Table of Contents

Overview

Neuquen Basin Shale Play Activity

Shale Gas and Light, Tight Oil Production Results

3D Maps

EIA Overview

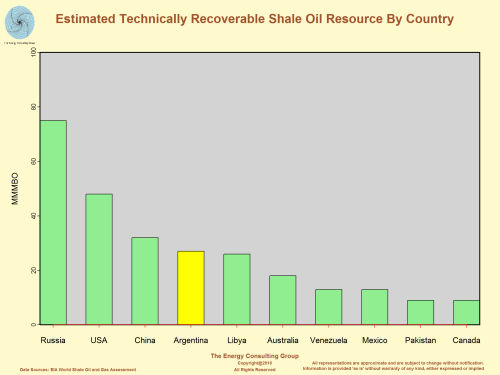

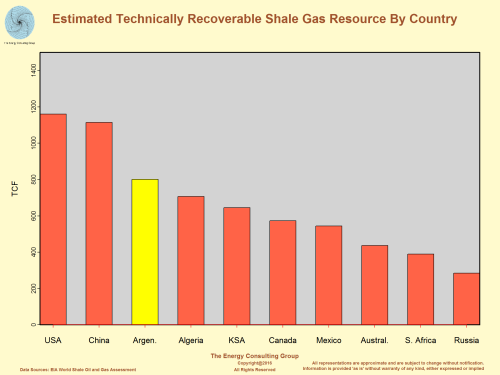

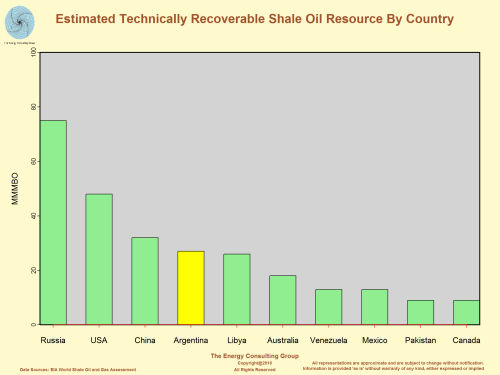

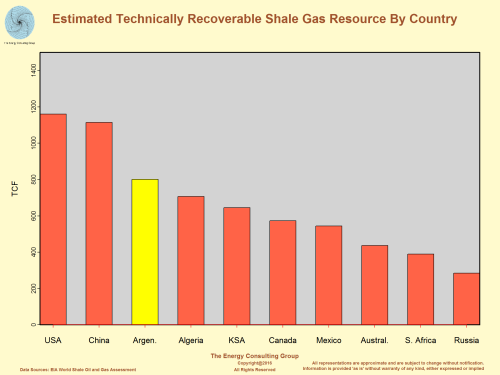

The Argentina government has made the development of the

shale resources of the country a priority since a EIA report

came out with a league table ranking showing Argentina with the

second highest shale gas resource potential and the fourth

highest oil resource potential. This suggested at least

the possibility of billions of barrels of oil and trillions of

cubic feet of natural gas that might be available to Argentina

for internal use and export. For a country struggling

under a variety of financial burdens, this potential was

extremely enticing, and led to a significant government effort,

up to and including the renationalization of YPF, the national

oil company, to encourage both directly and indirectly the

exploitation of these resources.

At the direction of multiple clients, The Energy Consulting

Group has done extensive work studying and evaluating the shale

and light, tight oil potential of Argentina, including the

ongoing efforts to convert the non-conventional resource

potential into useable oil and gas product streams. Below

we have presented a small sampling of this large body of work,

to provide the casual observer with some sense as to the status

of this national effort. If interested, please contact us

at

insight@energy-cg.com

for more detail.

Overview

Per the EIA, Argentina has some of the largest shale oil and gas

potentially recoverable resources in the world.

