The Energy Consulting Group

Management consultants for upstream oil and gas producers and service companies

|

E&P News and Information Scandinavian International and National International Energy

Agency Department of Trade and Norwegian

Petroleum Ministry of Industry

and E&P Project Information |

|---|

Deep, Dry Utica: "Super" Gas Shale

(The Technology of Horizontal, Multistage Fracking Continues to Improve)

Best shale gas wells: test rates as high as 73 MMCFD.

Click here for rate and pressure data for several high rate Utica dry gas wells.

Introduction

The oil and gas industry has drilled and tested dozens

of deep,

high rate Utica dry gas wells in southeastern Ohio, northwestern West Virginia, and

southwestern Pennsylvania. These wells have been tested at rates as high as

73 MMCFD, wtih reported flowing casing pressures as high as 10000 psi, which is more than

twenty times rates commonly observed in the Barnett play, the first of the large

scale shale gas plays. To get a sense of how much of a game changer

the deep, dry Utica might be given the tremendous productivity

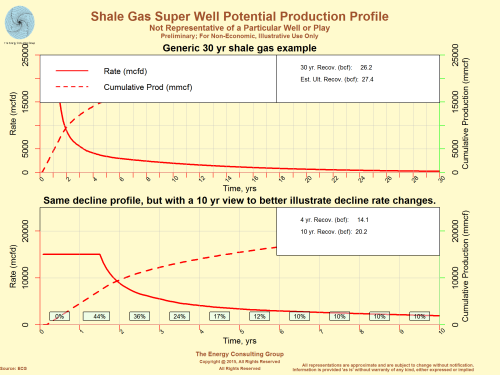

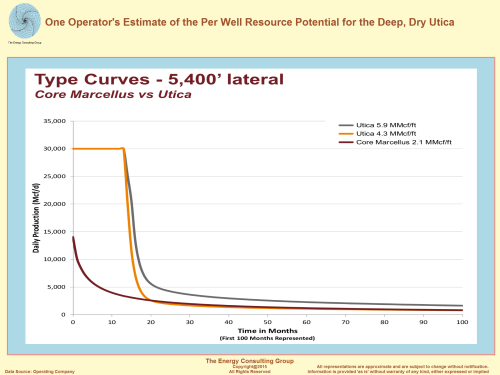

demonstrated to date, please note below the type curve comparisons between the

deep, dry Utica and the Marcellus provided by one operator in late 2015.

The operator projects that the Utica will have higher initial rates on average

than Marcellus initial rates, and will be able to maintain those rates for some period of

time before declining. Using the same type curves, the estimated ultimate recoveries (EUR's)

for dry Utica wells may range between 23-32 BCF/well for wells with a 5400' lateral,

compared to 11.5 BCF for an average Marcellus well of similar lateral extent.

Deep, Dry Utica Type Curves and Estimate Ultimate Recovery (EUR) Click Image for Larger Version |

Clearly, this operator is expecting dry Utica wells to outperform Marcellus wells. However, because the Utica sits thousands of feet below the Marcellus, well costs for the Utica are higher (currently much higher) than for drilling a Marcellus producer. We believe it likely that as more wells are drilled, and the play increasingly moves from the exploration/science phase into a more standardized development mode, drilling costs could well decline to the point of making Utica drilling costs comparable to the Marcellus on a per foot basis. Indeed, our Utica drilling costs analysis validates this assertion, but it may take until the middle to end of 2016 to approach development mode costs.

Our development mode timing is based on announcements made in the second half of 2015 that two large gatheirng systems are to be installed in southeastern Ohio dedicated to the deep, dry Utica. The following are links to the announcements:

Rice Energy and Gulfport, and will have approximately 1.8 BCFD of gathering capacity

As described, both will be designed and constructed to serve new wells primarily in the portion of Ohio overlying the dry Utica sweet spot. If the announced capacities of the two systems are fully utilized, they will gather and deliver about 3.8 BCFD, which is roughly equivalent to the entirety of current US Gulf of Mexico gas production, and will amount to about 5% of US gas supply. It is important to note that these volumes would be just from the western sliver of the play (about 10% of the total), so apparently will not cover SW PA, and the tremendous wells in that area.

