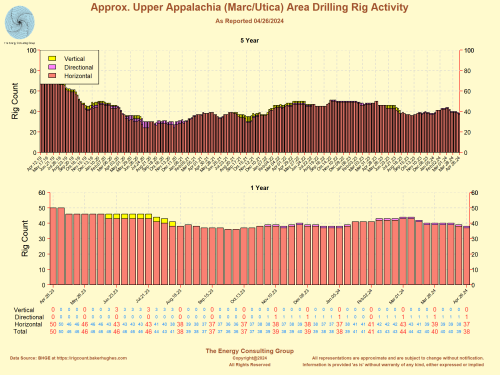

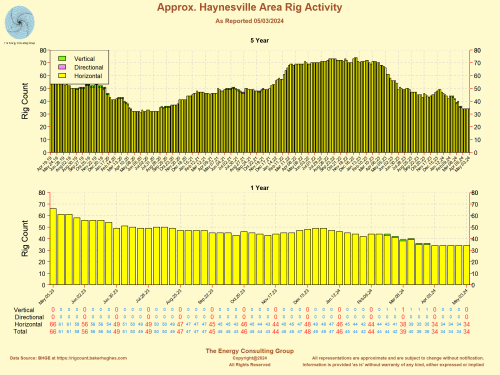

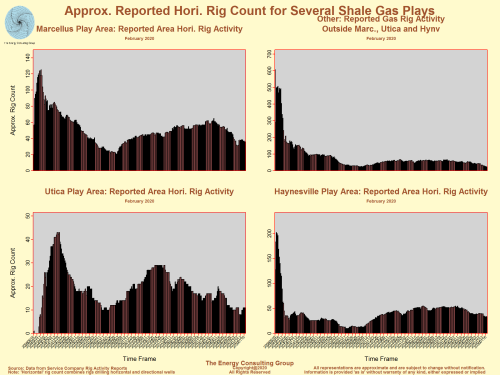

ECG Assessment of Horizontal Drilling Activity

in Several Large Shale Gas Plays in the USA (February 2020)

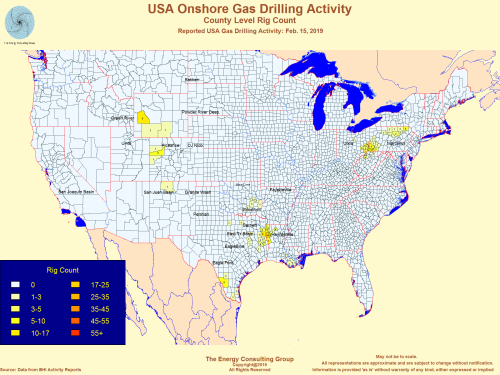

For Larger, Higher Resolution View, Click ImageMap of USA Onshore Gas Drilling Activity

February 2019

For Larger, Higher Resolution View, Click Image

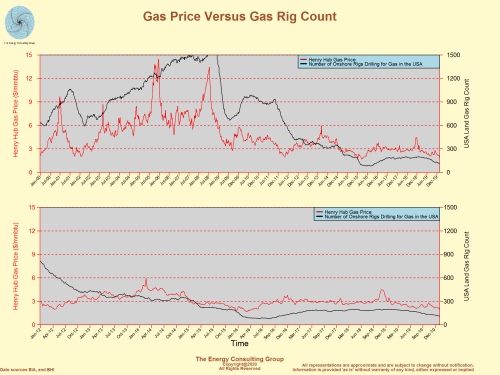

Gas Price Versus Gas Rig Count

(Feb 2020)

For Larger, Higher Resolution View, Click ImageMap of USA Onshore Drilling Active

September

2021

For Larger, Higher Resolution View, Click Image

Link to webpage with in-depth data and information about North America

oil and gas drilling activity.

