The Energy Consulting Group

Business strategy for upstream oil and gas producers and service companies

Our focus is to develop and implement strategies

that are practical, sustainable and allow organizations to achieve their

full potential. Our consultants have long histories of working closely with

senior executive teams of firms of all sizes to help their companies not

only be successful, but achieve performance that stands out relative to

peers.

.

Contact Bill at insight@energy-cg.com to

find out how we can help you.

| Utica Dry Gas "Super" Play Resource Potential |

Utica "super" shale web page

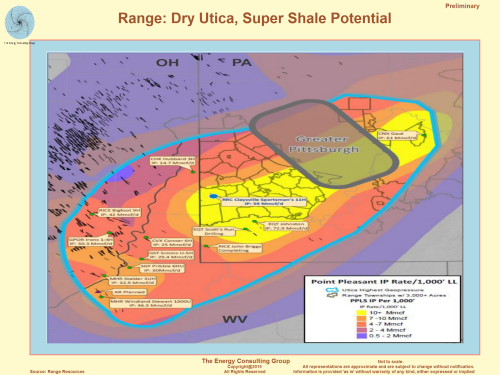

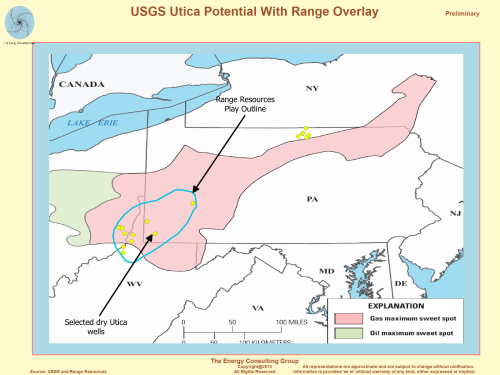

Range Resources: Dry Utica, Super Shale Potential Click Image for Larger Version USGS Utica Potential With Range Overlay  Click Image for Larger Version |

Using Range's map to the left, and assuming 4 wells/sq mile (160

acre spacing), and 20 BCF/well, the area within the blue outline

works out to a theoritical resource potential of approximately

400 TCF. The spacing is a general estimate, which means

that along with the BCF per well and area numbers, the spacing

assumptions are all

preliminary and subject to change as Utica wells are drilled and

placed on production. Some items to note. First, it is our view that the southern and northeastern boundaries of the southern dry Utica play are not yet fully defined, so it is possible that as additional wells are drilled in those areas, the play boundaries could be pushed further to the south and to the northeast. This is consistent with the USGS map, published in 2012, on the possible extent of the high potential parts of the Utica. Also, the 20 BCF/well is based on estimates listed in the July 9, 2015, Rice Energy presentation for its wells, which are close to the western boundary of the play, so it is possible that as the industry gains production experience with the dry Utica, we may see changes in the estimates for average per well recovery. Finally, Range references the "Point Pleasant" on its map, which many observers, us included, view as part of the Utica. Range uses IP per 1000' of horizontal lateral as the contour metric. To give some context as to what these values mean, one can look to the Marcellus where the wells are frequently around 2-4 mmscfpd/1000' of lateral. Per the Range map, the best Utica areas are clocking in at about 10-11 mmscfpd/1000'. However, it is worth noting that the Scott's Run well had an IP of over 22 mmscfpd/1000'. We believe one of the practical implications of this mega-find (keep in mind, as mapped by Range, it is considerably bigger than the much discussed gas discovery announced by ENI for deepwater Egypt, and which some are toting as the biggest discovery of the year) is that we believe it increases the likelihood that the DOE and FERC will approve additional US LNG export projects. Also intriguing is that some of the best parts of the Utica (and Marcellus, for that matter) could literally be under Pittsburgh. One expects that the Steel City might be able to make use of some of the cheapest energy in the world. This is especially the case as one of its main manufacturing competitors, Germany's Ruhr Valley, has some of the most expensive energy in the world. |

The Energy Consulting Group home page