The Energy Consulting Group

Management consultants for upstream oil and gas producers and service companies

Our focus is to work with management teams to develop and

implement business strategies that are practical, sustainable and allow

organizations to achieve their full potential. Our consultants have

long histories of working closely with senior executive teams of

firms of all sizes to help their companies not only be successful,

but achieve performance that stands out relative to

peers.

.

Algerian Oil and Gas, Exploration and Production Industry

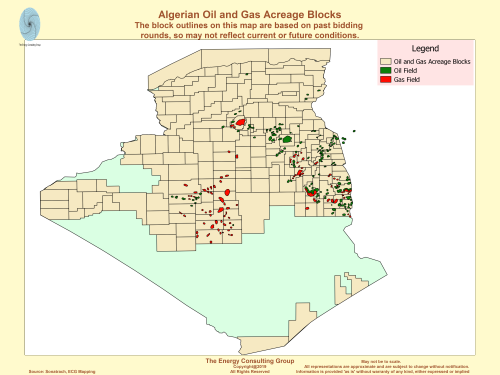

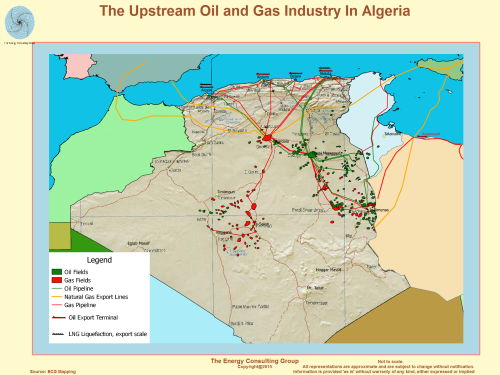

The Upstream Oil and Gas Industry In Algeria For Higher Resolution, Click Image |

Web Page Table of Contents (click on the hi-lighted text to go directly to that content) Overview Map of the Algerian Oil and Gas Industry Algerian Oil and Gas Production and Export Volumes/Infrastructure Maps Overview of Algerian Non-Conventional Plays (Shale Gas) Algerian Geology-Detailed (ALNAFT) Legal Framework for Carrying Out Hydrocarbon Research and/or Exploration Activities in Algeria (ALNAFT) 3D Algerian Shaded Relief Map (Rotatable, Zoomable, Roamable) 3D Algerian Shaded Relief Map with Oil and Gas Fields, and Pipelines (Rotatable, Zoomable, Roamable) Go to Energy Consulting Group Home Page |

|

E&P News and Information Scandinavian International and National International Energy

Agency Department of Trade and Norwegian

Petroleum Ministry of Industry

and E&P Project Information |

|---|

|

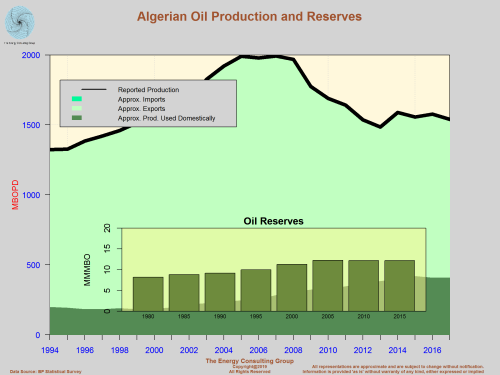

Algerian Oil Production and Reserves (Note: These are total liquid volumes, so are an amalgam of crude, condensate and NGL production. According to the EIA, Algeria produces about 320 MBLPD of NGL's and about 1200 MBOPD of crude and condensate)  For Larger View, Click Image |

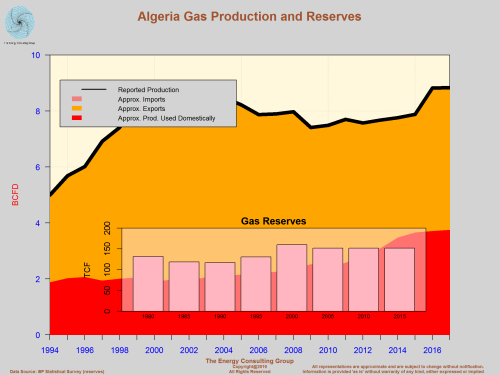

Algerian Gas Production and Reserves  For Larger View, Click Image |

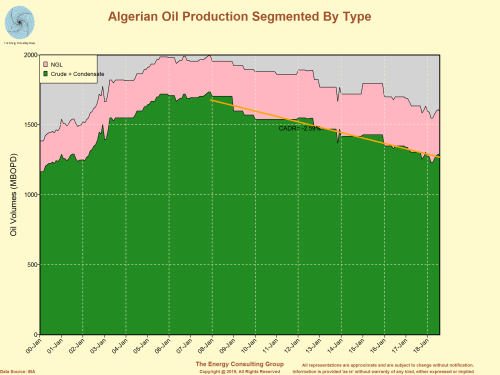

Algerian Oil Production Segmented By Type (Crude, Condensate,

and NGL) For Larger View, Click Image |

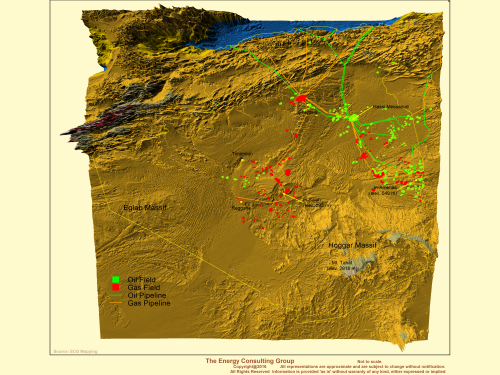

Algerian Oil and Gas Fields on 3D Surface Elev. Map  For Higher Resolution, Click Image |

|

Return to Web Page Index |

|

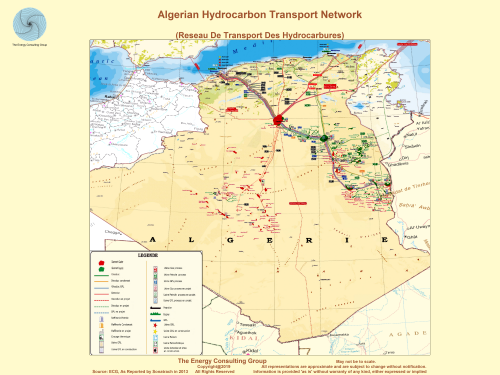

Algerian Hydrocarbon Transport and Export Network For Larger View, Click Image |

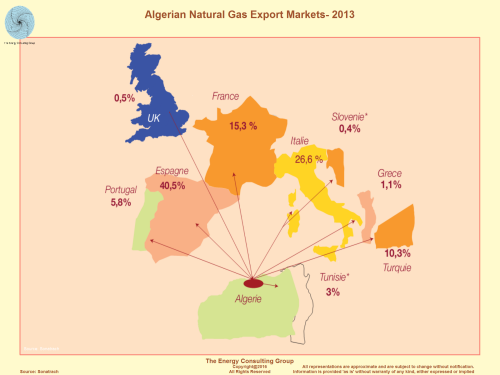

Algerian Natural Gas Export Markets-2013 For Larger View, Click Image |

|

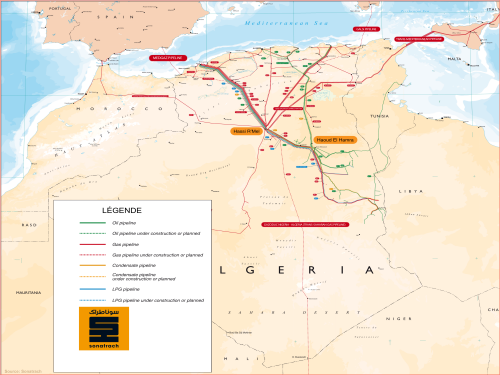

Algerian Oil and Gas Pipelines Relative to Oil and Gas Fields - Circa 2001  For Larger View, Click Image |

Algeria Pipeline Map (high resolution) For Larger View, Click Image |

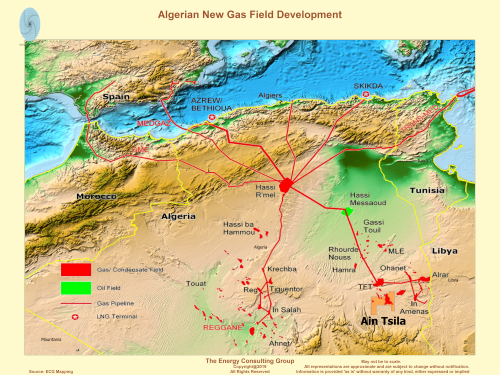

Algerian New Gas-Condensate Field Development: Ain Tsila Link to 3D version of the above map. The 3D representations shows how the terrain varies around the new field area, and how the elevation shifts as gas pipelines heads towards the domestic demand and export (LNG and pipelline) centers along the coast. 3D Map Controls: to rotate use the left mouse button, to zoom in/out use the mouse wheel, and to roam use the right mouse button. |

Algiers, March 13, 2019; Ain Tsila Project Approval Announcement

The

Isarene Group (Incorporated by SONATRACH, Petroceltic and Enel)

and PETROFAC International (UAE) LLC today signed an EPC

contract for the development

-

The completion of a CPF for wet gas treatment with a capacity of

12 million m3 Day; |

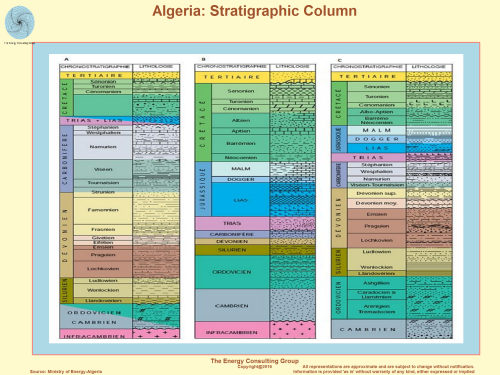

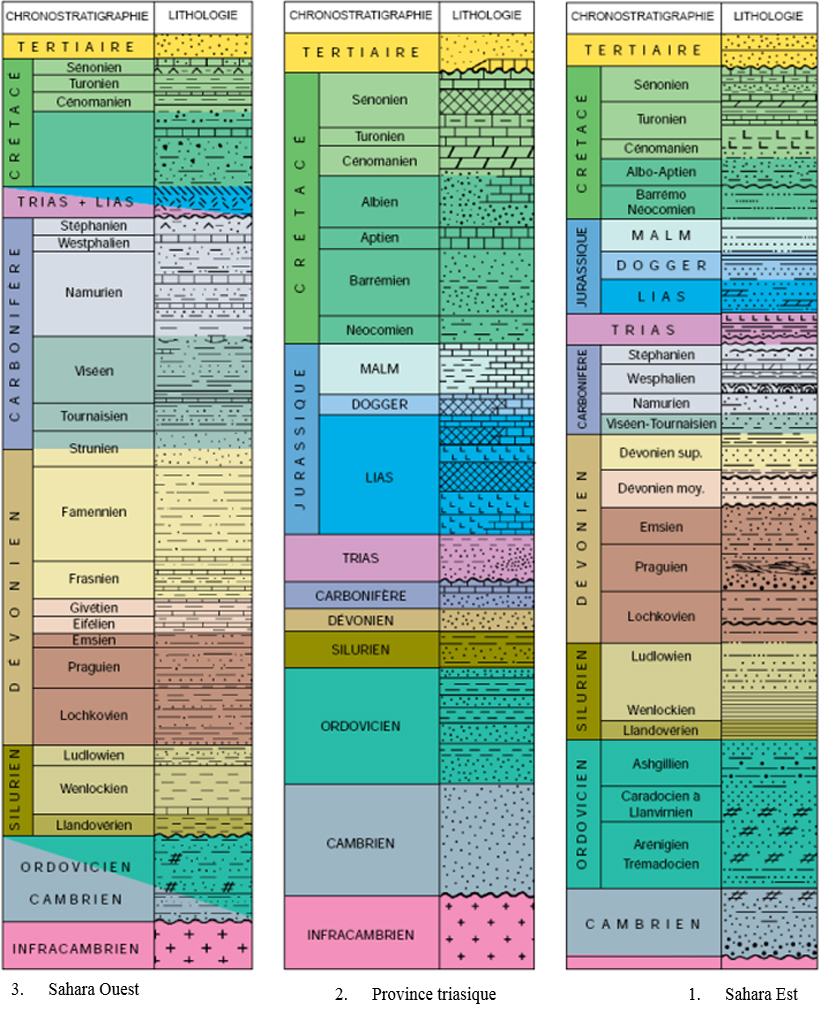

Algeria: Stratigraphic Column For Larger View, Click Image Stratigraphie de la plate-forme saharienne (A- la province occidentale, B- la province triasique, C- la province orientale) Stratigraphy of the Saharan platform (A-Western Province, B-Triassic province,C-the eastern province ) |

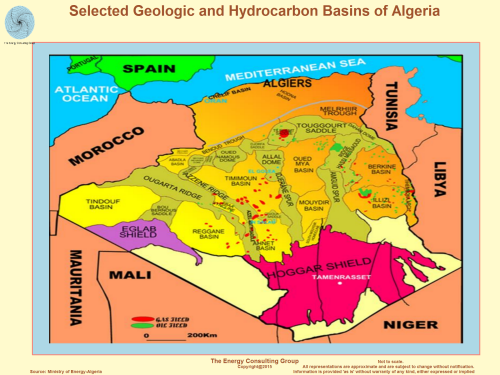

Selected Geologic and Hydrocarbon Basins of Algeria (with some

oil and gas fields) For Larger View, Click Image |

|

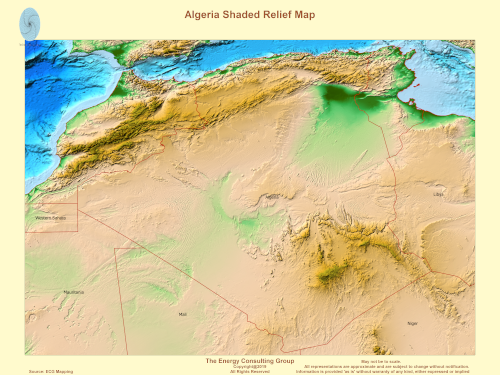

To the left is a 3D rendering of the Algerian shaded relief map

shown below. It is rotatable, zoomable, and roamable (per

the directions below).

