The Energy Consulting Group

Business strategy for upstream oil and gas producers and service companies

| Kuwait Oil and Gas, Exploration and Production Industry |

|

E&P News and Information Scandinavian International and National International Energy

Agency Department of Trade and Norwegian

Petroleum Ministry of Industry

and E&P Project Information |

|---|

Kuwait: Country Overview

(source: EIA)

EIA Overview

Overview

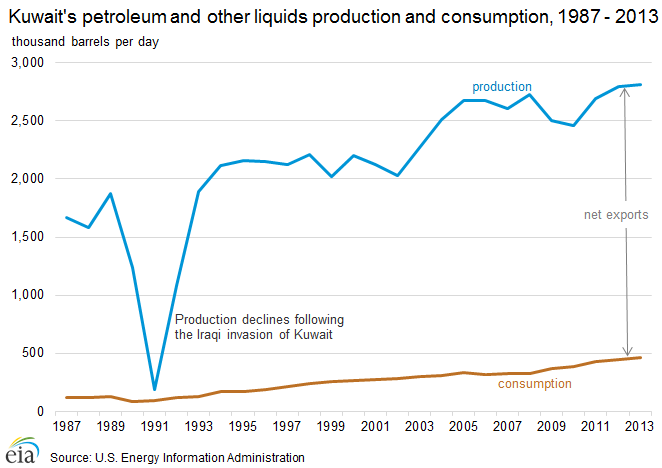

Kuwait was one of the world's top producers and net exporters of petroleum and other liquids in 2013.

As a member of the Organization of the Petroleum Exporting Countries (OPEC), Kuwait was the world's 10th largest petroleum and other liquids producer in 2013. Despite being the second smallest in land area among the OPEC member countries, Kuwait exports the fifth-largest volume of crude oil and condensates following Saudi Arabia, the United Arab Emirates, Iraq, and Nigeria.

Kuwait's economy is heavily dependent on petroleum export revenues, which account for nearly 60% its gross domestic product and about 94% of export revenues, according to OPEC and IMF data. EIA estimates these revenues were $92 billion in 2013. Kuwait attempts to remain one of the world's top oil producers as the country targets crude oil and condensate production of 4 million barrels per day (bbl/d) by 2020. However, Kuwait has struggled to boost oil and natural gas production for more than a decade because of upstream project delays and insufficient foreign investment.

To diversify its oil-heavy economy, Kuwait has increased efforts to explore and develop its nonassociated natural gas fields, which currently make up a small portion of its natural gas production. Greater natural gas production would increase Kuwait's feedstock for its struggling electricity sector, which frequently cannot meet demand in peak times. Kuwait has increased the share of natural gas in its primary energy consumption from 34% in 2009 to 42% in 2012, while the remaining share, consisting solely of petroleum and other liquids, has declined.

Energy policy is set by the Supreme Petroleum Council, overseen by the Ministry of Petroleum and is executed by the Kuwait Petroleum Corporation and its various subsidiaries. Kuwait also has an active sovereign-wealth fund, the Kuwait Investment Authority, which oversees all state expenditures and international investments.

Despite Kuwait's constitutional ban on foreign ownership of its resources and revenues, the government has taken measures to increase foreign participation in the oil and natural gas sectors through technical and service contracts. Kuwait is a constitutional emirate led by the Emir of Kuwait, a hereditary seat led by the Al-Sabah family. The Prime Minister and his deputy and the council of ministers are approved by the Emir. Kuwait's frequent delays of major energy projects are the result of political disagreements between the Emir and the parliament over contract management, especially those contracts involving foreign companies and project logistics.

Petroleum and other liquids

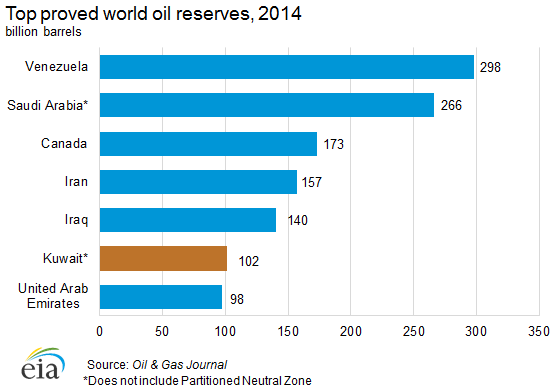

Kuwait holds the world's sixth-largest oil reserves and is one of the top 10 global producers and exporters of total petroleum liquids.