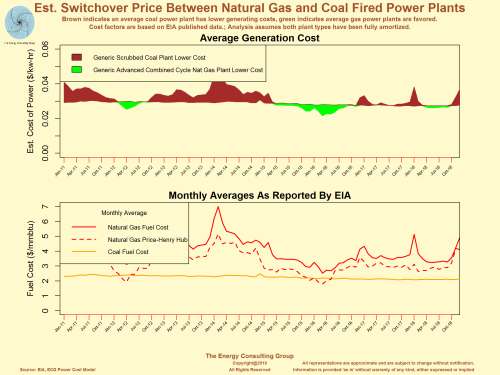

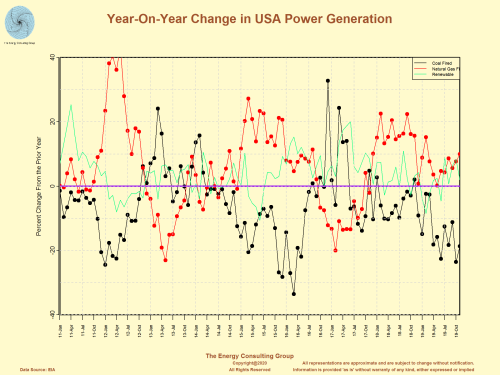

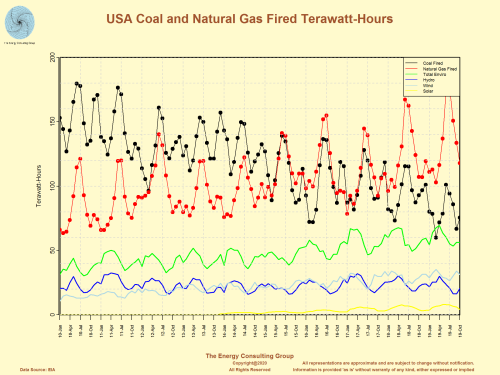

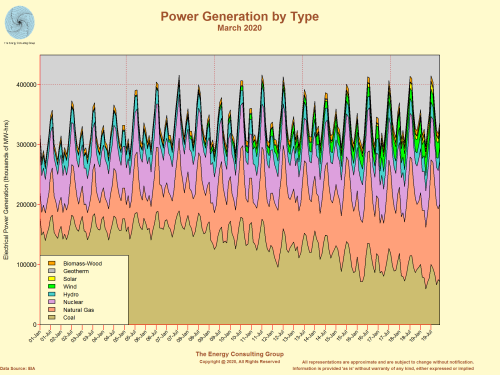

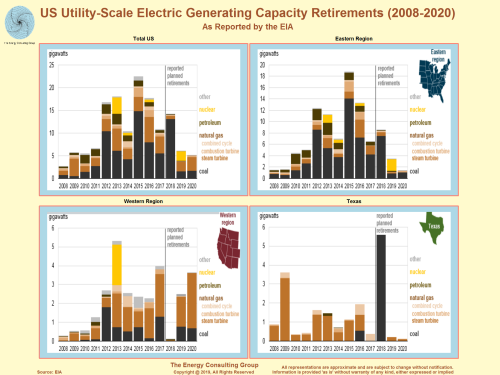

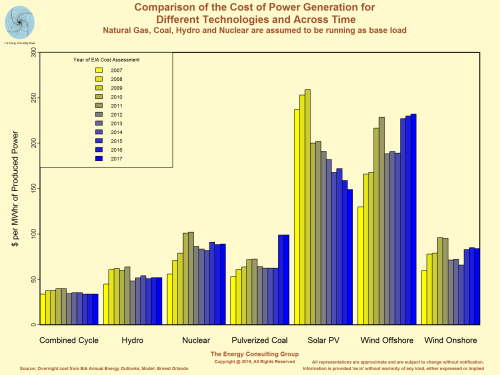

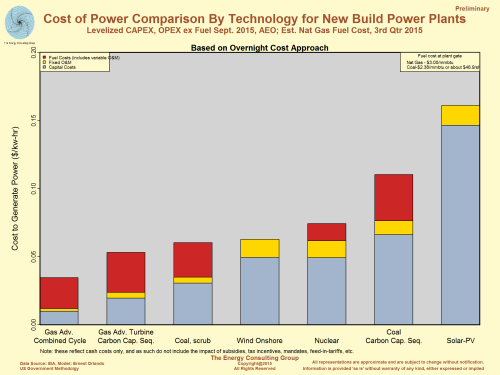

Another short to medium term factor in North American natural gas demand is fuel-on-fuel competition in the electric power industry.

So, while there is a secular, long term shift out of coal in the power sector

(noted below, in the exhibit titled, "US Electric Power Generation ByType: Coal

Market Share is Declining"), the power sector has also become adept at

short term, back and forth switching between between coal and natural gas fueled

power plants. The reason is to arbitrage relative price differences

between the fuels. Our research

(see below) illustrates that once natural gas prices at Henry Hub move below

$3.00/mmbtu, gas becomes increasingly competitive with coal for power

burn, and vice versa.