For a full screen version of the map, go to this link. (Controls for the 3D rendering to the left and online are: to rotate use the left mouse button, to zoom in/out use the mouse wheel, and to roam use the right mouse button.)  |

|

The 3D image to the left contains an interactive 3D elevation map of most

of Algeria with an overlay of oil and gas fields and pipelines. It is intended to help

provide geographic context for important oil and gas producing regions

in Algeria. It is rotatable, zoomable, and roamable (per

the directions below).

For a full screen version of the map, go to this link. (Controls for the 3D rendering to the left and online are: to rotate use the left mouse button, to zoom in/out use the mouse wheel, and to roam use the right mouse button.)  |

Algerian Non-Conventional Oil and Gas Plays (Shale Gas and Light,Tight Oil)

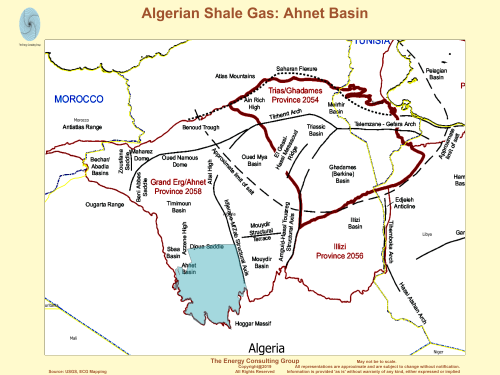

Algerian Shale Gas:

Ahnet Basin |

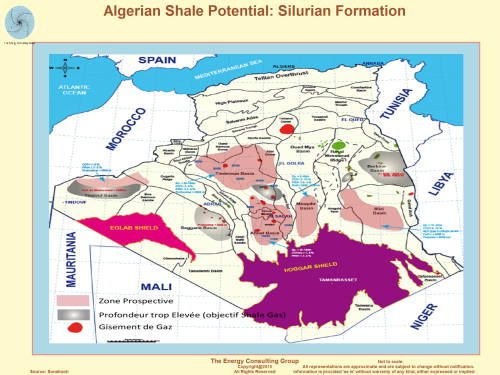

It has been reported that ExxonMobil is negotiating an agreement

to develop shale gas fields in the Ahnet Basin, southwestern Algeria

(see exhibit to the left) with

horizontal drilling and fracking technology. The shale gas zones are probably the

Frasnian and Silurian, which Sonatrach tested in 2015, and which

are described in more detail in the following exhibits. Reuters is reporting that ExxonMobil has temporarily suspended the above referenced negotiations due to the nascent anti-government protest movement that emerged in March 2019. |

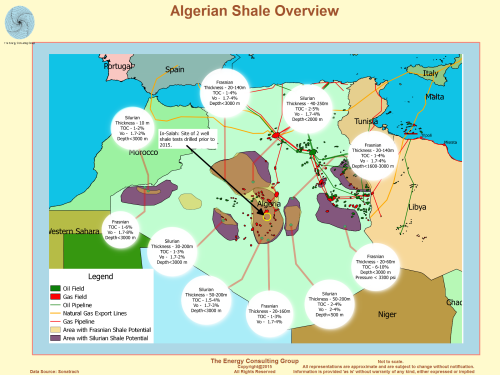

Algerian Shale Gas

Overview |

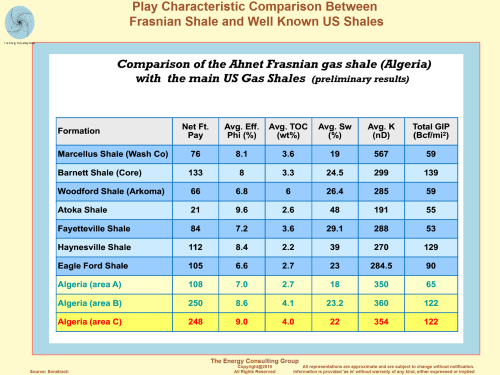

Play Characteristic Comparison Between Frasnian Shale and Well

Known US Shales |

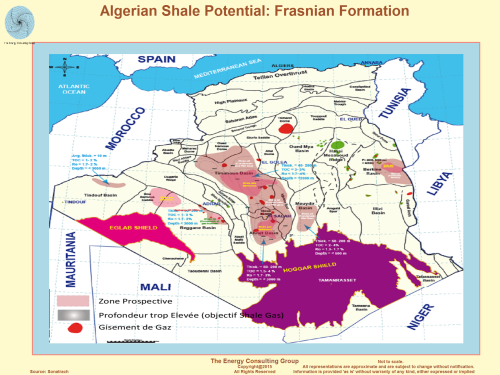

Algerian Shale Gas

Potential: Frasnian Formation |

Algerian Shale Gas Potential: Silurian Formation |

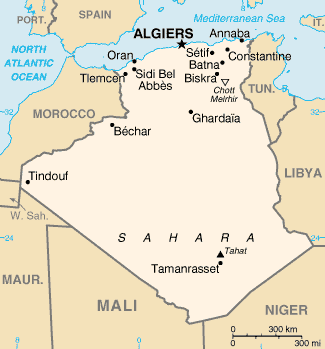

1.INTRODUCTION:

The boundaries of Algeria are the Mediterranean Sea to the north (1200 km of

coast), Morocco to the west, Tunisia and Libya to the east, Mauritania and

Western Sahara to the south-west and finally Mali and Niger to the south (Fig.

1).

Fig.1: Geographical map of Algeria

2. GEOLOGICAL FRAMEWORK

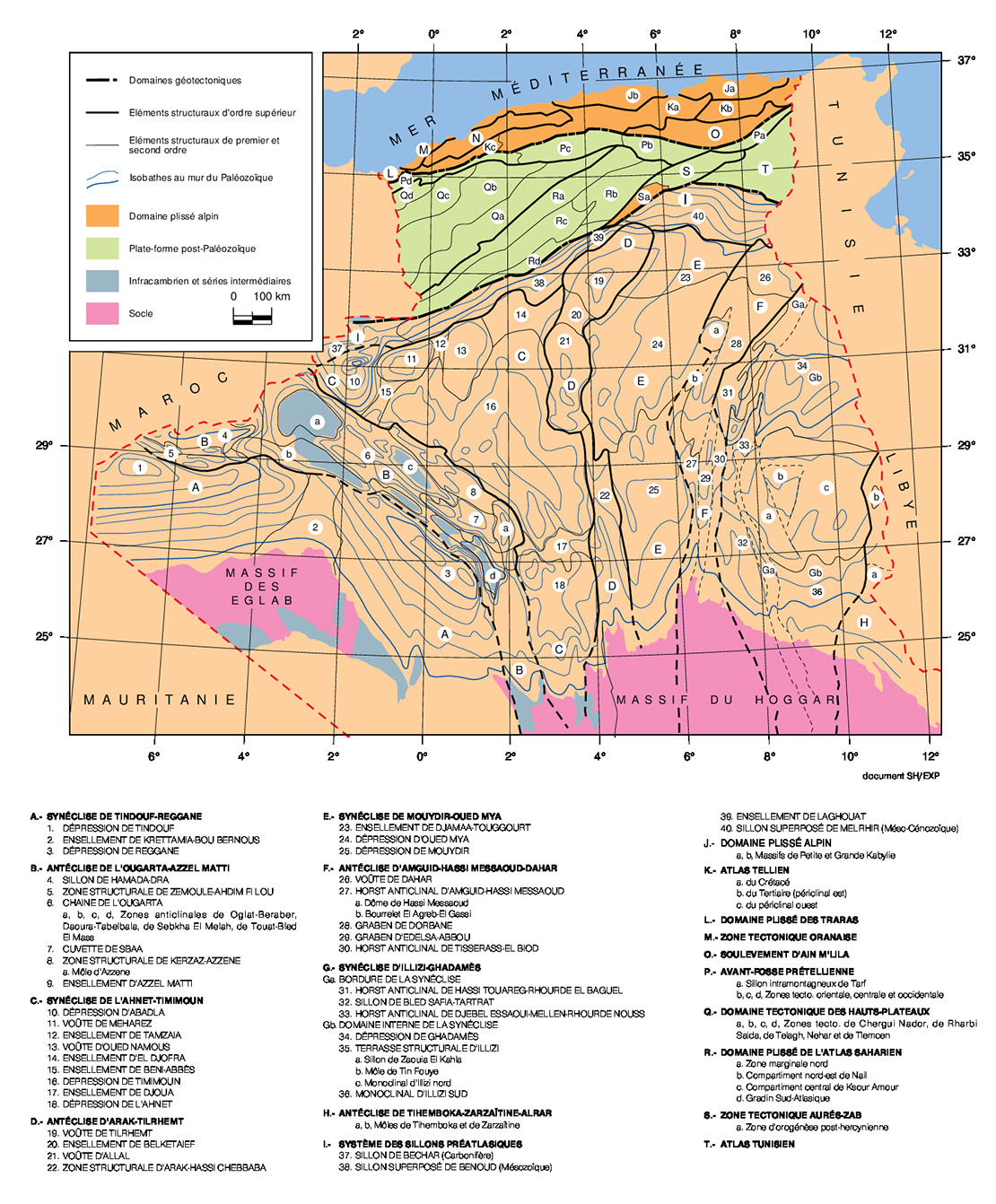

The geological history of Algerian sedimentary basins (Fig. 2) is part of the

global geodynamic process of plate tectonics that has structured Algeria in two

domains:

·

in the north, alpine Algeria;

·

to the south, the Saharan Platform.

Fig. 2: Structural Map of Algeria

2.1 ALGERIA ALGERIA:

The northern domain consists of young reliefs, modeled during the Tertiary by

the Alpine movements.

Alpine Algeria is composed of the following structural-sedimentary ensembles,

from north to south:

• the reduced Algerian continental shelf, with tertiary and quaternary deposits

(1000 to 3500 m), is based on a metamorphic base.

The main oil objective is the Mio-Pliocene;

• The Tell Atlas is the domain of aquifers, with basins of intramontane type (eg

Chélif basin), whose sedimentary series extends from Jurassic to

Miocene. Several deposits of variable interest are known there: Ain Zeft,

Tliouanet, Oued Guettirini. The main oil objectives are middle Cretaceous,

Miocene and allochthonous Eocene;

• The Hodna is a pre-pit basin whose filling sequence begins with continental

deposits of Eocene and Oligocene age and continues with a marine Miocene.

The main oil target is the Eocene;

• the highlands, alpine foreland, with reduced sedimentary cover, where local

processes of distension have allowed the formation of intramontane basins such

as those of Telagh and Tiaret. The main oil goal is the Lias;

• The Saharan Atlas was born from a long subsident furrow pinched between the

highlands and the Saharan Platform. In the Mesozoic, this furrow was filled by a

powerful sedimentary series (7000 to 9000 m). During the Tertiary, a compressive

tectonics reactivates the previous extensive structures in faults and inverse

structures resulting in the formation of this mountain range. The main oil

objective is Jurassic.

• the Chott Melrhir basins in the Constantine SE, structured in the Cretaceous

Tertiary Tertiary (5000 m), generated and accumulated hydrocarbons mainly in the

Cretaceous (Djebel Onk, Rass Toumb, Guerguet North El Kihal).

2.2 THE SAHARIAN PLATFORM:

It is located in the south of alpine Algeria and belongs to the North African

craton. It includes a Precambrian basement on which rests a powerful sedimentary

cover, structured in the Paleozoic in several basins separated by high zones. We

distinguish from west to east:

• the Tindouf and Reggane basins located on the northern and northeastern

borders of the Reguibat Shield. The sedimentary cover would reach 8000m in the

Tindouf basin and 6500m in the Reggane basin. In this little explored zone,

Paleozoic formations could be found in liquid and gaseous hydrocarbons;

• the Béchar basin bounded on the north by the High Atlas, to the south and west

by the Ougarta range. Its sedimentary cover would reach 8000m. The reservoirs

are found in lower Paleozoic detritic and Carboniferous reefs;

• the Ahnet-Timimoun basin bounded on the north by the Oued Namous highland, on

the west by the Ougarta range, on the south by the Touareg shield and on the

east by the Idjerane-Mzab ridge . Coverage would average 4000 m. In the south,

the lower Ordovician and Devonian reservoirs are gasiferous. To the north, in

the Sbaa basin, oil has been found throughout the Paleozoic;

• the Mouydir and Aguemour-Oued Mya basins are bounded on the west by the

Idjerane-Mzab Ridge and on the east by the Amguid-El Biod Ridge. In the south,

Paleozoic sediments are exposed in Mouydir. To the north, in the Aguemour-Oued

Mya depression, filled by a powerful Paleozoic and Meso-Cenozoic series (5000m

at Oued Mya), significant deposits have been found in the Cambrian (Hassi

Messaoud) and Triassic ( Hassi Rmel);

• The Illizi-Berkine syncline is bounded on the west by the Amguid-El Biod ridge

and on the east by the Tihemboka mole and the Tunisian-Libyan borders. In the

Ghadames basin, the sedimentary cover (greater than 6000 m) contains hydrocarbon

deposits in the Paleozoic and Triassic.