According to the Oil & Gas Journal (OGJ), as of January 2014, Kuwait had an estimated 102 billion barrels of proved oil reserves, roughly 6% of the world total and sixth among all countries. Additional reserves are held in the Partitioned Neutral Zone (PNZ), which Kuwait shares on a 50-50 basis with Saudi Arabia. The PNZ holds 5 billion barrels of proved reserves, bringing Kuwait's total oil reserves to 104.5 billion barrels. Kuwait's oil reserves include approximately 13 billion barrels of heavy oil, located primarily in northern Kuwait, with other reserves concentrated in the PNZ.

Sector organization

Kuwait Petroleum Corporation, Kuwait's national oil company, and its subsidiaries control the entire petroleum and other liquids sector from upstream to downstream and exports.

The government of Kuwait owns and controls all development of the oil sector. The Supreme Petroleum Council (SPC) oversees Kuwait's oil sector and sets oil policy. The SPC is headed by the Prime Minister. The rest of the council is made up of six ministers and six representatives from the private sector, all of whom serve three-year terms, and are selected by the Emir. The Ministry of Petroleum supervises all aspects of policy implementation in the upstream and downstream portions of the oil and natural gas sectors.

The Kuwait Petroleum Corporation (KPC) manages domestic and foreign oil investments. The Kuwait Oil Company (KOC), the upstream subsidiary of KPC, was taken over by the Kuwaiti government in 1975 and manages all upstream development in the oil and natural gas sectors. The Kuwait National Petroleum Company (KNPC) controls the downstream sector, while the Petrochemical Industries Company (PIC) is in charge of the petrochemical sector. Export operations are overseen by both KNPC and the Kuwait Oil Tanker Company (KOTC). Foreign interests of KPC are handled by the Kuwait Foreign Petroleum Exploration Company (Kufpec), and international upstream development and downstream operations are controlled by Kuwait Petroleum International (KPI). Kuwait Energy Company (KEC) is a privately-held company that has developed a number of foreign interests over the past decade, including interests in Yemen, Egypt, Russia, Pakistan, and Oman.

The Partitioned Neutral Zone (PNZ) has its own managing companies,

separated by onshore and offshore activities. The onshore sector was

developed by American Independent Oil Company (Aminoil), which was

nationalized in 1977. Getty Oil, which was subsumed by Chevron, was

brought in to develop onshore PNZ fields Wafra, South Umm Gudair, and

Humma. Chevron remains a participant along with KPC, although management

of all KPC's PNZ interests has been transferred to the Kuwait Gulf Oil

Company (KGOC). Offshore, a Japanese company, the Arabian Oil Company

(AOC) discovered the Khafji, Hout, Lulu, and Dorra oil fields in the

1960s. The concessions with Saudi Arabia and Kuwait expired in 2000 and

2002, respectively. KGOC was established in 2002 to oversee the offshore

operations for KPC. Subsequently, KGOC, along with Aramco Gulf

Operations Company (AOGC), set up a joint operating company, Al-Khafji

Joint Operations Company (KJO), which manages the offshore PNZ

production.

Exploration and production

Kuwait has implemented enhanced oil recovery measures to boost stagnant production rates. New discoveries have been made, but Kuwait's regulated oil sector has hindered further exploration and production.

