The Energy Consulting Group

Business strategy for upstream oil and gas producers and service companies

| Russian Oil and Gas Industry |

|

E&P News and Information Scandinavian International and National International Energy

Agency Department of Trade and Norwegian

Petroleum Ministry of Industry

and E&P Project Information |

|---|

Overview

Russia and

International Oil Companies

Arctic Ocean Pictures

3D Maps

Please contact us at insight@energy-cg.com for more detail.

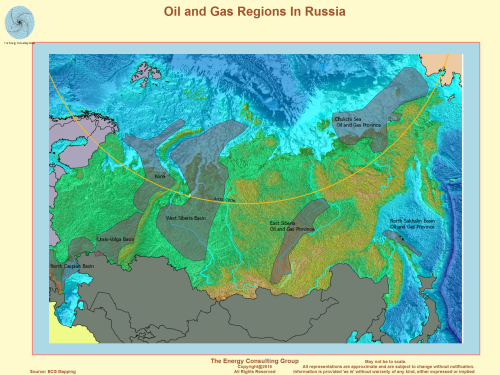

Russian Oil and Gas Index Map For Higher Resolution, Click Image |

|

|

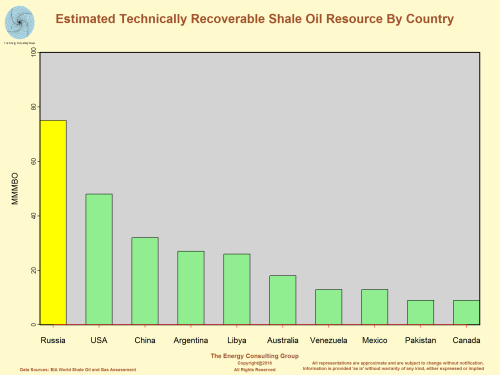

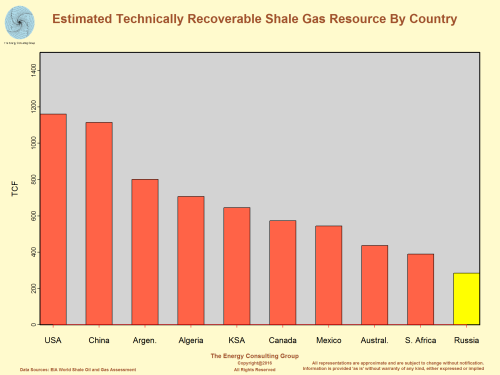

Estimated Technically Recoverable Shale Gas Potential

For Russia For Higher Resolution, Click Image |

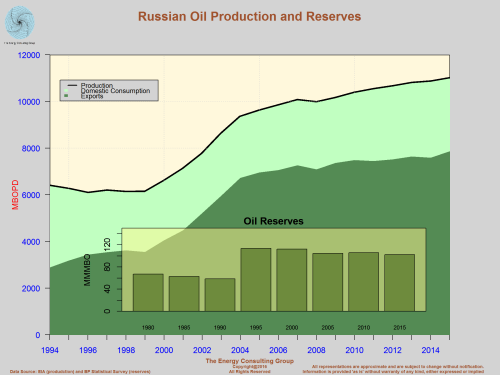

Russian Oil Production, Exports and Reserves For Higher Resolution, Click Image |

|

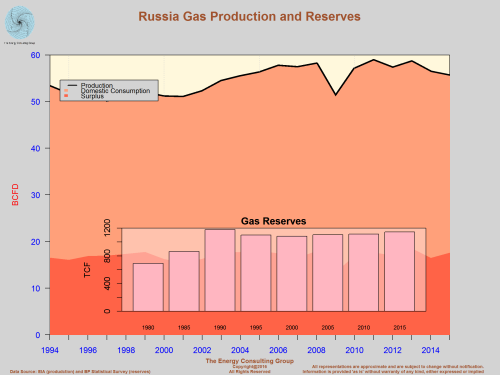

Russian Gas Production, Exports and Reserves For Higher Resolution, Click Image |

Russia and International Oil

Companies

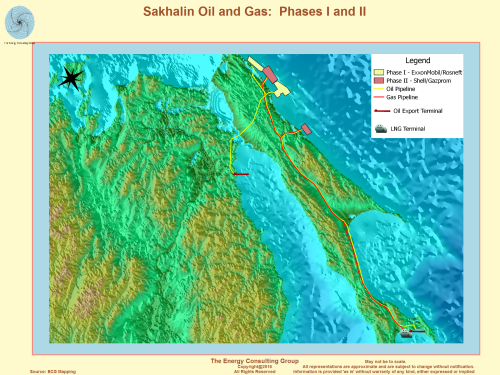

The Sakhalin 1 JV is producing oil and gas from 3

fields: Chayvo, Odoptu, and Arkutun-Dagi-

located in sub-Arctic conditions off the

northeastern coast of Sakhalin Island in the Russian

Far East. Development efforts at these three

fields are ongoing.

In addition to these

efforts, ExxonMobil and Rosneft are evaluating the

efficacy of adding an LNG export facility to

complement the existing facility that serves the

Sakhalin II joint venture.