3. GEODYNAMIC EVOLUTION

The formation of the Mediterranean alpine chains including the Algerian section

of this chain is linked to the rotation of Africa in relation to Eurasia. This

rotation is a slow drift of the two continents towards each other. The initial

stages of this convergence, detected as early as the Early Jurassic, did not

manifest themselves until after the Upper Jurassic (150 Ma).

The tectonics is that of the Africa-Europe collision. The Algerian alpine chain,

which leans against the northern fringe of the southern block, was born of this

collision.

Although the beginning of Africa's drifting movements from Europe is only clear

from the Malm, the initialization of the phenomena dates from the Lias (180

Ma). They are associated with the opening of the North Atlantic.

Schematically, this opening takes place from south to north and generates a

number of phenomena whose effects on Algeria can be summarized as follows:

During the Jurassic period (180-140 Ma), south of the current Azores-Gibraltar

fracture zone, Africa and the continental blocks attached to it separate from

the North America-Europe block (Fig. 5a). The general direction of the Atlantic

is NS while the future Mediterranean alpine zone takes an EO direction. This

direction is determined by the relative movement of Africa relative to

Europe. This movement, of sliding component sinister, persists until the

superior Cretaceous.

In the lower Cretaceous, Spain, acting as a corner opposite the slide, separates

from the America-Europe bloc. The drift of Spain is responsible for the finite

Jurassic-Eocretacea compression phase, as shown by the folds encountered in the

Middle Atlas. During the Cretaceous, as a result of the opening of the North

Atlantic basin (Fig. 5b), there is a decrease in the sinister slide.

The opening would have caused the cancellation of the sinister component of the

movement and even its "inversion". The convergence component of the two

continents, which remained in the background during the Cretaceous period,

became dominant during the cancellation of late Cretaceous slides.

During the Tertiary, a number of remissions and convergences are recorded,

alternating with more or less distensive phases.

From the Eocene, most of Western Europe is stabilized in a form close to the

current one. There is no active subduction zone in the western Mediterranean,

and the collision front extends from the west from the Pyrenees all the way to

the east. It is the zones of lithospheric weakness, mainly areas of Cretaceous

deformations, which absorb the effects of the collision. This generalized

compression provokes deformations on the European bloc and on North-Continental

Africa.

In the Oligocene, as a consequence of the conjugation of the north Atlantic

opening, in the west, and the East-Africa collision, in the east, the western

Mediterranean regions are subjected to a general tectonic regime of

distension. It is responsible for the large intracontinental grabens systems

affecting all of Europe from Spain to the North Sea.

The Mio-Pliocene sees the resumption of Africa-Europe convergence, implying the

resumption of tectonic deformations in the western Mediterranean.

At the level of the Azores-Gibraltar line, the convergence has a sinister

component which manifests on the one hand by activating local points of

subduction and on the other hand, by generating an intracontinental tectonics at

the level of the Pyrenees, the Iberian Chain and of the High Atlas. At the end

of the cycle, the crushing constraints generate the large sheets like the south

vergence of the Atlas Tellien especially developed between El Asnam and Annaba.

4. THE PETROLEUM PROVINCES

From the oil point of view, we distinguish, across the entire mining sector of

Algeria, four more or less mature provinces:

·

The Eastern Sahara, with known deposits of oil and gas, still has good potential

for discoveries;

·

The Central Sahara, considered as gas (deposits of varying importance) but where

recent discoveries of oil can hope for further developments;

·

Western Sahara is mainly considered globally gas with the exception of the oil

discoveries highlighted in the reservoir of Tournaisien basin Sbaa, its

resources remain virtually unknown;

·

In northern Algeria, integrating offshore basins, which despite small oil and

gas discoveries, the oil potential has not yet been revealed due to a complex

geology.

5.STRATIGRAPHIE

It is organized into two distinct areas as those already mentioned.

On the one hand, the Saharan Platform is a very large and stable region that has

been modeled since the Paleozoic and subdivided into three oil provinces.

On the other hand, the north of Algeria, modeled during the Tertiary by the

Alpine movements, has several different sets of stratigraphic characters.

5.1 THE SAHARIAN PLATFORM

The thicknesses of the series (1000 to 8000 m), their nature, the tectonic

deformations and the subsidence, shaped the Saharan Platform in a number of

basins distributed in the western province, the eastern province and the triasic

province.

Fig. 3: Stratigraphic section of the provinces of the Saharan platform

a) THE WESTERN PROVINCE

The western province includes the basins of Bechar, Tindouf, Reggane, Ahnet,

Mouydir, Timimoun and Sbaa. These depressions are Paleozoic, Cambrian to

Namurian. The Meso-Cenozoic is poorly developed. The power of the series varies

from 3500 to 8000m. The Tindouf and Reggane basins are dissymmetrical

depressions located on the N and NE borders of the Eglab massif.

Paleozoic sediments would reach 8000m in the Tindouf basin and 6000m in the

Reggane basin. The Bechar basin is bounded on the north by the High Atlas, on

the south and west by the Ougarta range and on the east by the Meharez

highland. The power of the series is of the order of 8000m.

The Ahnet-Timimoun basin is bounded on the north by the Oued Namous highland, on

the west by the Ougarta range, on the south by the Touareg shield and on the

east by the Foum Belrem ridges and Mzab. The Mouydir basin is bounded on the

west by the Foum Belrem Ridge and on the east by the Amguid-El Biod Ridge. The

sedimentary series can reach more than 3000m.

b) THE TRIAL PROVINCE

Located in the northern part of the Saharan Platform, the Triassic Province is

an EO-direction anticlinorium where the following major elements have been

individualized:

·

the vault of Tilrhemt and the high ground of Talemzane;

·

the structural system of Djemâa-Touggourt;

·

the El Agreb-Messaoud dislocation system;

·

the pier of Dahar.

These elements are separated by depressions (Oued Mya) where one meets the

typical series of the triasic province. (Fig.9b) Paleozoic deposits are often

highly eroded, as deep as the Ordovician or Cambrian.

The Mesozoic, discordant on the Paleozoic, is present from the Triassic to the

Cretaceous. The Cenozoic is represented by a detrital series of Mio-Pliocene.

c) THE EASTERN PROVINCE

This province, called Synéclise East Algeria, consists of the basins of Illizi

and Ghadames separated by the pier of Ahara.

The typical Precambrian sedimentary series (Fig. 9c) presents all the terms,

from the Cambrian to the Present. A sandy series of Mio-Pliocene age locally

covers the terminal formations of the Mesozoic.

Finally, the discontinuous Quaternary, of small thickness, constitutes the last

element of the stratigraphic series.

• Illizi Basin

Paleozoic sediments (about 3000m) rise to the outcrop to the south where they

form the Tassilis. As for the Mesozoic formations, they are only in the center

of the basin.

Tertiary deposits are well represented in the northwest

• Berkine Basin

This depression is an intracratonic basin that has retained a sedimentary

filling of over 6000m from the Paleozoic to the Present. The Mesozoic deposits

are characterized by a salt series located in the north and northeast of the

basin.

5.2 NORTHERN ALGERIA

Northern Algeria is part of the geological evolution of the Mesogean basin. The

foreland has four paleogeographic or structural sets (Fig. 2):

·

the Oran Meseta;

·

the Saharan Atlas at large;

·

southeastern Constantine;

·

the tellian domain.

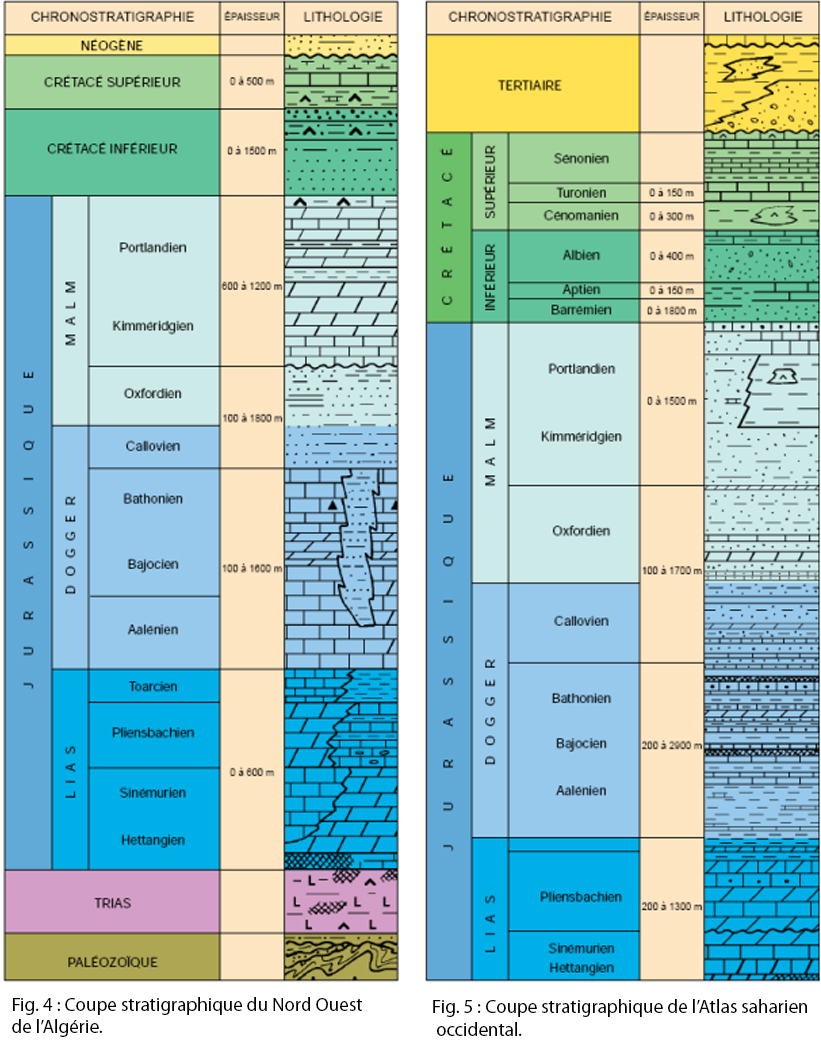

The stratigraphy (Figs 4 and 5) of northern Algeria has been defined in these

areas from field and survey data.

a) THE PALEOZOIC

It is mainly restricted to the northern part (Ghar-Rouban Mountains, Tiffrit,

Traras, Chenoua and Kabylie).

It consists of gneisses, micaschists, sandstones and quartzites, locally dated

(Ordovician, Devonian, Carboniferous, Permian).

b) THE MESOZOIC

• Trias

It is known in situ only in a few boreholes where it consists of a sandstone

series at the base followed by a powerful evaporitic series comprising

calcareo-dolomitic past and basic volcanic intercalations at the summit.

In Greater Kabylia, the lower Triassic, probably in part Permian, is represented

by red sandstones followed by Muschelkalk limestones, in thick banks or

platelets, themselves followed by red sandstones sometimes interspersed with

doleritic rocks.

Further south, in the Babors region, the Muschelkalk is surmounted by the salt

and gypsiferous formations of Keuper. The lagoon regime of the Babors extends

throughout the Tellian zone.

In the east, the lagoonal Triassic clay-detrital region, however, includes

carbonate-dominated top sequences attributed to Muschelkak. In Hodna and

Constantine, variegated clays are interposed in these same sequences.

At the end of the Triassic, with the exception of a few stable zones (Doui

Zaccar, Beni Snassene, etc.), the evaporitic facies are generalized.

• Jurassic

In most of northern Algeria, it begins with a transgressive Lias.

• Lias:

After the Evaporitic episode of the Upper Triassic, the marine character

increases during the Lias. The calcareodolomitic facies evolves gradually

towards the marls of the higher Lias. The marine character of the Lias is

confirmed by the appearance of dolomitic and oolitic limestones indicating an

open environment with pelagic influences without being very deep.

The Lias begins with a carbonate level that caps the evaporitic sequences of

Keuper. In various points of the Saharan Atlas, this level is Rhétien age. In

the southern parts of the chain, Hodna and Bousaada, the essentially

carbonaceous deposits fill the atlasic trench. The western Tellian zone and the

Saharan Platform see the carbonate sedimentation continue with a

Hettangien-Sinémurien limestone which reaches, in places, 200m. In the

Hettangien-Pliensbachien, the transgression reached its maximum with flint

limestones, red limestones with Ammonites, limestones with polyps, algae and

finally calcareous dolomites (200m). At Domérien, Algeria is entirely under

marine environment. The ammonitico-rosso facies appear in the Djurdjura.

• Dogger:

It is distributed, from north to south, in different paleogeographic

domains. The kabyle domain with reduced carbonate deposits, followed by the

relatively thick clay-carbonate sedimentary zone, by the high plateaus and the

Constantine mole with mainly carbonated deposits, and finally by the atlasic

pit, with clay-sandstone facies often exceeding 2000m. thickness. In the

southern part of the Oran highlands and the western Saharan Atlas, the upper

Bajocian is marked by traces of detrital sedimentation, reflecting the proximity

of fluvio-deltaic activity.