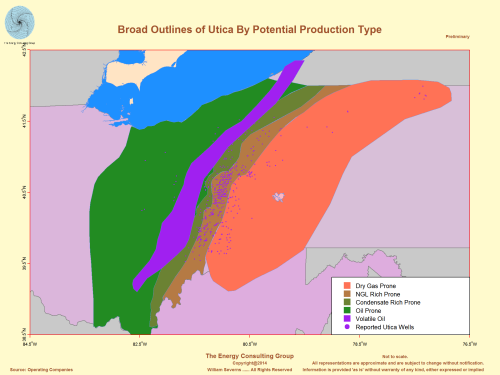

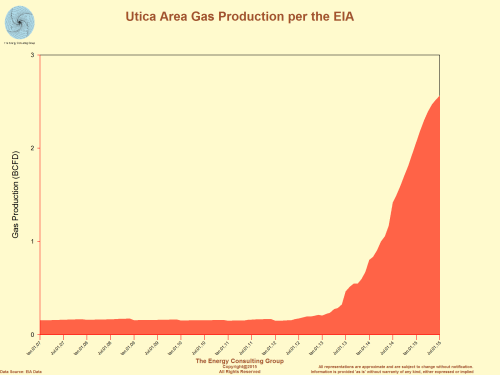

Overview

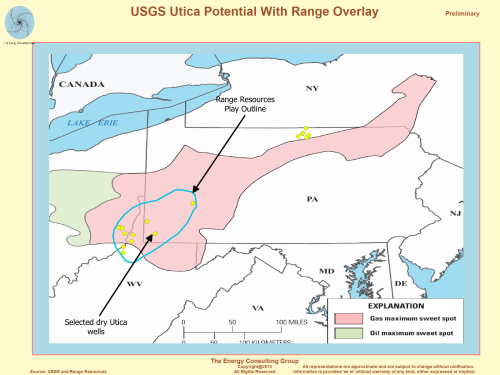

The Utica is already producing

large volumes of natural gas, along with NGL's, and condensate. Most of

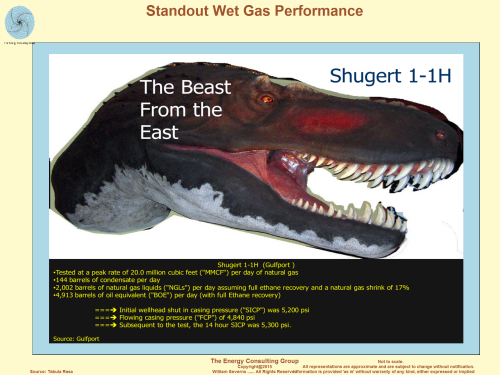

this production is sourced from the wet gas regions of the Utica (see map

below), which can also be prolific, as illustrated by the standout Shugert1-1H

well (below). However, with the pullback in oil prices, liquids rich gas wells

have become less economically attractive, so the industry has shifted more of

its attention to dry gas plays, such as the southern, deep, dry Utica.