One of the more interesting

facets of the Russian oil and gas industry has been the success

that large, integrated international oil companies have had in

making inroads into the Russian oil patch since the dissolution

of the Soviet Union at the end of the 1980's.

Historically, the USSR was not open to allowing western firms to

help them develop its vast oil and gas endowment. However, upon

the dissolution of the USSR, Russia sought western capital and

expertise to help revitalize its oil and gas business, ENI,

Total, Shell, Statoil, BP, and others established upstream

footprints with varying degrees of success. Perhaps no

other firm better exemplifies such efforts than ExxonMobil under

the leadership of Rex Tillerson. As the maps below illustrate,

ExxonMobil has established a wide ranging position, with

potentially enormous reserves and value, in the Russian upstream

oil and gas industry.

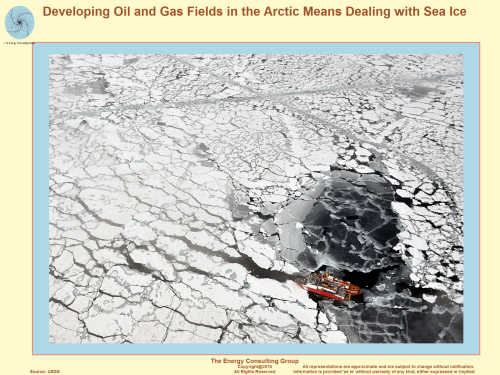

Pursuing oil and gas developments in the Arctic Ocean obviously

means successfully navigating sea ice, and protecting the

unparalleled wildlife endowment of the region.

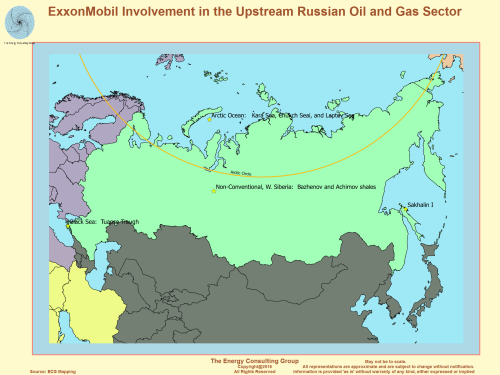

ExxonMobil Involvement in the Upstream Russian Oil and

Gas Sector

For Higher Resolution, Click Image

At the heart of ExxonMobil's

efforts in Russia is its Strategic Cooperation Agreement

(SCA) with Rosneft, the largest of Russia's oil and gas

companies.Of the four initiatives listed on the map to

the left, the one currently producing oil and gas is the

Sakhalin I joint venture with Rosneft at Sakhalin

Island, where the JV is producing large amounts of oil

and gas from the three oil and gas fields.

However, it is the Arctic

Ocean concessions that have the potential to truly "move

the needle" of the type that Wall Street pays attention

to, especially reserves. Rosneft provided

estimates for the 8 acreage blocks that comprise

the ExxonMobil and Rosneft joint venture to

approximatley 210 billion boe of oil and gas resource

potential. Now, we recognize that this estimate is

highly speculative and based on little actual drilling,

so is subject to change (perhaps dramatically so) when,

and if, the JV partners get around to drilling in the

license areas. That said, it does seem to indicate

that Rosneft, and presumably ExxonMobil, believe the

acreage to be highly prospective, potentially extremely

valuable.

Sakhalin Oil and Gas: Phases

I and II

For Higher Resolution, Click Image

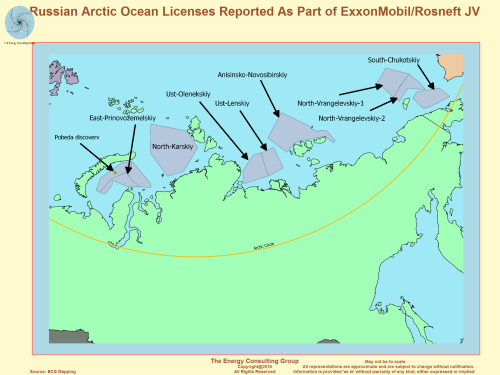

Russian Arctic Ocean Licenses Reported As Part of

ExxonMobil/Rosneft JV

For Higher Resolution, Click Image

Rosneft and ExxonMobil Arctic

Ocean Joint Venture

In August 2011, ExxonMobil, the largest western oil

company, and Rosneft signed a deal to develop oil and

gas reserves in the Russian Arctic,

opening up one of the last unconquered drilling

frontiers.

Specfically the deal

encompassed the East Prinovozemelsky (EPNZ) License

Block located in the Kara Sea and with a total area of

126,000 square kilometers (30 million acres).

To hi-light the importance of the deal from a

Russian perspective, it was signed by

Exxon boss Rex Tillerson and Russia's top energy

official deputy prime minister Igor Sechin

in the presence of Russian prime minister Vladimir Putin.

ExxonMobil and Rosneft announced plans to

increase the scope of their strategic cooperation by

adding seven new blocks in the Russian Arctic in the

Chukchi Sea, Laptev Sea and Kara Sea, spanning

approximately 600,000 square kilometers (150 million

acres).