• Malm:

The extension of sandstone facies towards the north shows that the regression,

initiated in the Atlas fossa at the end of the Dogger, is accentuated. During

this period, marine areas in the north and continental or deltaic domains in the

south are opposed. In the latter, however, we find in the highlands and the

Atlas fossa, facies of marine influence in the form of sand and sandstone, clay

and limestone. East of the meridian passing through Sedrata-Laghouat, a free

marine environment without detrital input persists throughout the Upper

Jurassic.

• Cretaceous

It is outcropping in the Saharan Atlas. Its detrital and siliceous sediments

know their greatest development in the Western Saharan Atlas with thicknesses of

1200m.

• Neocomial-Barremian:

This period is characterized by a maximum regression to the Barremian with a

retreat of the sea from the Tell Atlas, the Constantine mole and the NE of the

Atlas fossa. The facies are most often alternating between clay-sandstone

episodes and carbonate levels.

• Aptian:

In the region of Hodna and Aurès, it is represented by a brief transgressive

marine episode with carbonates and reefs. To the south and west, sandstone

facies dominate and reflect a fluvio-deltaic regime.

However, in the Atlas fossa, there is nothing to distinguish the Aptian from the

Albian, except in the region of Laghouat where calcareous deposits have been

found.

• Albian:

Two lithological sets are distinguished. In the Saharan Atlas, the sandstone

Albian at the base, evolves towards flysch facies towards the south. In the

Tell, it is represented by a clay-sandstone facies and finally in the south-east

Constantine, where the transgression is already initiated, the Albian is

carbonated.

In the upper Albian, deposits of marl and limestone succeeding the sandstone

facies of Tell and Hodna, announce the major transgression of the Upper

Cretaceous.

• Cenomanian:

After the Albian transgression, the sea stabilizes.

In the south, a decrease in the water slice causes evaporitic

sedimentation. Elsewhere, the trend is clearly marine. In the Tell Atlas, the

deposits are marl (1000m) with pelagic fauna. The Cenomanian is neritic in the

Telagh and Tiaret regions and carbonated (300 to 400m) in the Hodna Mountains.

• Turonian:

With the exception of some areas of the highlands and Constantine, the sea

covers all of northern Algeria and the Sahara. Cenomanian facies are replaced by

lamellibranch and echinoderm marl.

• Senonian:

It is a marl-limestone sedimentation with lumachelles.

The previous paleogeography persists until the Upper Senonian, with a slight

deepening of the sea and, again, an abundant pelagic microfauna.

c) THE CENOZOIC

• Eocene

In Algeria, the Eocene formations are very important both in terms of their

surfaces and their thickness. In the Tell, the Eocene includes marls rich in

microfauna, limestones and clays. Lutetian and Thanetian are represented by the

classical nummulite levels in these regions. South of the Hodna, the lower

Eocene is composed of gypsum marls, phosphated limestones and flint

limestones. The Lutetian comes under a facies of oyster marl.

• Oligocene-Miocene

·

Oligocene: it is characterized by important contributions of essentially

sandstone material

·

Lower Miocene: it is the seat of a vast transgression taking in sling, following

a line substantially EO, all the Algerian domain of the region of Tlemcen to the

Saharan depression of Biskra. It consists of a thick series of blue marls (more

than 1000m) passing laterally to marine clayey sandstones. Within this immense

submerged zone, individual basins, the Tafna, the low and the medium Chelif, the

Hodna, the Sébaou, etc., are individualized.

·

Upper Miocene: the regression of the Burdigalian is followed by a progressive

transgression on the Chelif scale. The upper Miocene includes various facies

(black or blue marl, sand, sandstone, limestone, diatomite and gypsum).

d) THE PLIOCENE AND THE QUATERNARY

At the Pliocene, in Chelif and Mitidja the sea deposits blue marls with

sandstone intercalations (1000m). In the rest of Algeria, the Pliocene is

lagoonal and passes upward to continental quaternary formations.

6 . THE MERIE ROCKS:

The sedimentary cover of Algeria includes a number of parent rock levels

distributed from Paleozoic to Cenozoic.

The main source rock levels likely to be the source of the hydrocarbons

highlighted in the different reservoirs of the sedimentary cover are:

- The Silurian:

This bedrock includes radioactive clays made of gray-black to black clays,

radioactive at the base. This source rock settled over the entire Saharan

platform. Some regions are devoid of it as a result of Hercynian erosion.

The state of cooking of kerogen is dry gas and condensate in the center and

north of the basins of Reggane and Tindouf, in the center of the basin of

Ghadames and Oued Mya, in the center and the North West of the furrow of Sbaa

and finally in the basins of Timimoun, Ahnet, Bechar, Mouydir.

On the other hand, this same kerogen is in oil phase in the rest of the Triassic

province, in the Illizi basin, in the southern part of the Reggane and Tindouf

basins, in the eastern part of the Reggane basin around the Uganda and finally

in the South East of Sbaa furrow. The kerogen is often immature as is the case

for the South East of the Sbaa furrow, near the vault of Azzene.

- The Frasnian:

The Frasnian consists of black radioactive organic clays. The distribution of

clays shows that in the basins of Ghadames, Illizi, Mouydir, Ahnet, Timimoun,

Benoud furrow, this level is rich in organic matter (Fig. 6).

However, the kerogen is immature to the South East of the Sbaa furrow. It is in

oil phase in the basins of Illizi, Ghadames (except in the center), the furrow

of Sbaa (except the SE) and the southern border of the basins of Tindouf and

Reggane. On the other hand, in the basins of Timimoun, Ahnet, in the center of

the basins of Tindouf, Reggane and Ghadames, the kerogen is in gas phase (dry

gas condensate).

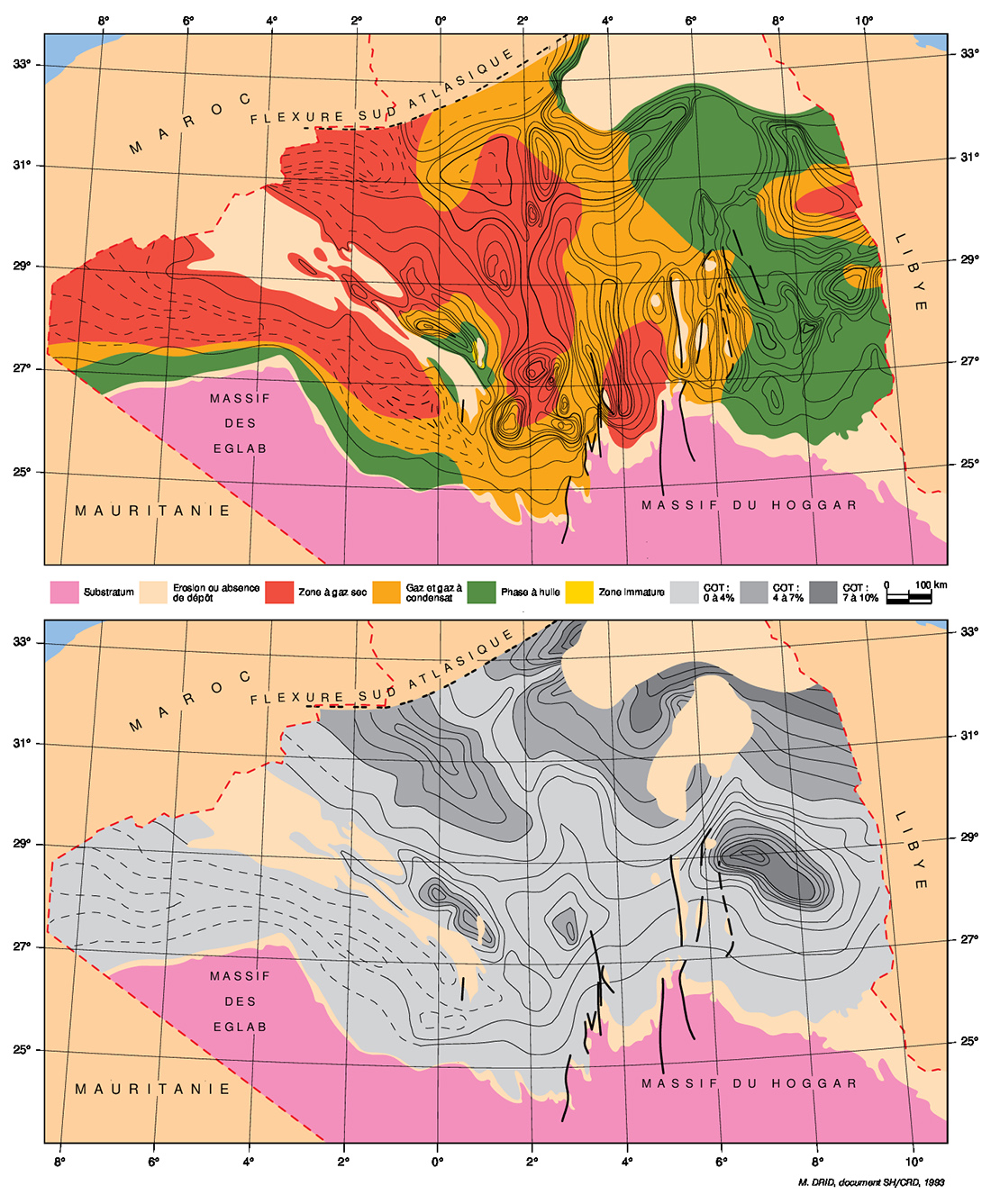

Fig. 6: Isopach, maturation and TOC in the radioactive clays of Frasnien.

-The Cenomanian-Turonian passage:

The main Mesozoic bedrock is located at the Cenomanian-Turonian Passage. The

latter shows the persistence of the marine transgression initiated from the

Albian. The mother rock is limited (Fig. 7) to the east by the Tunisian border,

to the north by the front of the Tellian aquifers, to the west by the meridian

of Algiers and to the south by the parallel 32 ° 50 '.

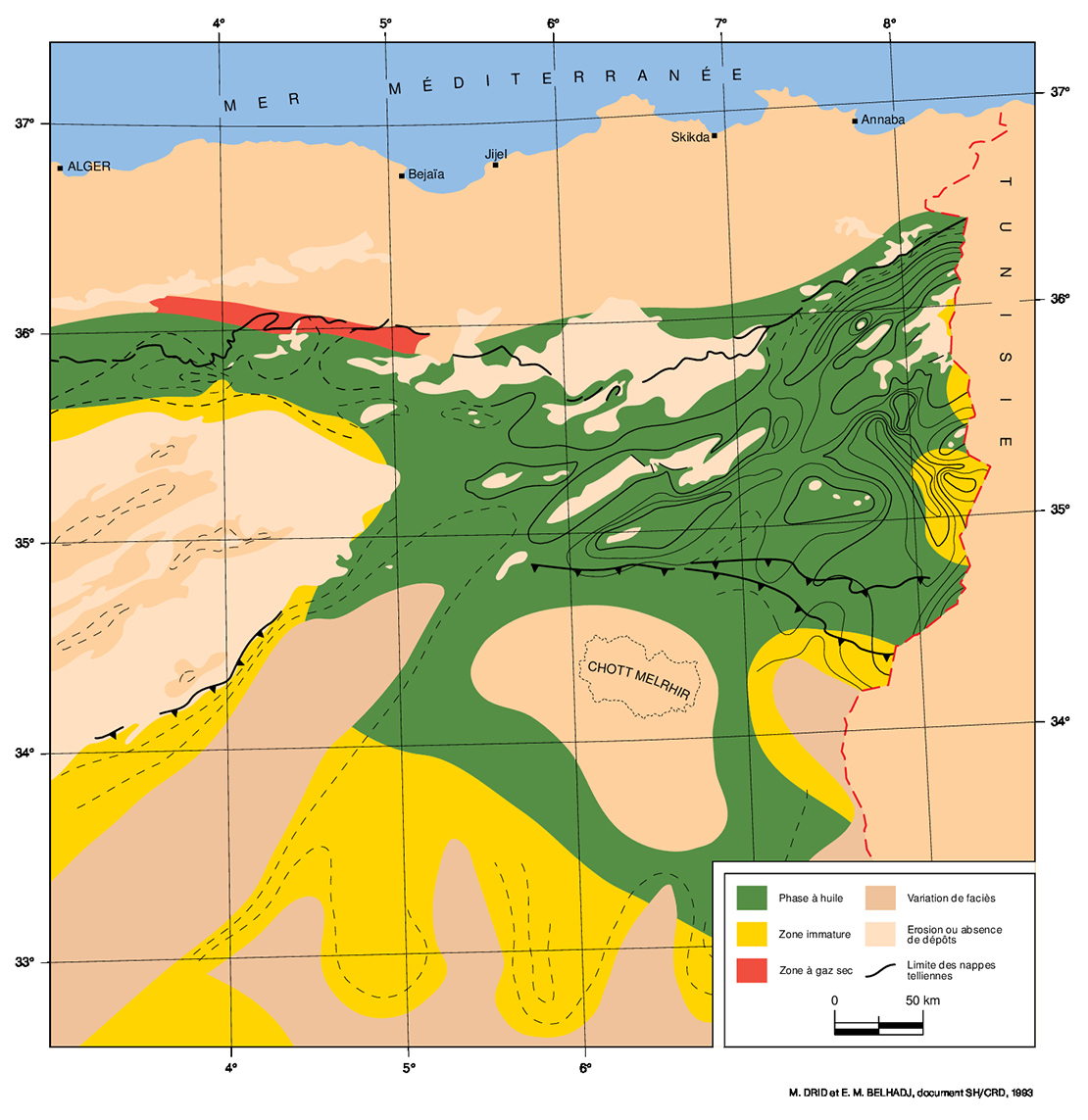

Fig. 7: Isopach and ripening of Cenomano-Turonian radioactive clays.