Return to Web Page Index

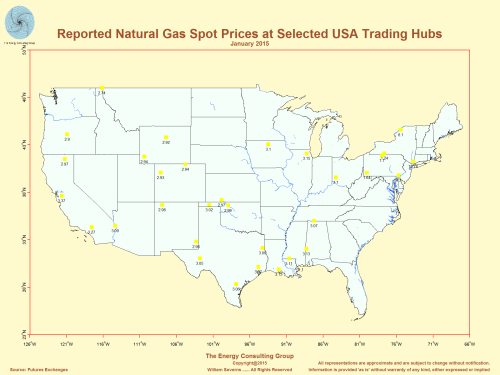

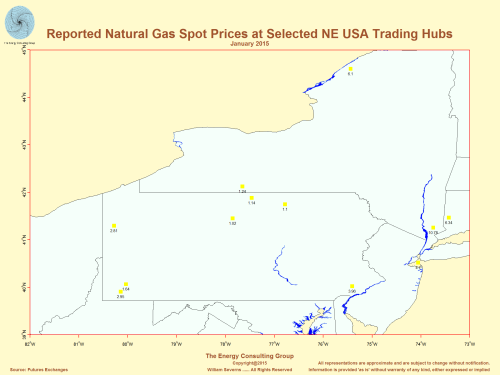

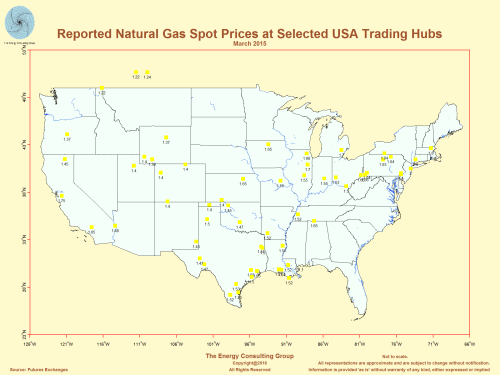

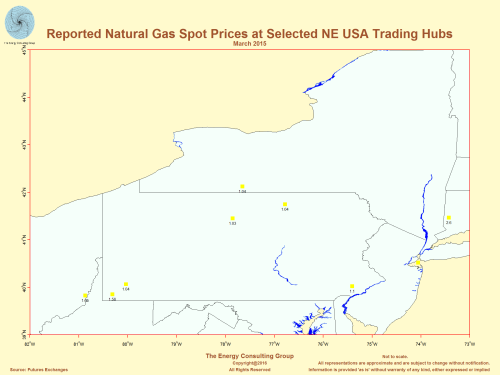

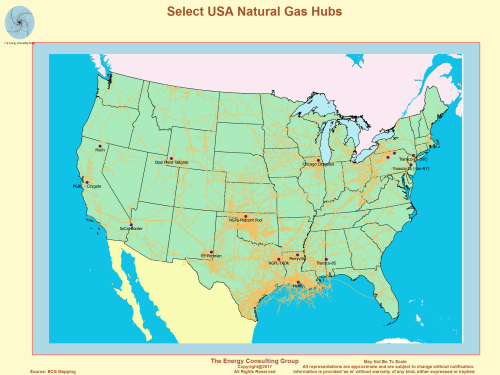

Regional Price Variation Across the US Natural

Gas Market

The spot price, trading hub maps presented below

illustrate the price impact that plays can have on the underlying commidty

price. In this case, the

Marcellus and Utica in the northeast USA are hi-lighted. As shown by the spot price map

of the northeast USA, prompt prices in the Marcellus/Utica area were about half

or less that of Henry Hub/NYMEX pricing in January and February 2015.

Select USA Natural Gas Hubs

(These map locations should roughly correspond with the hubs listed to

the right)

or Larger, Higher Resolution View, Click Image

Natural Gas Intelligence (NGI) and Genscape website.

Click

here to go to the full page for all the information.