The

combined size of the 8 blocks is large. For

perspective, if the licenses were combined into one and

considered a country, it would be ranked as the 40th

largest country in the world, approaching Turkey in

size.

According to Rosneft, estimated potential recoverable

oil resources in the three

East Prinovozemelsky

subblocks stand at 6.2 billion

tons (about 45 billion barrels) with total potential

hydrocarbon resources at up to 20.9 billion tons of oil

equivalent, which works out to over 600 TCF of gas.

Now, these are huge numbers, which is exciting, but

there are some important caveats. With the exception of

the University-1 well, which resulted in the Pobedo

discovery, it is our understanding that this resource

estimate is based on 2-D seismic only, meaning it is

subject to revisions (potentially very large revisions)

as propects are drilled. That said, if the just

discussed volumes were realized and if average realized

oil and gas prices were respectively, $55/bbl and

$6/mcf, then the total revenue stream could approach

approximately $3 trillion dollars.

The results of the

University-1 well seems to confirm that there is quite

large potential in this block. This well was

drilled in 2014 and the State Reserves Commission

confirmed Rosneft reserve estimates for the Pobeda

discovery of130 million tonnes of oil and 499.2 billion

cubic meters (bcm) of C1+C2 gas, which is roughly

equivalent to 1 billion barrels of oil and 17 TCF of

gas. Still a far cry from the total block

potential discussed above, but nonetheless encouraging

Developing

Oil and Gas Fields in the Arctic Means Dealing with Sea

Ice For Higher Resolution, Click Image |

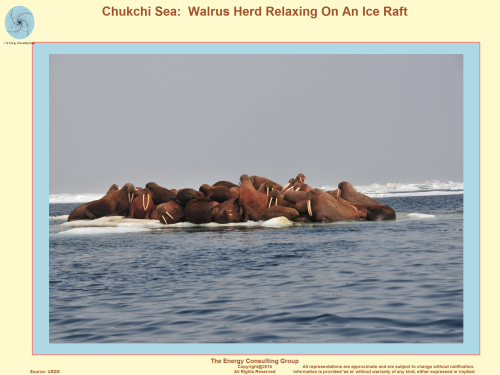

Chukchi Sea: Walrus Herd

Relaxing On An Ice Raft For Higher Resolution, Click Image |

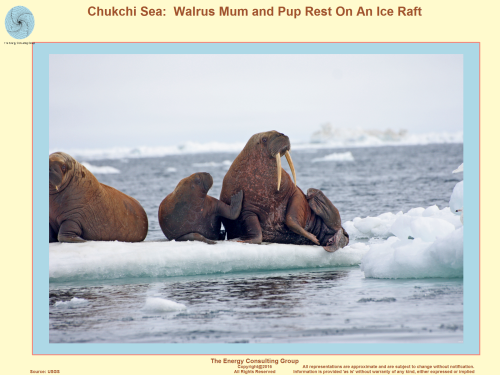

Chukchi Sea:

Walrus Mum and Pup Rest On An Ice Raft For Higher Resolution, Click Image |

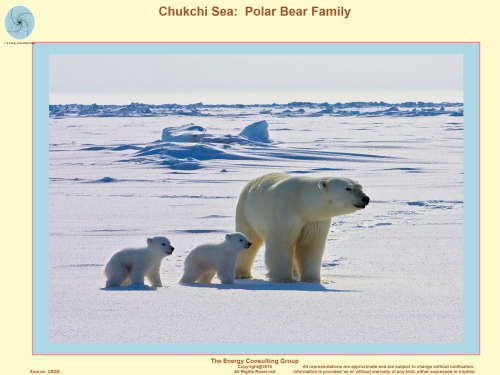

Chukchi Sea: Polar Bear Family For Higher Resolution, Click Image |

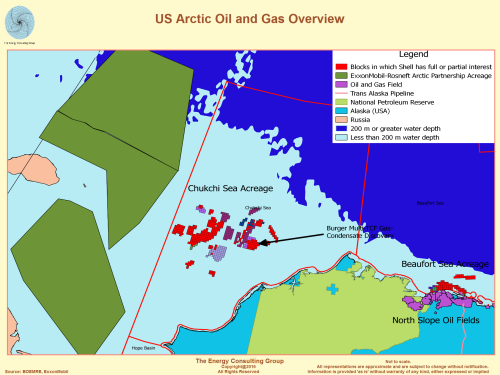

In December 2016, President Obama placed the Arctic Ocean offlimits to new oil and gas leasing. However, this action does not apply to areas outside US territorial waters. A good example of this is the Rosneft-ExxonMobil JV, which includes three acreage blocks just to the west of the US-Russia boundary demarcation. As the map illustrates, the Russian Chukchi JV acreage dwarfs the existing leases in US waters, and the eastern side of these blocks is close to the US-Russian border, raising questions about the effectiveness of the US ban on actually halting or even slowing development of oil and gas resources in the Arctic Ocean.

Comparison of

US and Russian Oil and Gas Leasing in the Chukchi Sea |

|

3D Maps

The following panel contains an interactive 3d elevation map of

Russia's Sakhalin Island.

The Energy Consulting Group home page