For Higher Resolution, Click Image |

Estimated Technically Recoverable Shale Oil Resource By Country

For Higher Resolution, Click Image

For Higher Resolution, Click Image |

|

Estimated Technically Recoverable Shale Gas Resource By

Country

For Higher Resolution, Click Image |

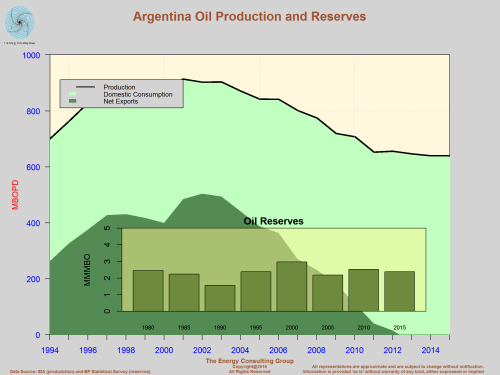

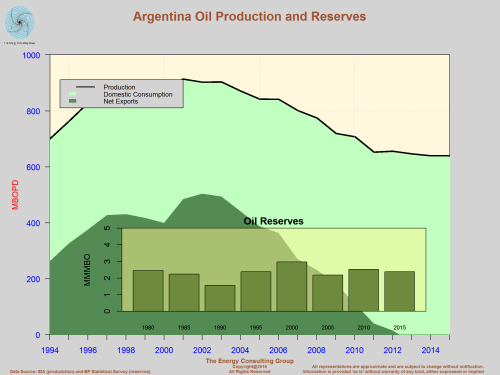

Argentina Oil Production and Reserves as Reported in the

BP Statistical Survey

For Higher Resolution, Click Image |

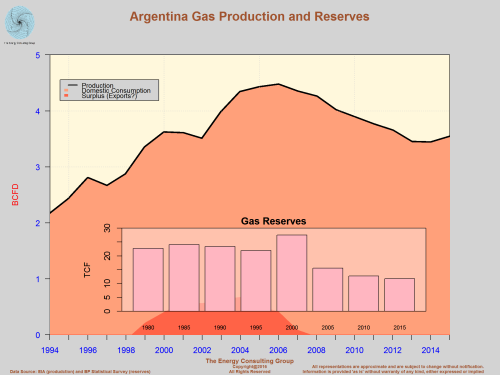

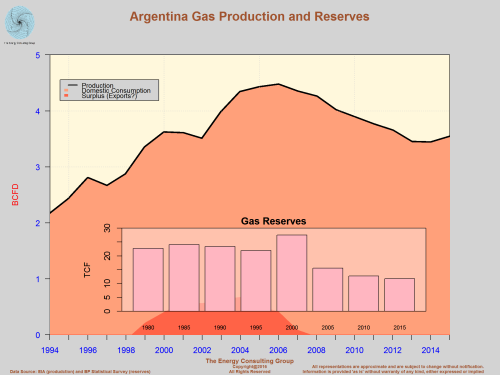

Argentina Gas Production and Reserves as Reported in the

BP Statistical Survey

For Higher Resolution, Click Image |

|

Neuquen Basin Shale Play Activity

Neuquen Basin, Argentina

For Higher Resolution, Click Image |

Vaca Muerta Potential Fluid Types

For Higher Resolution, Click Image |

Production Results

The Energy Consulting Group has compiled

the production histories of all the shale and light,

tight oil wells drilled in Argentina, which are now approaching

600 in total number, and include both vertical and horizontal

completions. This gives us the capability to assess both

the economics of shale efforts, but also the technical efficacy

of the different well and fracking designs being utilized.

Below are four examples of shale well results, two each from the

Vaca Muerta and Mulichinco plays (we have temporarily removed

the axis values). What is apparent from our analysis is

that the production results are steadily improving, and are now

approaching, and in some cases, equaling North American shale

production results. That said, wells costs and fiscal

terms are subtantially different from the North American

counterparts, so the well level economics are lagging.