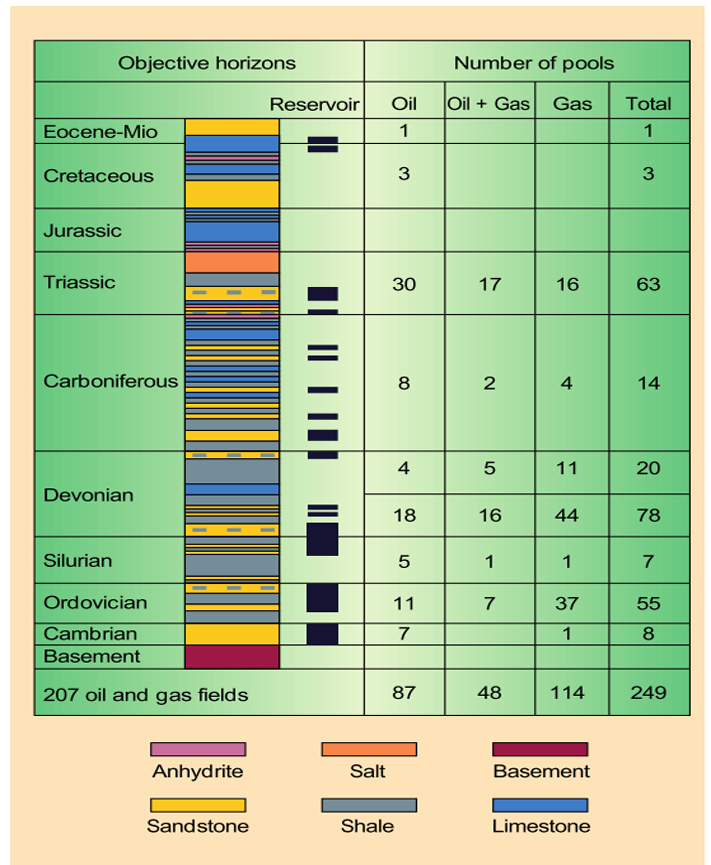

7. THE PETROLEUM TANKS:

As a rule, the reservoirs of the Saharan Platform are related to the Paleozoic

and Mesozoic whereas for the North of Algeria they are reservoirs of the

Mesozoic and Cenozoic.

THE RESERVOIRS OF THE SAHARIAN PLATFORM:

THE PALEOZOIC RESERVOIRS

The Paleozoic includes mostly well-developed and regularly distributed

reservoirs in all the basins of the Saharan Platform (Fig 8). It constitutes

an important part of the reserves of the Algerian Sahara.

- THE CAMBRIAN:

It is productive in the fields of the Triassic province and in the basins of

Illizi and Timimoun.

The main production comes from the Ra and R2 lithozones and to a lesser extent

R3. Productive reservoirs are mainly related to fracking.

- THE ORDOVICIAN:

The relatively numerous Ordovician reservoirs are located in the following

formations:

·

the clayey sandstone of Oued Mya and the sandstone of El Atchane;

·

the quartzites of Hamra;

·

the sandstone of Ouargla;

·

the sandstone of Oued Saret;

·

the sandstone of Ramade or the slab of Mkratta.

The sandstones come from a wide variety of environments, ranging from marine to

glaciofluvial, resulting in a great diversity of reservoir geometry as well as

some disparity in the distribution of most facies.

Fig. 8: Generalized geological section for the whole area of Algeria.

- THE SILURIAN:

On the entire Saharan Platform, the Silurian is known for its rock-mother

qualities. In the Illizi basin and the Triassic province, it has in its upper

part potential reservoir zones where the thicknesses often important make it a

good oil objective.

- THE DEVONIEN:

In general, the Devonian is a producer wherever he exists. Reservoir levels are

medium to coarse sandstones with good petrophysical characteristics. It exists

in three stratigraphic sets (F6, F5 and F4).

- THE CARBONIFERE:

The reservoirs are divided into three sectors. To the west of the platform in

the basins of Tindouf, Ahnet and Timimoun, the matrix characteristics of

sandstone can be good reservoirs.

In the triassic province, the good reservoirs are located in the south-west in

the Viséen and in the north-west in the Moscovian.

Deposits are known in the Viséen of Ghadames and the Moscovian of Bordj Nili. In

the Illizi Basin, well-developed levels (D8 to D0 and B14 to B10) produce in the

Viseen to Zarzaïtine, Tiguentourine, Edjeleh and Adeb Larache. Oil occurrences

have been encountered in the Viséen region of Hassi Messaoud. Namurian (B8, B6,

B4 and B0) produced only in Zarzaïtine.

MESOZOIC RESERVOIRS:

In the northwestern part of the Saharan Platform, the Mesozoic in general and

the Triassic in particular harbor significant oil and gas resources.

The Triassic is divided into a clay-sandstone base sequence (TAGI), a median

carbonate Triassic and a clay-sandstone upper sequence (TAGS).

- TRIAS ARGILO-GRESEUX INFERIEUR (TAGI)

The main discoveries were made in the Rhourde Nouss, Gassi Touil, Nezla, El

Borma, Keskessa, Wad-Teh, Haoud Berkaoui and recently Bir Rebaa-North and

Rhourde El Khrouf regions.

- TRIAS CARBONATE AND ITS EQUIVALENTS:

Located at the top of the sequence (TAGI), it is formed by clay series and

brown-red dolomite with some limestone levels.

It should be noted, however, that the South West part of the Saharan Platform

has given good results in the regions of Rhourde Nouss, Hassi Chergui and Sif

Fatima.

Similarly, in the northwest of the triassic province, the fluvial sandstones

have good potential, as in the southeast of the Ghadames Basin (Zarzaaitin

series).

- TRIAS ALGILO-GRESEUX SUPERIEUR (TAGS):

It is one of the main reservoirs of the Saharan Platform, however it has

produced in Hassi Rmel, Rhourde Nouss, Hassi Chergui, Rhourde Adra, Hamra,

Rhourde Chouf, Brides and recently Rhourde Messaoud and Rhourde El Khrouf.

The Triassic province has well-developed reservoirs.

·

THE RESERVOIRS OF NORTHERN ALGERIA:

Although northern Algeria is only partially known, its oil potential may be

limited to sandstone or carbonate reservoirs of Jurassic to Miocene age (Fig.

8).

- THE JURASSIQUE:

The reservoirs are carbonated with bioclastic buildings and dolomites. They are

found mostly in the Saharan Atlas. Despite indications, no commercial deposits

were discovered.

- CRETACE:

The best-known reservoirs are located in the Cenomano- Turonian. Intergranular

porosity has been improved by dolomitization and fracturing.

Some barremian reservoirs have porosities of 30%. Despite some clues, these

levels have not delivered commercial discoveries.

- THE TERTIARY:

The historical discovery of oil exploration in Algeria goes back to the Miocene

sandstone of Ain Zeft in the Chélif basin at the end of the last century.

Similar discoveries took place at the beginning of the century in the Tliouanet

post-nappe Tortonian sandstones.

The reservoirs are the Eocene Nummulites of the Hodna basin and the Miocene

sandstones of the Chélif basin. The first commercial discovery took place in

1949 in the facies of high energy platform of Oued Gueterini.

9. ROCHES COVERINGS

9.1 THE SAHARIAN PLATFORM:

The basins of the Saharan Platform include levels of Paleozoic and Mesozoic-aged

rock, and are argilo-evaporitic deposits.

THE PALEOZOIC:

- THE ORDOVICIAN

The Ordovician age covered rocks are present on almost the entire Saharan

Platform

- THE LOWER ORDOVICIAN - ARGILES OF EL GASSI

They are gray-black to black clays and cover the Cambrian tanks. This facies is

distributed throughout the Sahara (Ain Romana in the Ghadames Basin).

- THE ORDOVICIAN MEDIUM - ARGILES OF AZZEL AND TIFEROUINE

These gray-black silty-micaceous clays ensure the sealing of Hamra quartzites

and Ouargla sandstones.

- THE ORDOVICIAN SUP. - MICRO-CONGLOMERATIC CLAYS

These are black and gray clays with rolled quartz grains of periglacial

origin. This level may lie unconformably on several Cambrian and Ordovician

reservoirs.

- THE SILURIAN

The Silurian formations of the Saharan Platform are considered on the one hand

as source rocks composed of clay horizons and on the other hand as covered rocks

for reservoirs of the Upper Ordovician.

They are found in Moukhag El Kebach and in the Oued Mya Basin or in Guaret El

Gueffoul and Hssi Msari in the Ahnet Basin.

- THE DEVONIEN

These are mainly Frasnian and Famennian clays, located in the western Sahara

(Teguentour basin and In Salah basin) and in the basins of south-eastern Sahara.

For its part, the clayey Praguian constitutes the lower Devonian cover of the

southeastern Saharan basins, as in Bir Berkine and Bir Rebaa.

- THE CARBONIFERE

The cover of the Tournaisian reservoirs, like those of the localities of Krechba

and Zarafa, is ensured by clays dated from the Viséen.

THE MESOZOIC:

The Mesozoic cover corresponds to the Triassic and Lias clays and evaporites. In

the Triassic basin, they cover the sandstone reservoirs of the Triassic and,

sometimes unconformably, that of the Paleozoic reservoirs.

9.2 NORTHERN ALGERIA

The north of Algeria has been little explored, the distribution of the cover

corresponds to reservoir facies.

- THE JURASSIQUE

The Jurassic cover includes clays and marls of the Upper Lias or Lower Malm.

- CRETACE

The Cretaceous reservoirs are covered by the Santonian and Campanian clay-marly

facies (Rass Toumb, Guerguitt El Kihal and Djebel Foua).

- THE TERTIARY

Tertiary cover is provided by the Lutetian evaporitic clays or the clays and

marl of the Mio-Pliocene outer platform and basin.

10. HYDROCARBON TRAPS:

Until the last few years, exploration was mainly focused on the structural

pitfalls from which most of the current production comes. New tools and concepts

now provide a better understanding of other types of traps, taking into account

their respective geological contexts.

10.1 THE SAHARIAN PLATFORM

10.1.1 STRUCTURAL TRAPS:

These are anticlinal folds formed during the different tectonic phases. Indeed,

there are many anticlines created by tectonic inversion in the Triassic

Basin. In the Illizi basin, the anticlines are associated with steeply dipping

reverse faults and setbacks. The anticlines developed on low-dip reverse fault

are known in some areas such as Sbaa Bowl.

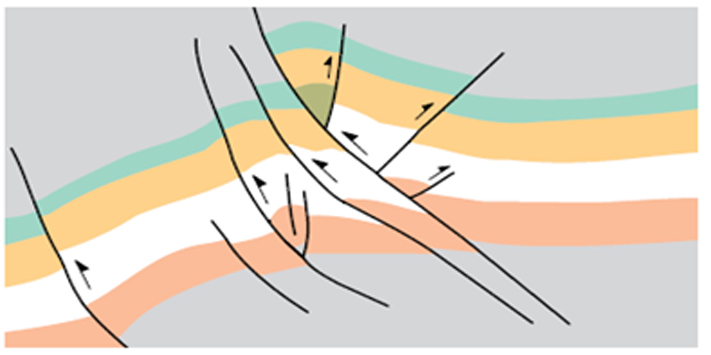

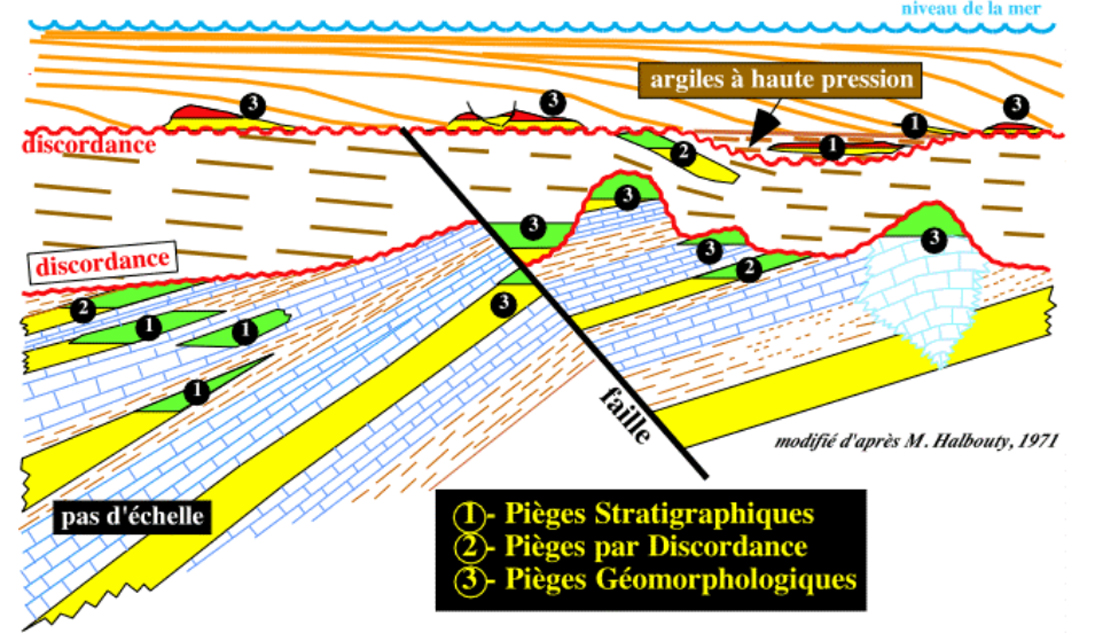

Fig. 9: trap of structural type.