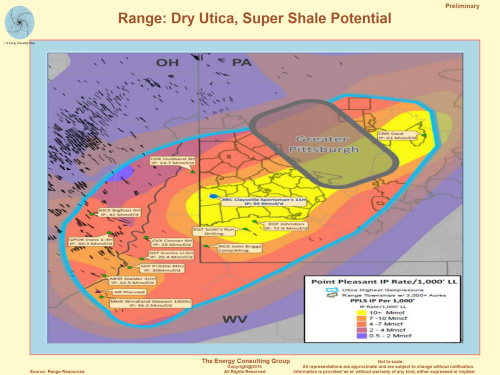

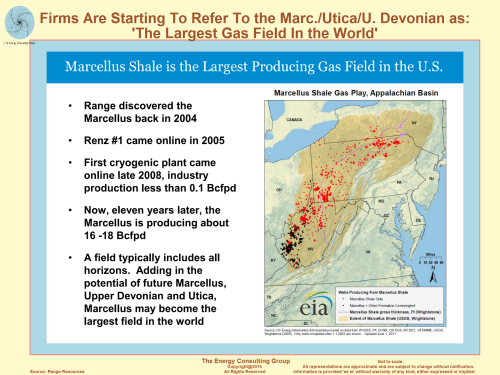

In addition to the world class well results, the length and breadth of the deep Utica are such that it may compete for the title of the world's largest natural gas field.The follwing two maps illustrate the potential areal extent of the play:

Given the extraordinary resource potential of the Marcellus, Utica, and Upper Devonian, some firms, such as Range Resources (see below), are starting to refer to the northern Appalachia region as the largest gas field in the world.

Deep, Dry Utica: One of the Largest Natural Gas Fields in the World? Click Image for Larger Version |

A large proportion of this resource potential in northern Appalachia resides within the Utica. In fact, our preliminary estimate of the resource potential for the deep, dry Utica places it, on a standalone basis, near the top of a global league table of selected natural gas fields ranked by resource potential.

Global League Table of Selected Large Natural Gas Fields (preliminary)

|

Field name |

Country |

Potential Recoverable Reserves (TCF) |

Max Rate (BCFD) |

|

|

1 |

1235 |

|

||

|

Early development, with active exploration, and delineation programs. |

Deep, Dry Utica* |

USA |

Resource potential: 280-400 TCF

|

|

|

2 |

222 |

32 BCFD

|

||

|

3 |

138 |

17 BCFD |

||

|

4 |

123 |

7 BCFD

|

||

|

5 |

110 |

|

||

|

6 |

98 |

|

||

|

7 |

95 |

12 BCFD

|

||

|

8 |

81 |

2-3 BCFD |

||

|

9 |

73 |

10 BCFD |

||

|

10 |

70 |

|

||

|

11 |

68 |

|

||

|

12 |

48 |

|

||

|

13 |

47 |

|

||

|

14 |

46 |

|

||

|

15 |

45 |

|

||

|

16 |

45 |

|

||

|

17 |

42 |

|

||

|

18 |

42 |

|

||

|

19 |

30 |

|

||

|

20 |

30 |

|

||

|

* ECG estimate as currently mapped. Subject to change as more well results are announced.

|

||||

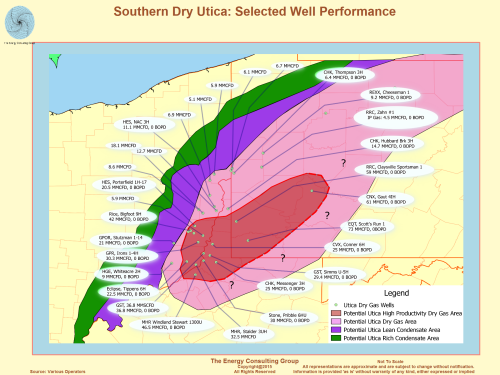

The right hand column in the following section showcases summaries for some of the prominent deep, dry Utica well tests. Most of the summaries contain links to standalone web pages, which provide more details regarding the well tests,such as rate and flowing pressures, and the early production performance. At the top of the left column, is a thumbnail of a map showing the location of the summarized wells. Clicking on the map well call up a full size, downloadable version.