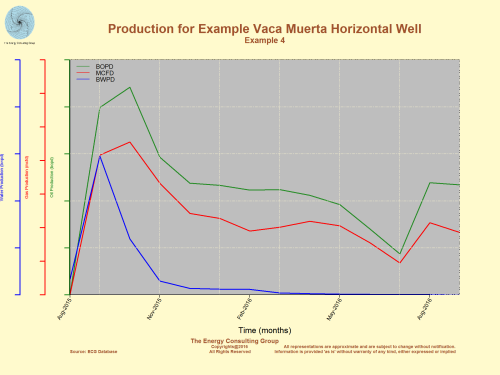

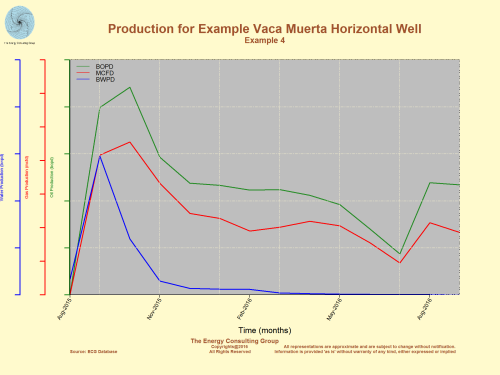

This example reflects one of the more successful

Vaca Muerta horizontal

completions.

For Higher Resolution, Click Image |

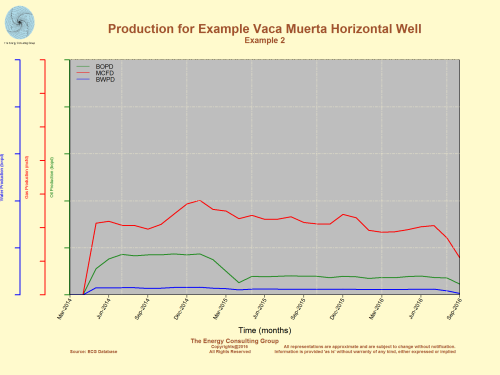

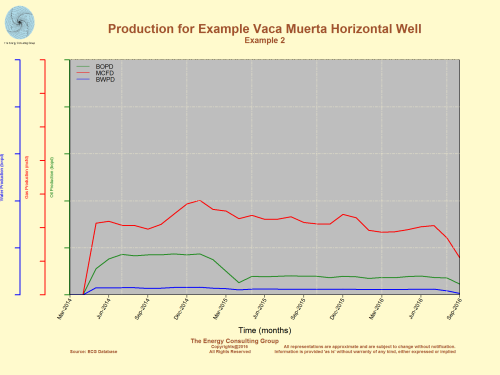

This example reflects that the

Vaca Muerta is also capable of significant gas

production.

For Higher Resolution, Click Image |

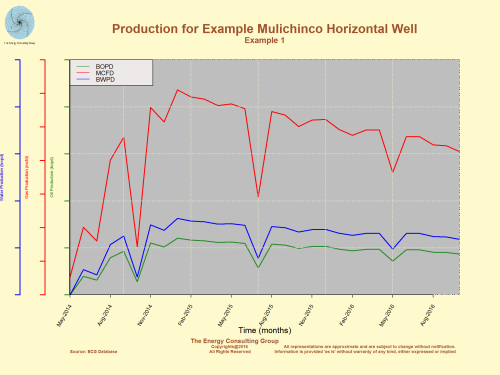

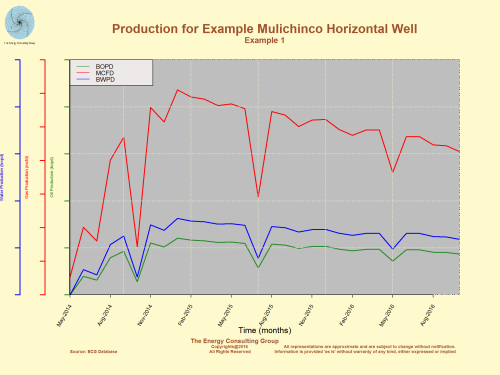

Mulichinco

horizontal shale wells are capable of delivering solid

production results, though not all do so.