10.1.2 OTHER TRAPS:

With the exception of diapirs, the Saharan Platform contains all known

traps. However, no major discovery has been made outside the structural domain.

Fig. 10: The different types of stratigraphic traps.

a) Stratigraphic traps

The tanks are generally sandstone bodies closed by lateral bevelling. Among the

best studied basins are the Illizi Basin with the Devonian erosion bevels (tanks

F3, F4 and F6) around the Ahara mole or the regressive sandstone units of the

Tihemboka mole (reservoir Devonian F6).

The same is true of Devonian erosion bevels of the Allal and Wadi Namous

vaults. In the furrow of Benoud, we note the same type of bevel in place in both

the Devonian and the Carboniferous. Finally, at Wadi Mya, it is the sizzling

lenses of the Triassic that serve as a reservoir.

b) Reef traps

They are mainly known in the Carboniferous limestones of the Bechar basin and

the Benoud furrow.

c) Hydrodynamic traps

The F6 reservoir of the Tin Fouyé deposit in the Illizi basin is a good example.

d) permeability barrier

This type of trap characterizes mainly the sandstone reservoirs of the

Ordovician basin Illizi and Ahnet (Fig. 10).

10.2 NORTHERN ALGERIA:

10.2.1 STRUCTURAL TRAPS:

These are structures formed during the atlas phase. The Finite-Lutetian and

Miocene periods were the most active.

10.2.2 OTHER TRAPS:

Although little explored, the alpine domain potentially includes most of the

known traps.

a) Stratigraphic traps:

The known examples are the carbonated Ypresian bevel or the erosion bevel under

the Miocene (Barremian-Senonian) mismatch of the Hodna basin. Elsewhere, as on

the southern flank of the Chotts basin (Upper Cretaceous) and the northern flank

of the Western Atlas (Jurassic) furrow, there are good traps in accretion

bevels.

b) Reef traps (Fig. 10):

They are known in a number of points as in the southeastern Constantine with the

Albo-Aptian reefs. In the north of this basin, they are often related to

diapirs.

We find in the Cenomanian, Turonian and Coniacien south of the basin of

Chotts. Finally, the reefs of the Portlandian and Kimmeridgian central Atlas or

those of the Lias of the Western Atlas are also good potential targets.

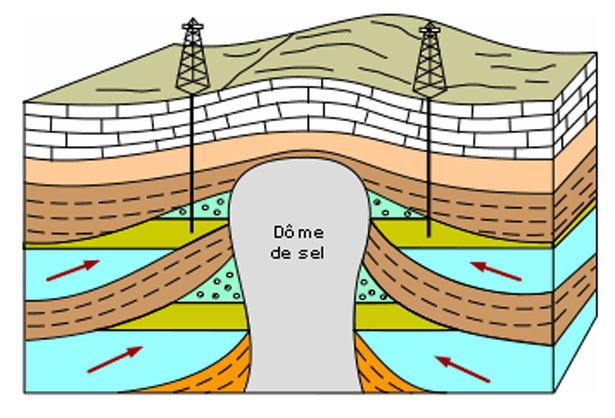

c) Diapirism (Fig. 11):

Apart from the reefs associated with diapirism that have just been mentioned,

the salinity traps are likely to exist both in the highlands, in the western

Hodna basin, in the Chelif basin and finally in the Ain Beïda region east of

Constantine.

Fig. 11: Traps associated with diapirism.

d) lateral variations of facies

This type of trap is illustrated by the carbonate-anhydrite passage of the

regions of Rass-Toumb and Hassi-Bouras (Cretaceous) or even by the variation of

sandstone clay in the Miocene reservoirs of the Cheliff basin.

X. DESCRIPTION OF SOME FIELDS

The hydrocarbon deposits of the Algerian Sahara are distributed in the Illizi

basin, the Ghadames basin, the Triassic basin and in the Central West basin.

In the same way deposits are dated from Cambrian to Triassic. All types of

traps, structural, stratigraphic, hydrodynamic or mixed traps, are represented.

The nature of the fluids varies from undersaturated, saturated oils to volatile

oils as well as condensate gas or dry gas.

THE MAIN FIELDS:

a) ALRAR FIELD:

It is located in the northern part of the Illizi Basin, this deposit was

discovered in 1961 by the drilling of Alrar East-1.

Significant gas-condensate accumulation was found in Middle Devonian (F3)

sandstones.

An oil ring about ten meters thick was encountered three years later on the

wells Nord Alrar 103 and Nord Alrar 106.

(b) ZARZAITINE FIELD:

It is located south-east of Algiers near the Libyan border. This field was

discovered in 1957 and was put into production in 1960.

It is an oil deposit surmounted by a gas-cap and subjected to an active aquifer.

The main F4 reservoir is of lower Devonian age, this field also produces smaller

reservoirs, some of Carboniferous age and others of higher Devonian age (F2).

c) FIELD OF TIN FOUYE TABANKORT (TFT):

This field is located south-east of Hassi Messaoud and north of In-Amenas. The

reservoir is Ordovician age impregnated with oil.

The gas-cap of Tin Fouyé Tabankort was discovered in 1961 by the TFE-1

survey. The oil was only encountered in 1965 in the TFEZ drilling.

d) FIELD OF RHOURDE EL BAGUEL:

This deposit is located on the western edge of the Ghadames Basin, it was

discovered in 1961. The Cambrian constitutes the productive level of the Rhourde

El Baguel field.

It was put into production in August 1963 with the RB-1 test, which produced,

from a large accumulation of oil, in the Cambrian quartzites.

e) GASSI TOUIL FIELD:

This field is located in the triassic basin south of Hassi Messaoud. The first

well established in July 1960 proved the presence of oil in the Triassic

clay-upper sandstone (TAGS), in the Triassic carbonate (Triassic intermediate)

and in the lower clay-sandstone Triassic (TAGI).

Given the evolution of the energy sector, which the world has experienced,

especially during the last decade, a reflection has been initiated with the aim

of bringing about an adaptation of the legislation and regulations to allow the

continuation of activities exploration and exploitation of our hydrocarbon

resources, under the most profitable conditions for operators and investors, as

well as for the state. It should be noted that not all of these resources are

concentrated in mature areas and whose potential is very well identified.

Indeed, some of them are located in little explored areas, far from

infrastructure or complex geology.

This reflection was crowned by the promulgation of a new law, in this case the

law n ° 13-01 of February 20, 2013, modifying and completing the law 05-07 of

April 28, 2005 on hydrocarbons, which takes in view of the developments in the

hydrocarbon sector, introducing incentives to boost hydrocarbon exploration and

exploitation.

Among the amendments made by the law n ° 13-01 of February 20, 2013 to the law

05-07 of April 28, 2005 on hydrocarbons, one cites, particularly, those relating

to the component relating to the exercise of the activities of prospection,

research and / or exploitation of hydrocarbons.

In fact, the introduction of new provisions aimed at relaxing the conditions

under which prospecting, research and / or exploitation of hydrocarbons can be

carried out is one of the objectives of this new law.

The improvements to Law 13-01 of February 20, 2013 focus on:

1. Prospecting

2. Research and exploitation

- Contractual term,

- Surface rendering,

- Lucky find,

- Unitization,

- Call for competition,

- Anticipated production.

3. The applicable tax regime

- Surface tax,

- Royalty fee,

- Tax on oil income,

- Flaring tax,

- Transfer right,

- Additional tax on the result.

1. In prospecting

- Increase in prospecting time: Possibility

of renewal for a maximum of two (2) years of the prospecting authorization.

- Establishment of a right of preference: A

right of preference is granted for the person who has carried out or carries out

prospecting work on a perimeter put to the competition, provided that it aligns,

on the spot, on the best offer, subject to the tender being submitted for the

relevant area.

- Possibility of recovery of prospecting expenses: Expenses

of prospection previously approved by ALNAFT and incurred by a person on a given

perimeter, will be considered as research investment in the case of the

conclusion with this person of a contract for the research and the exploitation

of hydrocarbons on the perimeter.

2. In terms of research and exploitation

- Contractual duration:

·

In Research: An

extension of the two (2) year research period may be granted by ALNAFT to allow

completion of a discovery delineation program completed before the end of the

research period.

·

In operation: An

additional five (5) year period is added to the operating period of the natural

gas fields. The operating period can be increased by the duration of an unused

search period.

·

Unconventional hydrocarbons cases:

In Research: A

pilot phase of up to four (4) years will be awarded to the contractor by

ALNAFT. This pilot phase adds to one of the phases of the search period,

bringing the search period to eleven (11) years maximum.

In operation: two

successive extensions are now possible, beyond the initial duration (30 years

for liquids and 40 years for gas)

- Surface rendering

The rendering rate to be performed at the end of each phase of the search period

is set in the contract. This means that this rate will vary from one contract to

another according to the specificities of each perimeter.

For unconventional hydrocarbons, the conditions and methods of surface rendering

will be fixed in the contract.

A right of preference may be granted to the contractor having returned

geological surfaces or horizons, if the latter are put in competition.

- Lucky find.

The contractor may claim a right to a fortuitous discovery made during the

implementation of the development plan in the geological level or levels covered

by the development plan.

- Unitization.

In addition to the obligation to carry out a unitization plan, in the case where

a declared commercial deposit extends over perimeters that are the subject of

separate contracts, the amendment provides for the possibility for deposits that

extend over perimeters. free, an extension of the extension area to the

contractual scope.

- Call for competition.

The selection criterion is no longer fixed by decree. ALNAFT determines for each

perimeter, the criterion (s) retained for the selection of the offers.

A right of preference is granted to the companies having bid on perimeters on

which they have prospected, or on those which have been the object of a

rendering as part of a surface rendering.

- Anticipated production

In the case of conventional hydrocarbons, the contractor is entitled to advance

production for a maximum period of two (2) years, solely to enable the

acquisition of information necessary for drawing up the development plan.

In the case of unconventional hydrocarbons, the contractor may claim, under the

pilot, an anticipated production within the limit of the pilot's duration

(maximum 4 years).

3. Tax regime

With regard to the applicable tax regime, the amendments concern the following

aspects:

- Superficial tax

·

The amounts of the surface tax for the research and exploitation areas of

unconventional hydrocarbons are those provided for zone A.

·

The amounts of the superficial tax for the pilot phase are those applicable to

the third phase.

·

The amounts of the superficial tax for the extension of the research phase for

the delineation of a discovery are those applicable to the period of exceptional

extension.

- Royalty fee.

·

The rate of the royalty applicable to the quantities of unconventional

hydrocarbons is (5%).

·

The rate of the royalty applicable to the quantities of hydrocarbons coming from

the exploitation perimeter located in the areas very little explored, with

complex geology and / or lacking infrastructure is (5%).

- Tax on oil income.

The rate of the petroleum tax (TRP) is calculated on the basis of the

profitability of the project and no longer on the turnover. This rate is

applicable according to two coefficients (R1 and R2), according to four distinct

cases:

·

Cases of perimeters whose maximum daily production is less than 50 000 BOE,

·

In the case of exploitation perimeters, whose maximum daily production is

greater than or equal to 50 000 BOE,

·

Case of operating areas located in areas of low exploration, complex geology

and / or lacking infrastructure whose list will be determined by regulation.

·

Case of unconventional hydrocarbons

- Additional tax on the result

Each person participating in the contract is subject to a supplementary income

tax according to the fixed rates.

- Transfer right

·

Any transfer of rights and obligations in a contract is subject to the payment

to the public treasury by the transferring person of a right equal to (1%) of

the value of the transaction.

·

The transferring person is exempt from the payment of this transfer right, when

it is made by a company to one of its subsidiaries, wholly and directly owned.

- Flaring tax

·

Flaring remains prohibited.

·

For special cases, the operator may apply for an exceptional flaring

authorization, in which case he must pay a specific tax payable to the public

treasury on flared gas volumes.

·

Specific pricing conditions are provided for remote or isolated areas,

characterized by a lack or absence of infrastructure to recover and / or

evacuate the gas.

Algeria: Country Overview

(source: EIA)

EIA Overview

Algeria is the leading natural gas producer in Africa, the second-largest natural gas supplier to Europe, and is among the top three oil producers in Africa. Algeria is estimated to hold the third-largest amount of shale gas resources in the world. However, gross natural gas and crude oil production have gradually declined in recent years, mainly because new production and infrastructure projects have repeatedly been delayed.

Algeria is the leading natural gas producer in Africa, the second-largest natural gas supplier to Europe outside of the region, and is among the top three oil producers in Africa. Algeria became a member of the Organization of the Petroleum Exporting Countries (OPEC) in 1969, shortly after it began oil production in 1958. Algeria's economy is heavily reliant on revenues generated from its hydrocarbon sector, which account for about 30% of the country's gross domestic product (GDP), more than 95% of export earnings, and 60% of budget revenues, according to the International Monetary Fund (IMF).