|

Southern Dry Utica: Selected Well Performance  Click Image for Larger Version |

Production results to date for at least some of the southern

dry Utica wells have been impressive,

as summarized at this linked web page Super Shale: Emerging Deep Utica Dry Gas Shale Play ======================================== Click either here, or on the map, for a bigger, higher resolution version of the map. ======================================== Click here for more information regarding the Magnum Hunter, Stewart Windland 1300R.-46.5 MMCFD ======================================== Click here for more information regarding the Rice Energy, Big Foot 9H - 42 MMCFD ======================================== Click here for more information regarding the Gulfport Energy, Iron 1-4H -30.3 MMCFD ======================================== Click here for more information regarding the Magnum Hunter, Stalder 3UH - 32.5 MMCFD ======================================== Click here for more information regarding the Gastar Blake U-7H - 36.8 MMCFD @ 6200 psi ======================================== Click here for more information regarding the Range Resources, Claysville Sportsman's Club No. 1 in western Washington Co, PA - 59 MMCFD @ 10200 psi ======================================== Click here for more information regarding the Scotts Run Club No. 1 in central Greene Co, PA - Initial 24 hr test rate: 72.9 MMCFD . Subsequently, EQT performed a 7 day flow test at 27 MMCFD and 9500 psi flowing pressure. On a choke restricted basis the well flowed at 30 MMCFD for the first month of production and produced approximately 1 BCF of gas. Test and production profiles are at the above link. ======================================== Click here for more information regarding the Consol Energy, Gaut 41H in Westmoreland Co, PA - Gaut 41H well test results: 61 MMCFD at 7500 psi or higher flowing pressure (per a transcript of CNX conference call). Article in The American Oil and Gas Reporter about the deep, dry Utica play. It is titled."Soaring Well Productivities,Emerging Deep Dry Gas Play Drive Marcellus, Utica Growth". The Gaut 41H is featured prominently in the article as are Consol Energy's plans for the Utica. ======================================== Click here for more information regarding the Consol Energy, Switz 6D H in Monroe Co, OH - Switz 6D H well test results: 45 MMCFD at 6835 psi flowing pressure. ======================================== Click here for more information regarding the Rex Energy, Patterson 2H in Lawrence Co, OH - Patterson 2H is reported to be producing. The operator expressed satisfaction with results to date, but is helding off providing specific rates and pressure data until comfortable the well is performing in a stable, forcastable manner. ======================================== Might the Green Hill 9 (GH 9) Utica well achieve a 100 MMCFD on test? We think it possible. Go to this web page to understand why. ======================================== For information how these extreme IP's might translate into longer term rates, ultimate recoveries, and economics, please contact us at insight@energy-cg.com |

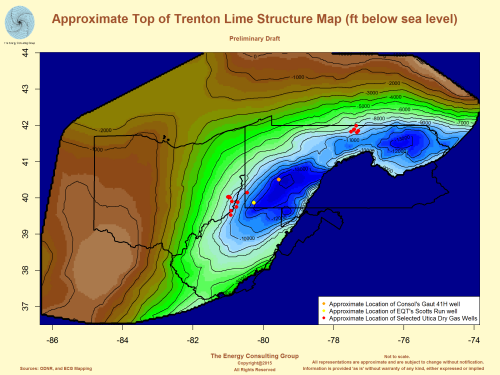

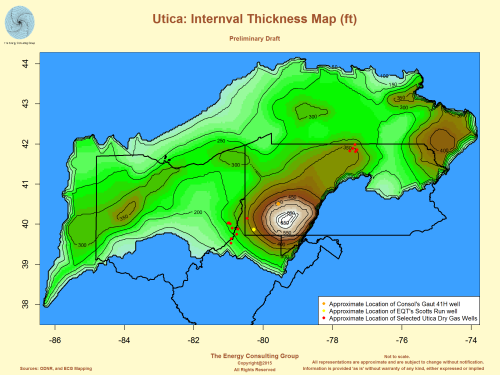

Geology

This section contains preliminary drafts of basic geological information for the Utica, including thumbnails of regional sructure and thickness maps. Clicking on the thumbnails will call up full size, downloadable versions. Also, provided are links to 3D versions of these maps with selected dry Utica wells incorporated into the maps to better illustrate well location and performance relative to the geologic features.