For Higher Resolution, Click Image |

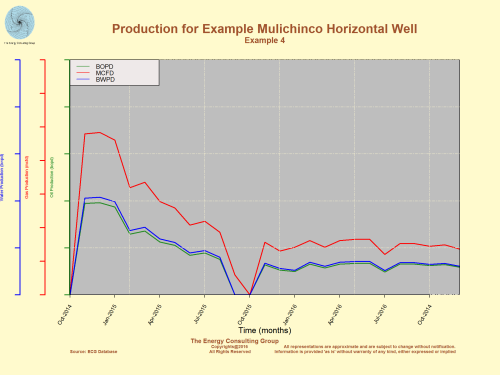

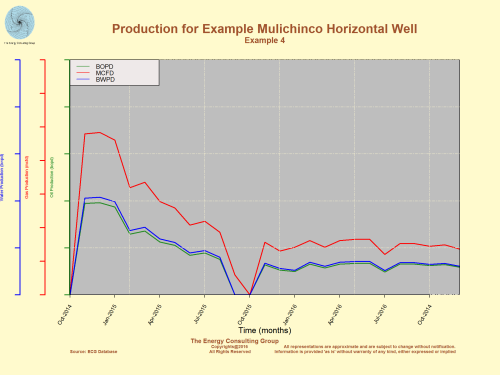

As with all shale plays, there are a range of

production results.

For Higher Resolution, Click Image |

| |

|

| |

|

| |

|

| |

|

3D Maps

The following panel contains an interactive 3d elevation map of the

Neuquen Basin region.

This is intended to provide a quick way of visualizing how the

surface topography of the Neuquen increases the costs and challenges of

exploiting oil and gas resources, including the shale/tight plays as

activity, going from east to west.

(source: EIA)

Link to EIA

article

Last Updated: March 2016

EIA Overview

Map of Argentina

- In 2014, Argentina was the largest dry gas producer and

the fourth largest petroleum and other liquids producer in

South America.

- Argentina’s new hydrocarbons reform, published on

October 31, 2014, provides investors with offshore

exploration opportunities and encourages foreign ventures in

unconventional plays. Before the 2014 reform to the 1967

Hydrocarbon Law, Argentina’s energy sector policies prompted

an imbalance of energy supply and demand by limiting the

industry’s attractiveness to private investors, restraining

the profits of domestic producers, and shielding consumers

from rising prices. Domestic demand for energy grew rapidly

while production of both petroleum and other liquids and

natural gas declined – making Argentina a net hydrocarbons

importer.

- To incentivize foreign investment in the hydrocarbons

sector and boost domestic energy supplies policy reforms

have changed the national bidding process, increasing the

frequency of offshore licensing rounds, allowing for longer

exploitation periods, and offering tax exemptions to

companies that invest more than $250 million over a

three-year period.

- To limit the influence of the low oil prices on

production, the Ministry of Economy reduced oil exports

tariffs in 2014.

- The Argentine government provides tax incentives to

companies that form partnerships with state-owned energy

company, Energía Argentina Sociedad Anónima’s (ENARSA), for

offshore exploration and offers higher gas prices for new

gas production sold in the domestic market under the Gas

Plus Plan.

- In Argentina, the energy sector is regulated by the

Ministerio de Planificación Federal, Inversión Pública y

Servicios (Ministry of Federal Planning, Public Investment,

and Services). The Ministry includes the Ente Nacional

Regulador de Gas (ENARGAS), which regulates natural gas

transportation, and distribution activities; and the

Secretaría de Energía (Energy Secretariat), which oversees

upstream oil and natural gas production. The 2014 reform

transferred all of the offshore permits and concessions of

state-owned energy company ENARSA’s to the Energy

Secretariat.

- According to the 2014 Energy Balance published by the

Argentina’s Energy Secretariat, total primary energy

production in Argentina was 3.35 quadrillion Btu. Natural

gas production accounted for approximately 51%, and

production of crude oil represented 37% of the total energy

production portfolio. Hydroelectricity is the third largest

primary energy source.

- Natural gas, which is used widely in the electricity,

industrial, and residential sectors, represented 52% of

total primary energy consumption in 2014 (3.34 quadrillion

Btu). Oil is the primary fuel used in the transportation

sector and represented 33% of total primary energy

consumption. A smaller share of the country’s total energy

consumption can be attributed to nuclear, coal, and

hydropower, which are used for electricity generation, while

other renewable resources are used to produce biofuels for

transportation.