Oil and natural gas export revenues amounted to almost $63.8 billion in 2013, down from $69.8 billion in the previous year, mainly because of lower export volumes, according to the Middle East Economic Survey (MEES). Algeria's oil and gas export revenue has allowed the country to maintain a comfortable level of foreign exchange reserves, which reached $194 billion by the end of December 2013, according to the country's central bank.

Crude oil and gross natural gas production have gradually declined in recent years, mainly because of repeated project delays resulting from slow government approval, difficulties attracting investment partners, infrastructure gaps, and technical problems. In the past three licensing rounds, there was limited interest from investors to undertake new oil and gas projects under the government's terms. As a result, the Algerian government enacted new contractual and fiscal provisions in 2013 in hopes of attracting more foreign investment to new projects, particularly toward unconventional assets (shale oil and gas, tight gas, heavy oil, and coal bed methane). In January 2014, the government launched its first licensing round since 2011. According to PFC Energy, 31 blocks, of which 17 hold shale resources, are being offered. All blocks are expected to be awarded in 2014.

Algeria is estimated to hold the third-largest amount of shale gas resources in the world, according to an U.S. Energy Information Administration (EIA) sponsored study. The EIA study estimates that Algeria contains 707 trillion cubic feet (Tcf) and 5.7 billion barrels of technically recoverable shale gas and oil resources, respectively. Some industry analysts are cautious about the prospects of Algeria becoming a notable shale producer. An analysis by MEES points out the obstacles Algeria will face, which include: the remote location of the shale acreage, the lack of infrastructure and accessibility to sites, water availability, the lack of roads and pipelines to move materials, and the need for more rigs because shale wells deplete quicker.

Any major disruption to Algeria's hydrocarbon production would not only be detrimental to the local economy but, depending on the scale of lost production, could affect world oil prices. Also, because Algeria is the second-largest natural gas supplier to Europe outside of the region, unplanned cuts to natural gas output could affect some European countries.

Algeria also relies on its own oil and natural gas production for domestic consumption, which is heavily subsidized. Natural gas and oil account for almost all of Algeria's total primary energy consumption. Domestic prices for oil products (diesel, gasoline, and liquefied petroleum gas) and natural gas are very low in Algeria by regional and global standards, according to the IMF. The IMF estimates that Algeria has the second-cheapest domestic price for natural gas in Africa, after Libya, as retail prices have not changed since 2005 and are now below operational costs. The IMF estimates that the cost of the implicit subsidies on oil products and natural gas (both in the intermediary and final-use stages) amounted to $22.2 billion in 2012, or 10.7% of GDP.

Natural gas accounts for 98% of power generation in Algeria,

according to the IMF. Like natural gas, electricity prices have also

been unchanged since 2005. However, the cost of gaining an electricity

connection to obtain access can be time-consuming and costly.

Nonetheless, more than 99% of Algeria's population has access to

electricity.

Oil and natural gas sector management

Algeria's national oil and natural gas company, Sonatrach, dominates the country's hydrocarbon sector, owning roughly 80% of all hydrocarbon production. By law, Sonatrach is given majority ownership of oil and natural gas projects in Algeria.

Algeria's oil and natural gas industries are governed by the Hydrocarbon Act of 2005. The initial legislation established terms that guided the involvement of international oil companies (IOCs) in upstream exploration and production, midstream transportation, and the downstream sector. The original 2005 legislation was more favorable to foreign involvement than its predecessor, which was passed in 1986. However, amendments to the bill were made in 2006, and some of the favorable terms were reversed. In the 2006 amendments, Algeria's national oil company, Entreprise Nationale Sonatrach (Sonatrach), was granted a minimum equity stake of 51% in any hydrocarbon project, and a windfall profits tax was introduced for IOCs.

Over the past few years, Algeria has experienced difficulties attracting foreign investors, particularly at licensing rounds. In the country's seventh licensing round in 2008, only 4 of the available 16 blocks were awarded, 3 of 8 in 2009, and 2 of 10 in 2011. Some analysts believe that the lack of fiscal incentives to attract foreign investors to new projects, coupled with past Sonatrach corruption allegations, were to blame. Algeria's precarious security environment has also been a concern for investors.

In 2013, Algeria revised parts of the hydrocarbon law in an attempt to attract foreign investors to new projects. Amid declining hydrocarbon production and stagnant reserves, the Algerian government has stated it needs foreign partners to increase oil and gas reserves and explore new territories, such as offshore in the Mediterranean Sea and onshore areas containing shale oil and gas resources. The 2013 amendments introduced a profit-based taxation, as opposed to revenue-based and lowered tax rates for unconventional resources, according to PFC Energy. The amendments also allow for a longer exploration phase for unconventional resources (11 years compared to 7 years for conventional resources) and a longer operating/production period of 30 and 40 years for unconventional liquid and gaseous hydrocarbons, respectively (compared to 25 and 30 years for conventional liquids and gas, respectively). The amendments, however, do not change Sonatrach's mandated role as a majority stakeholder in all upstream oil and natural gas projects.

Sonatrach owns roughly 80% of total hydrocarbon production in Algeria, while IOCs account for the remaining 20%, based on data from Rystad Energy. IOCs with notable stakes in oil and gas fields are: Cepsa (Spain), BP (United Kingdom), Eni (Italy), Repsol (Spain), Total (France), Statoil (Norway), and Anadarko (United States). Sonatrach's substantial assets in Algeria make it the largest oil and gas company not only in the country, but also in Africa. The company operates in several parts of the world, including: Africa (Mali, Niger, Libya, Egypt), Europe (Spain, Italy, Portugal, United Kingdom), Latin America (Peru), and the United States.

Security risks

Militant groups operating in North Africa and the Sahel have presented security risks to oil and natural gas installations in the region. In January 2013, a militant group stormed Algeria's In Amenas gas facility, resulting in several causalities and a temporary suspension of gas production at the facility.

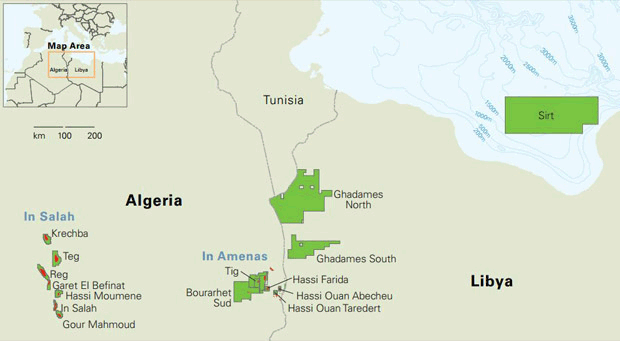

Concerns over Algeria's security environment resurfaced on January 16, 2013 when a militant group attacked the In Amenas gas facility, resulting in several worker and militant causalities. The attack reportedly damaged two of the facility's three processing trains, of which each has the capacity to process 3 billion cubic meters per year (Bcm/y), or 106 billion cubic feet per year (Bcf/y). Gas output at In Amenas was first partially restarted at the end of February 2013 at one of the three trains. Currently, two of the three trains are operating, while the third train was still offline during the first half of 2014.

The In Amenas gas processing facility, located near the Libyan border, is jointly operated by Sonatrach, BP, and Statoil. After the incident occurred, BP and Statoil withdrew their staff from In Amenas and the In Salah gas facility (located 373 miles to the west of In Amenas), setting back plans to boost output at both projects. Some staff has since returned.

Natural gas output at In Amenas averaged 4.1 Bcm or 145 Bcf in 2013. Prior to the attack, In Amenas output averaged 7.8 Bcm/y (or 275 Bcf/y) of dry natural gas, accounting for almost 10% of Algeria's dry natural gas production and almost 16% of exports in 2012. Natural gas plant liquids (NGPL) are also produced at the In Amenas fields and averaged 43,400 barrels per day (bbl/d) in 2012, although nameplate capacity is around 60,000 bbl/d, according to MEES. Despite the absence of some personnel, production at In Salah remained relatively unchanged at 8.2 Bcm/y (290 Bcf/y) in 2013, compared with the previous year.

The In Amenas attack prompted companies to review their security at oil and gas installations in Algeria and other North African countries. The Algerian government has said it will increase security presence at all of its oil and gas facilities, particularly those in the remote south.

Oil sector

Reserves and exploration

Algeria holds the third-largest amount of proved crude oil reserves in Africa, all of which are located onshore because there has been limited offshore exploration. According to Sonatrach, about two-thirds of Algerian territory remains largely underexplored or unexplored.

According to the latest Oil & Gas Journal (OGJ) estimates, released in January 2014, Algeria held an estimated 12.2 billion barrels of proved crude oil reserves, an estimate that has been unchanged for many years. All of the country's proved oil reserves are held onshore because there has been limited offshore exploration. The majority of proved oil reserves are in the Hassi Messaoud province, which contains the country's oldest and largest oil field, Hassi Messaoud, located in the eastern part of the country, near the Libyan border. Hassi Messaoud is estimated to hold 3.9 billion barrels of proved and probable recoverable reserves, followed by the Hassi R'Mel field (3.7 billion barrels) and the Ourhoud field (1.9 billion barrels), according to the Arab Oil & Gas Journal.

According to Sonatrach, roughly two-thirds of Algerian territory remains underexplored or unexplored. Most of these areas are in the north and offshore. In the current licensing round, launched in January 2014, there are 6 northern blocks being offered, along with 7 central, 6 eastern, and 12 in western Algeria. There is also still potential to expand production in areas that have already been exploited, particularly in the Hassi Messaoud, Illizi, and Berkin basins. According to Sonatrach, the Hassi Messaoud-Dahar province contains about 71% of the country's combined proved, probable, and possible oil reserves, while the Illizi basin, the second largest area, contains about 15%. The Illizi and Berkine basins have been home to many discoveries since the 1990s and still hold significant potential.

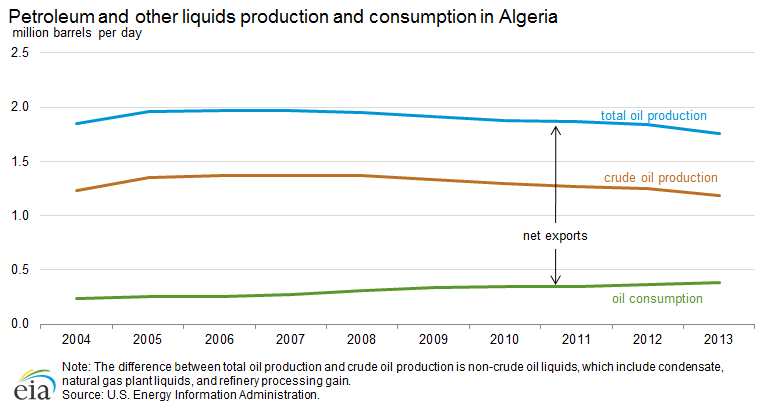

Production and development

The country produced almost 1.8 million bbl/d of total petroleum and other liquids in 2013, which includes crude oil, condensate, natural gas plant liquids, and refinery processing gain. The largest and oldest oil field, Hassi Messaoud, contributed more than 40% of total crude oil production, which averaged 1.2 million bbl/d in 2013.

Algeria produced an estimated average of 1.2 million bbl/d of crude oil in 2013, slightly lower than the previous year. Combined with almost 600,000 bbl/d of non-crude oil liquids, which are not included in its OPEC quota, Algeria's total oil production averaged almost 1.8 million bbl/d in 2013.

Algerian oil fields produce high-quality light crude oil with very low sulfur and mineral content. Sonatrach operates the largest oil field in Algeria, Hassi Messaoud, which produced roughly 500,000 bbl/d of crude oil in 2013, or more than 40% of Algeria's total crude output. Other large producing areas in Algeria include the Ourhoud and the Hassi Berkine complex. Algeria's largest oil fields are mature. Field expansions and enhanced oil recovery techniques have kept the country's oldest fields at a steady rate of production, but this trend is slowly starting to reverse. As a result, EIA projects that Algeria's crude oil output will gradually decline at least in the short and medium term.

Algeria does not have any major crude oil projects scheduled to come onstream. There are smaller new oil projects scheduled to come onstream (Bir Seba and Timimoun), along with additional output from existing fields (Gassi Touil-Rhoude Nouss and Hassi Messaoud), but the amount is expected to fall short of what is needed to offset natural decline rates at older fields. The Algerian government has been concerned with depletion rates at oil fields, and as a result, has temporary restricted production rates at some oil fields. In 2013, temporary restrictions were placed on the production rates of the mature Ourhoud field, the new El Merk field, and other fields.

The latest notable field to start production was El Merk, located south of Hassi Messaoud in the Sahara desert. Production started in early 2013, and output of crude oil, condensate, and liquefied petroleum gas (LPG) averaged roughly 165,000 bbl/d for the first quarter of 2014. Sonatrach and Anadarko manage the project, and other companies that have been involved in the field's development include Eni, ConocoPhillips, Talisman Energy, and Maersk Oil. El Merk is also expected to produce 220 Bcf/y of associated natural gas.

Crude oil exports

The vast majority (about 72%) of Algerian crude oil exports are sent to Europe. The United States was the single largest destination until 2013 when U.S. imports fell to 29,000 bbl/d, or by more than 75%, compared with 2012.