Return to Web Page Index

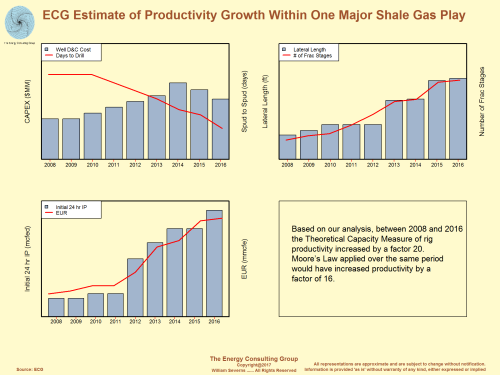

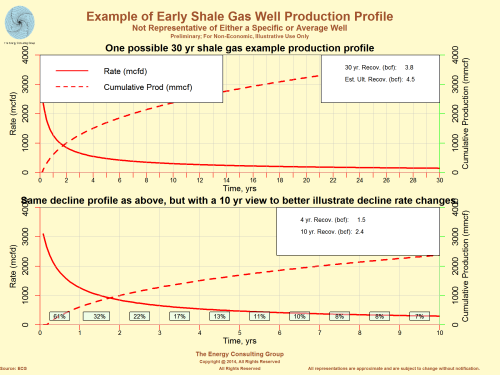

Shale Gas Technology and Productivity Trends

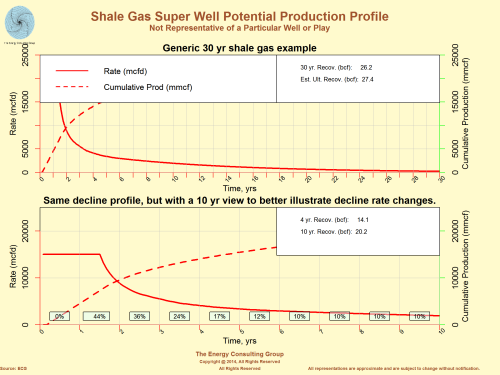

The rapid pace and magnitude with which

shale play technology is improving is illustrated by the two plots below. The

one on the left is an example is from an early shale gas well with an initial

rate of about 3 MMCFD, and an EUR of about 4.5 BCF. As the horizontal drilling,

multistage fracking technology improved and became less expensive, individual

well rates and recoveries climbed. After years of this dynamic, the industry is

now developing super wells, which are capable of flowing as much as 60-80 MMCFD,

and producing as much as 30 BCF from a single well. This 20-25x increase in

rate, and 4-6 times increase in EUR, is accomplished with about a 2x-2.5x increase in

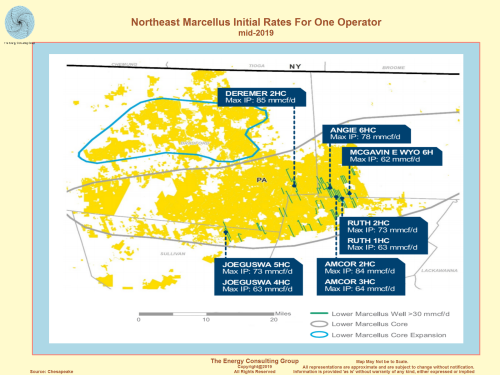

well cost. Such "super" wells are becoming increasingly common. See

map below for reported initial rates from Marcellus wells completed in NE PA in

2019.

|

Rig Productivity Growth Within One Major Shale Gas Play  For Larger, Higher Resolution View, Click Image |

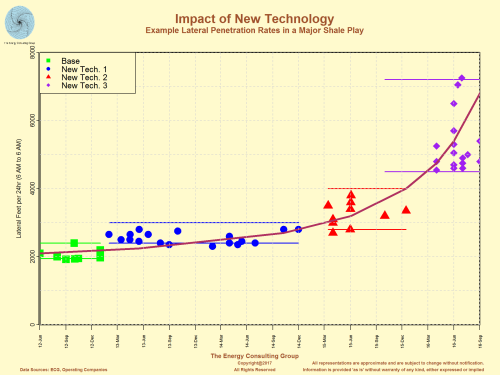

How is this possible you might ask? Well, this is one of our

speciality areas, i.e. tracking new technology in the upstream oil and

gas industry, and assessing how that technology "moves the needle" for

companies and the larger industry. Below is an example from an

operator showing how over a few short years, it managed to increase average

drilling penetration rates in a major shale play by a factor of almost

three, from 2000'/day to almost 6000'/day.

For Larger, Higher Resolution View, Click Image For Larger, Higher Resolution View, Click Image |

|

Northeast Marcellus Initial Rates Reported for One Operator mid-2019  For Higher Resolution View, Click Image |

|

Example of Early Shale Gas Well Production Profile For Larger, Higher Resolution View, Click Image |

Example of Emerging Super Shale Gas Well Production Profile For Larger, Higher Resolution View, Click Image |

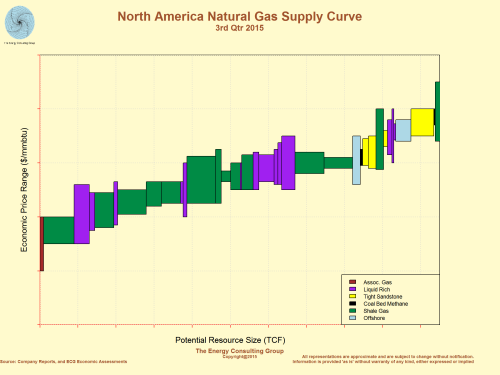

As a result of this technological revolution, the North American natural gas supply curve (below), as we calculate it, has been dramatically pushed down, and flattened. The implications are that large volumes of gas can be developed at lower breakeven costs. Meaning the shale revolution is not likely to be a flash in the pan, but rather a force of positive change that has the potential to lower the cost of living for everyone. There is no better example of this than what is happening in the deep, dry Utica in southwest Pennsylvania.

Return to Web Page Index at the start of this web page

Go to The Energy Consulting Group home page for more oil and gas related information.

|

|