Petroleum and other liquids

As of January 2016, Argentina held 2.4 billion barrels

of proved crude oil reserves according to Oil and Gas

Journal (OGJ). In 2015, total oil production was

716,000 barrels per day (b/d), of which 513,000 b/d was from

crude oil and 108,000 b/d was from natural gas plant

liquids.

YPF is the largest oil producer in the country and

extracts oil from about 59 fields. The second-leading oil

producer, with 19% for total production in 2014, is Pan

American Energy (PAE), which is owned by BP and the Bridas

Corporation (a 50-50 joint venture between the China

National Offshore Oil Corporation and Bridas Energy

Holdings). PAE currently operates one of Argentina’s largest

oil fields, the Cerro Dragón field. Chevron (U.S.),

Petrobras (Brazil),

and Sinopec Group (China)

also have had a significant presence in Argentina’s upstream

oil production.

Argentina has ten refineries with a combined 634,000 b/d

of crude refining capacity, more than half of which is

controlled by YPF, according to the OGJ.

Argentinian refined products do not satisfy all domestic

fuel demand. As a result, Argentina imported 91,813 b/d of

total oil products, including 63,000 b/d from the United

States, in 2015.

In November 2013, the European Union (EU), Argentina’s

largest biodiesel export market, implemented anti-dumping

tariffs on biodiesel imports. In January of 2015, the U.S.

Environmental Protection Agency (EPA) approved the import of

biodiesel from Argentina for fuel use, a move that may help

the country recover from the EU tariffs. However, in the

fourth quarter of 2015, total biodiesel exports were down

33% year on year.

Natural gas

Argentina had proved natural gas reserves of

approximately 11.7 Trillion cubic feet (Tcf) in January

2016, according to latest estimates from OGJ, an increase of

0.6 Tcf from 2015. Argentina holds the world’s

second-largest shale gas reserves. Vaca Muerta, located in

the Neuquen Basin, is Argentina’s largest shale gas play

with an estimated 308 Tcf of dry, wet, and associated shale

gas resources.

According to Argentina’s energy ministry, YPF

—Argentina’s former state owned energy company— was

Argentina’s largest natural gas producer in 2015, accounting

for about 31% of the country’s total domestic supply. Other

significant players in the natural gas sector include Total

Austral, Pan American Energy, Petrobras (Brazil), Tecpetrol

(Argentina), and Apache Energy (U.S.).

Argentina produced 1.25 Tcf of natural gas in 2014

according to BP. The largest-gas producing basins include

Neuquén, Austral, and Noroeste. Together, these three basins

account for roughly 85% of the country’s natural gas

production.

Argentina has 18,598 miles of natural gas pipelines.

Predominant pipelines include Neuba I, Neuba II, and San

Martin, which connect producing provinces in the Neuquén,

San Jorge, and Austral basins (located in the central and

southern parts of the country) with Buenos Aires and other

demand centers.

Bolivia

is the source of virtually all of Argentina’s natural gas

imports via pipeline. In 2014, Argentina imported 203

Billion cubic feet (Bcf) from Bolivia via pipeline. Located

on the Paraná River, the Escobar terminal is Argentina’s

sole LNG terminal. Argentina imported 207 Bcf of liquefied

natural gas in 2014 via the terminal, of which the largest

share of LNG came from

Trinidad and Tobago.

Although Argentina is a net importer of natural gas, it

continues to export natural gas to its neighbors — largely

Chile and, to a

lesser extent,

Uruguay.

Electricity

Argentina consumed 120.9 billion kilowatthours in 2013

and remains the second-largest consumer of electricity in

South America, after Brazil.

Through electrical transmission interconnections with

Brazil, Chile,

Paraguay, and Uruguay,

Argentina imported 18.4 billion kilowatthours in 2014, a

130% increase from electrical energy imports in 2013 (8.0

billion kilowatthours), to meet increasing domestic

electricity demand.

The Energy Consulting Group home page

|