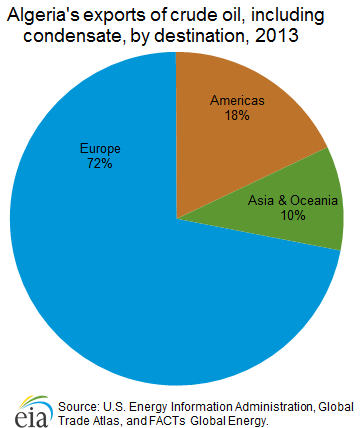

Algeria exports mostly light crude oil. The country's main crude grade is the Sahara blend, which is a blend of crudes produced at fields in the Hassi Messaoud region. In 2013, Algeria exported approximately 750,000 bbl/d of crude oil, including condensate, according to estimates from EIA, Global Trade Atlas (GTA), and FACTs Global Energy. Most of Algeria's crude oil exports are sent to Europe (72%), with the remainder sent to the Americas (18%) and Asia & Oceania (10%).

The United States was one of Algeria's single largest markets for crude oil for almost a decade until 2013. U.S. crude oil imports from Algeria have substantially declined in recent years. The United States imported 29,000 bbl/d of crude oil from Algeria in 2013, which is down from its peak of 443,000 bbl/d in 2007. The growth in U.S. light, sweet crude oil production from the Bakken and Eagle Ford shale plays has resulted in a sizable decline in U.S. imports of crude grades of similar quality, such as Algeria's crude oil.

Petroleum products

Algeria has five oil refineries with a total nameplate capacity of 652,500 bbl/d. The vast majority of Algeria's domestic petroleum consumption, which averaged 380,000 bbl/d in 2013, derives from domestically refined products. Algeria's petroleum consumption has increased by an annual average of 5% over the past decade.

Algeria has five oil refineries with a total nameplate capacity of 652,500 bbl/d, according to the Arab Oil & Gas Journal. The country's largest refinery, Skikda, is located along Algeria's northern coastline and is the largest refinery in Africa. It has the capacity to process 352,700 bbl/d of crude oil and condensate, accounting for more than half of Algeria's total refinery capacity. Skikda processes the Saharan blend, which derives from the Hassi Messaoud oil fields. Algeria's two other coastal refineries, Algiers and Arzew, have the capacity to process 63,400 bbl/d and 58,500 bbl/d, respectively. The country's inland refineries, Hassi Messaoud and Adrar, are connected to local oil fields and supply oil products to nearby areas.

| Refinery | Capacity (thousand bbl/d) |

Type | Owner |

|---|---|---|---|

| Skikda | 352.7 | Crude Oil/Condensate | Sonatrach/Naftec |

| Hassi Messaoud | 163.5 | Crude Oil | Sonatrach/Naftec |

| Algiers (El Harrach) | 63.4 | Crude Oil | Sonatrach/Naftec |

| Arzew | 58.5 | Crude Oil | Sonatrach/Naftec |

| Adrar | 14.4 | Crude Oil | CNPC/Sonatrach |

| Total | 652.5 | ||

| Note: CNPC is the China National Petroleum

Company. Source: Arab Oil & Gas Journal |

|||

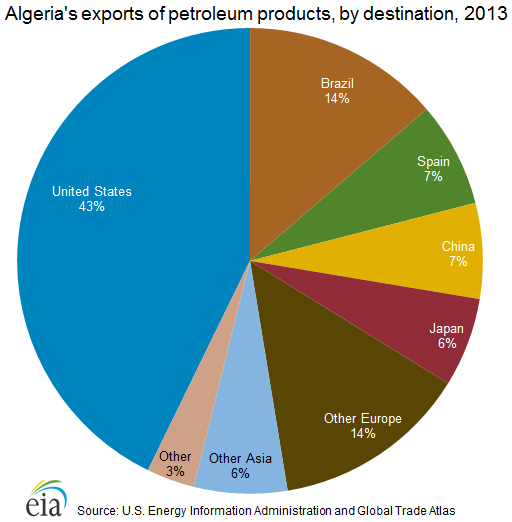

The vast majority of Algeria's domestic petroleum consumption, which averaged 380,000 bbl/d in 2013, derived from domestically refined products. Algeria's petroleum consumption has increased by an annual average of 5% over the past decade (2004 to 2013). Algeria typically produces a surplus of refined petroleum products, which is exported to global markets. According to GTA, based on data provided by Algeria's Customs Office, Algeria exported approximately 200,000 bbl/d of petroleum products in 2013, of which 43% was sent to the United States. Algeria also imports petroleum products, mainly from European countries and Russia. In 2013, Algeria imported approximately 75,000 bbl/d of petroleum products, according to GTA.

Oil pipelines and export terminals

Algeria uses multiple coastal terminals to export crude oil, refined products, LPG, and NGPL. These facilities are located at Arzew, Skikda, Algiers, Annaba, Oran, and Bejaia in Algeria and La Skhirra in Tunisia. Algeria's domestic pipeline network facilitates the transfer of oil from interior production fields to coastal infrastructure. The most important pipelines carry crude oil from the Hassi Messaoud field to refineries and export terminals. Algeria does not have any transcontinental export oil pipelines.

Natural gas

Reserves and exploration

Algeria holds the world's tenth-largest amount of proved natural gas reserves and the third-largest technically recoverable shale gas resources. In May 2014, Algeria's Council of Ministers gave formal approval to allow shale oil and gas development.

According to OGJ, as of January 2014, Algeria had 159 Tcf of proved natural gas reserves, the tenth-largest natural gas reserves in the world and the second largest in Africa, behind Nigeria. Algeria's largest natural gas field, Hassi R'Mel, was discovered in 1956. Located in the center of the country to the northwest of Hassi Messaoud, it holds proved reserves of about 85 Tcf, more than half of Algeria's total proved natural gas reserves. According to the Arab Oil & Gas Journal, Hassi R'Mel accounted for three-fifths of Algeria's gross natural gas production in 2012. The remainder of Algeria's natural gas reserves is located in associated and nonassociated fields in the southern and southeastern regions of the country.

Algeria also holds vast untapped shale gas resources. According to an EIA-sponsored study released in June 2013, Algeria contains 707 Tcf of technically recoverable shale gas resources, the third-largest amount in the world after China and Argentina. The Ghadames Basin, encompassing eastern Algeria, southern Tunisia, and western Libya, was identified as a major shale gas basin in the assessment. In May 2014, Algeria's Council of Ministers gave formal approval to allow shale oil and gas development. The Council of Ministers estimated that it would take 7 to 13 years to confirm Algeria's potential shale resources.

Production and development

Algeria's gross natural gas production was 6.4 Tcf in 2012, a 4% decline from the previous year. Production has steadily declined over the past decade as output from the country's large, mature fields is depleting. There are several new projects planned to come online, but they have repeatedly been delayed.

Algeria's gross natural gas production was 6.4 Tcf in 2012, a 4% decline from the previous year. Algeria's gross production has been falling since its peak of 7.1 Tcf in 2008. The decline in 2012 mainly reflects fewer volumes of natural gas used to improve oil recovery by reinjecting it into wells.

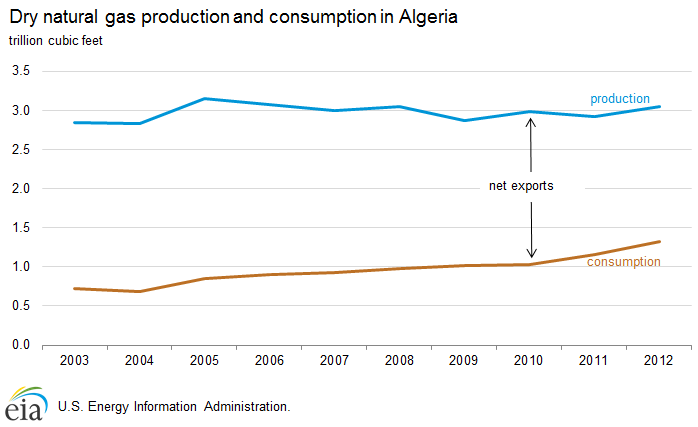

In 2012, 56% (3.6 Tcf) of gross production was marketed, 42% (2.7 Tcf) was reinjected into wells to enhance oil recovery, and 2% (0.1 Tcf) was vented or flared. Despite the decrease in gross production, the marketed volume increased in 2012 by 4% over the previous year. Dry natural gas (a sub-category of marketed gas that occurs when associated liquid hydrocarbons are removed) was 3.05 Tcf in 2012, of which 1.3 Tcf was consumed locally and 1.7 Tcf was exported.

Algeria has been planning to bring onstream several new natural gas fields to compensate for the loss of production from mature fields, but many of these projects have been delayed by several years, mostly because of delayed government approval, difficulties attracting investment partners, infrastructure gaps, and technical problems.

| Project Name | Companies | Peak output (Bcf/y) 1 | Target start year |

|---|---|---|---|

| South West Gas Project: Phase 1 | |||

| Touat | GDF Suez/Sonatrach | 160 | 2017 |

| Reggane Nord | Repsol/Sonatrach/RWE/Edison | 100 | 2017 |

| Timimoun | Total/Sonatrach/Cepsa | 55 | 2017 |

| South West Gas Project: Phase 2 | |||

| Ahnet | Total/Sonatrach/Partex | 140 | 2018 |

| Hassi Ba Hamou | BG Group | 70-110 | -- |

| Hassi Mouina | Statoil/Sonatrach | -- | -- |

| Timimoun expansion | Total/Sonatrach/Cepsa | -- | -- |

| Isarene (Ain Tsila) | Petroceltic/Sonatrach | tbd | 2017 |

| Other gas projects | |||

| In Salah (expansion)2 | BP/Sonatrach | 200 | 2016 |

| Isarene (Ain Tsila) | Petroceltic/Sonatrach | 130 | 2017 |

| 1Billion cubic feet per year is

Bcf/y. 2Field expansion at In Salah is to ensure that the current level of output at In Salah is maintained. Source: Arab Oil & Gas Directory, Middle East Economic Survey, Repsol, Total, and Oil & Gas Journal |

|||

Algeria is in the process of developing its Southwest Gas Project, which includes the Reggane Nord, Timimoun, and Touat projects, all of which are expected to start production at the earliest in 2017, at least three years behind the initial schedule. The Repsol-led Reggane Nord project consists of developing six fields and is expected to reach a peak production rate of 100 Bcf/y. The Timimoun project, led by Total in partnership with Sonatrach and Cepsa, is expected to reach a peak production of 60 Bcf/y, and the Touat project, led by the France-based GDF Suez in association with Sonatrach, is projected to reach a peak production of 160 Bcf/y. The Southwest Gas Project entails the construction of gas-gathering facilities, a gas treatment plant, and a pipeline to the Hassi R'Mel gas hub, called the GR5 pipeline. The planned infrastructure will connect the remote Southwest gas fields to the Hassi R'Mel region and allow for the commercialization of other fields in the south as well. The development and commercialization of the Ahnet natural gas project in the south will also depend on the new infrastructure.

The Southwest Gas Project is very important for Algeria's ability to meet contracted exports and its expected growth in domestic demand. Gross natural gas production in the country will most likely continue to steadily decline in the short term, but it may recover in the medium term if planned projects come online and offset natural declines. Output from the Southwest Gas Project and other proposed projects (some of which are not included in the table) have the potential to increase Algeria's output by 1 Tcf/y or more after 2018. However, these projects are contingent on attracting investors and building new infrastructure or upgrading older infrastructure.

Midstream and downstream infrastructure

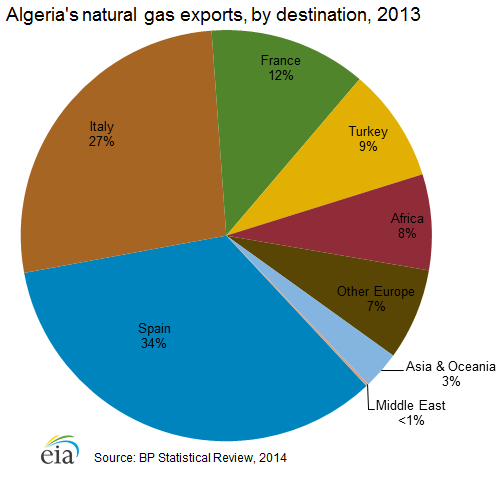

Algeria exports natural gas via pipelines and on tankers in the form of liquefied natural gas (LNG). It has three transcontinental export gas pipelines: two transport natural gas to Spain and one to Italy. Algeria's LNG plants are located in the coastal cities of Arzew and Skikda. Algeria was the first country in the world to export LNG in 1964.

Domestic pipelines

Algeria's domestic natural gas pipeline system transports natural gas from the Hassi R'Mel fields and processing facilities, owned by Sonatrach, to export terminals and liquefaction plants along the Mediterranean Sea. There are three main domestic pipeline systems: Hassi R'Mel to Arzew, Hassi R'Mel to Skikda, and Alrar to Hassi R'Mel. The Hassi R'Mel to Arzew system is a collection of pipelines that move natural gas from Hassi R'Mel to the export terminal and the LNG plant at Arzew. The system also includes an LPG pipeline. The Hassi R'Mel to Skikda system transports natural gas from the Hassi R'Mel fields to the Skikda LNG plant, and the Alrar to Hassi R'Mel system transports natural gas produced in the Alrar and the southeastern region to the Hassi R'Mel processing facilities. Sonatrach plans to build the GR5 Southwest fields to the Hassi R'Mel pipeline to monetize natural gas reserves in fields discovered in southwestern Algeria. The expected completion date is 2017.