Approximate Top of Trenton

Lime Structure (ft below sea level) Click Image for Larger Version |

Rotatable 3D Structure Map with Wells:

Utica structure (Utica usually sits on top of the Trenton LS) relative to

selected Utica wells. The location of the Consol Energy, Gaut 41H well

is included. (Note, this is a large file, so it will take longer

to load than the standard web page. Use a standard

browser with mouse to rotate and zoom around the map.) |

Utica_Intercal Thickness

(ft) Click Image for Larger Version |

Rotatable 3D Thickness Map with Wells: Utica thickness relative to selected Utica wells. The location of the Consol Energy, Gaut 41H well is included. (Note, this is a large file, so it will take longer to load than the standard web page. Use a standard browser with mouse to rotate and zoom around the map.) |

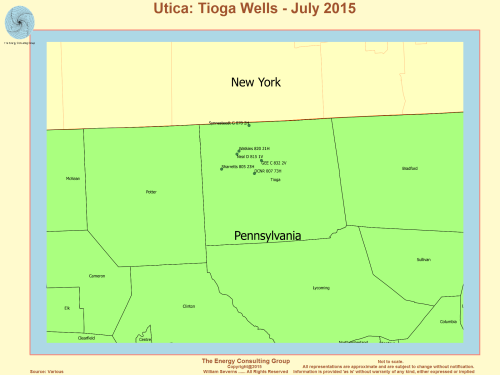

| The northeastern extent of the play is still

being delineated, but appears to have have been significantly extended by the

successful CNX Gaut

41H. To that point, in Tioga county, Pennsylvania, which is many miles to the northest of the Southern Utica area, other deep, dry gas Utica wells have been drilled, which, while not apparently as strong as the Big Foot, Stewart Windland or Sportsman Club wells, are still very good producers. In this Northern Utica dry gas area, Shell Oil has taken a leadership role and has several impressive wells to show for its efforts. Notable wells include, the Watkins and Synnestvedt tests, along with the Gee, Neal, and DCNR 007 73H. |

Approximate Location of Shell's Deep, Dry Gas

Utica Wells in Tioga Co., Pennsylvania  Click Image for Larger Version |

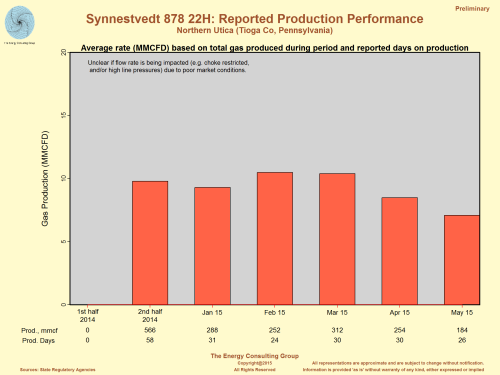

| Synnestvedt 878 22H:

Reported Production Performance Northern Utica (Tioga Co., Pennsylvania)  Click Image for Larger Version |

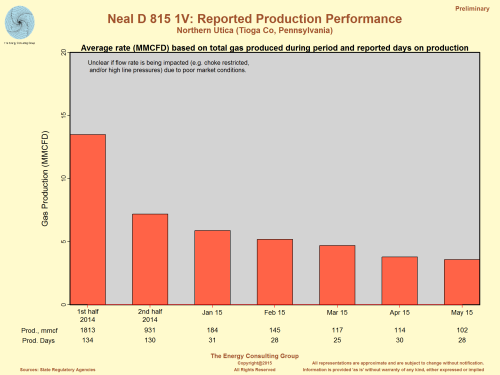

Neal D 815 1V: Reported Production

Performance Northern Utica (Tioga Co., Pennsylvania)  Click Image for Larger Version |

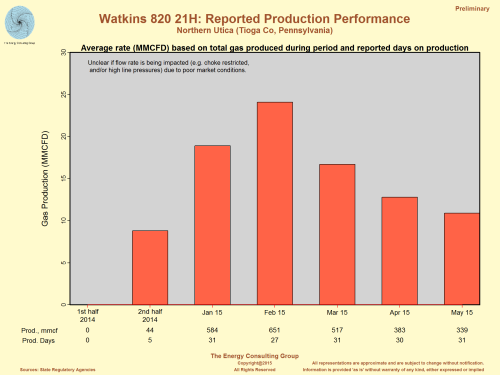

| Watkins 820 21H:

Reported Production Performance Northern Utica (Tioga Co., Pennsylvania)  Click Image for Larger Version |

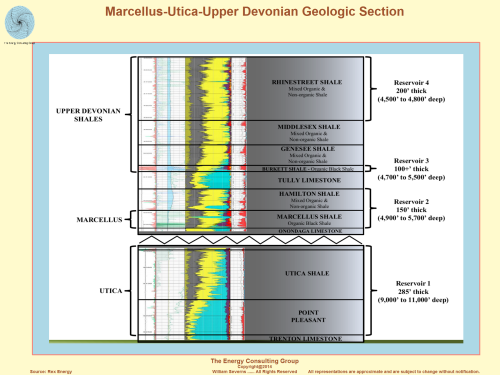

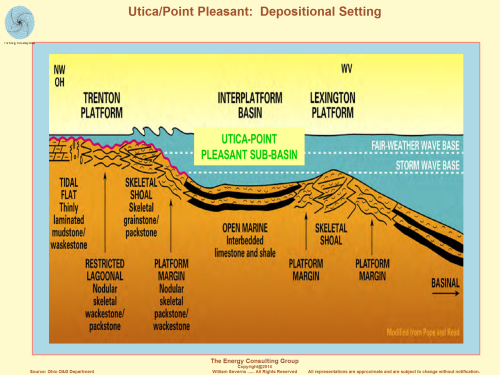

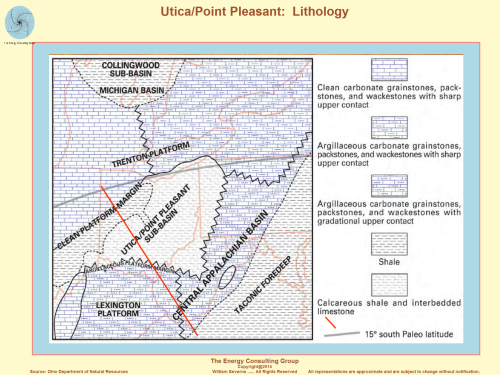

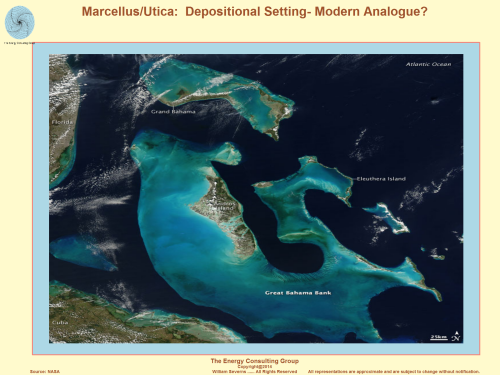

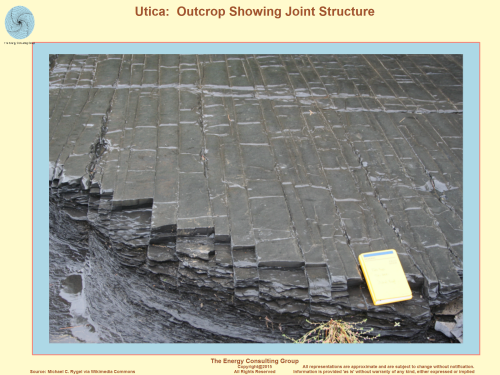

More Utica/Point Pleasant geologic information, including stratigrapic column, depositional environment, and pictures illustrating what may be a modern day analogue for the depositional setting.

Marcellus/Utica/Upper

Devonian Geologic Cross-Section Click Image for Larger Version |

Utica/Point Pleasant: Depositional Setting Click Image for Larger Version |

Utica/Point Pleasant:

Lithology Click Image for Larger Version |

Utica/Point Pleasant: Are the Bahamas the

Current Day Depositional Analogue? Click Image for Larger Version |

Utica: Outcrop Showing Joint Structure  Click Image for Larger Version |

===========================================================================================================================================================

Go to The Energy Consulting Group home page for more oil and gas related information.