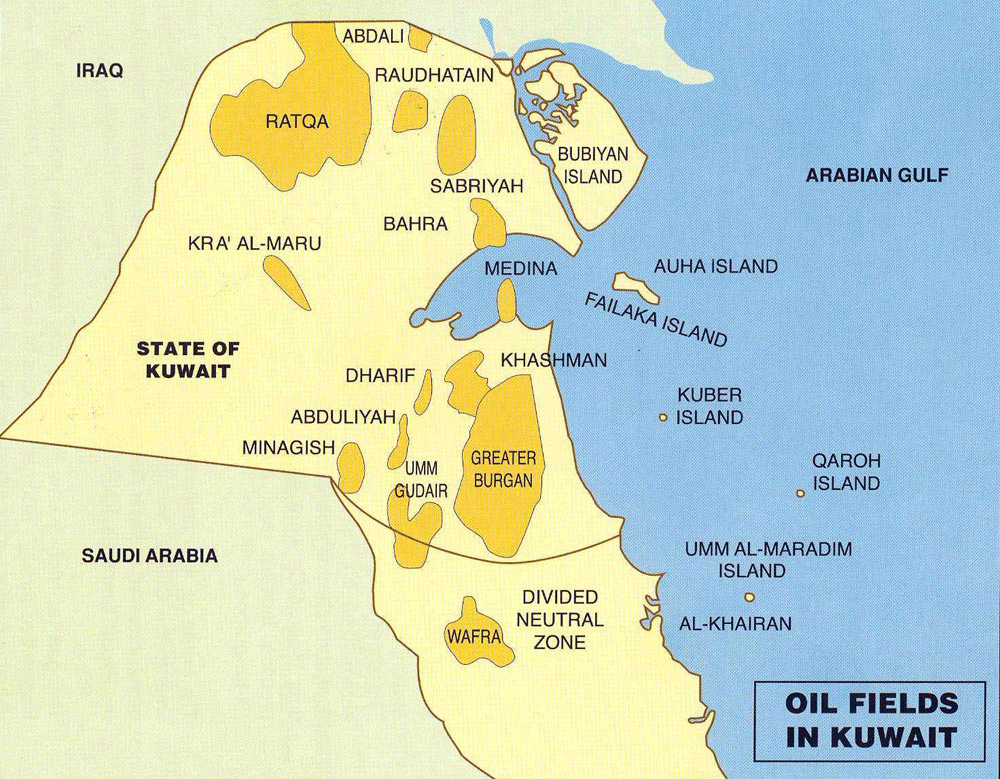

In 2013, Kuwait's petroleum and other liquids production was approximately 2.8 million barrels per day (bbl/d), including its share of approximately 250,000 bbl/d of oil production from the PNZ. Of the country's 2013 production, approximately 2.6 million bbl/d was crude oil and nearly 200,000 bbl/d was non-crude liquids. About half of Kuwaiti crude oil production in 2013 came from the southeast region of the country, largely from the Burgan field, which has a production capacity of 1.7 million bbl/d. Current crude oil production capacity from the northern fields has increased to approximately 700,000 bbl/d according to MEES. In early 2011, as one of the few OPEC members with spare capacity, Kuwait increased oil production to compensate for the loss of Libyan supplies.

Because of the constitutional ban on foreign ownership of Kuwait's natural resources, development of domestic fields has stalled. There have been several discoveries of lighter crudes in the center of the country, but progress has not moved toward production. In 1984, a discovery was made in South Maqwa in the Greater Burgan field, revealing light crude of API 35° to 40° grade, and after drilling began at Kra'a al-Mara in 1990, significant volumes of 49° API crude oil grade were found. Another discovery was made in 2006 in the Sabriya and Umm Niqa areas in the northern region of the country, which added an estimated 20 to 25 billion barrels of reserves, although mostly of a heavier, sour quality and more technically challenging to develop.

In a plan to circumvent the constitutional ban, international oil companies (IOCs) were allowed involvement through Enhanced Technical Service Agreements (ETSA) and through agreements to assist Kuwait in enhanced oil recovery (EOR) of its mature fields. Royal Dutch Shell, in February 2010, signed an ETSA to develop the Jurassic natural gas field in northern Kuwait, although progress to boost production has been slow. KOC is also having trouble developing the Lower Fars reservoir of the northern Ratqa field. KOC initially negotiated with ExxonMobil, Shell, and Total to develop this field, but KOC subsequently abandoned plans for a joint project development. KOC also signed a memorandum of understanding (MOU) in July 2010 with Japan Oil, Gas, and Metals National Corporation (JOGMEC) to assess the feasibility of carbon dioxide injection as a potential EOR technique.

KPC announced a $75-billion capital spending plan over five years (2015-20) for the upstream sector ($40 billion) and the downstream ($35 billion) sector, according to MEES. In efforts to continue economic reform and funding for large infrastructure projects, this plan encompasses some of the delayed projects that were part of the five-year spending plan expiring at the end of 2014. Kuwait intends to upgrade its production and export infrastructure, expand exploration, and build downstream facilities, both domestically and abroad. This effort is expected to boost total oil production capacity to 4 million bbl/d by 2020, and it is projected that the production capacity would be maintained through 2030. To achieve its 2020 target, IOC investment and participation will be necessary.

Much of Kuwait's reserves and production are concentrated in a few mature oil fields discovered in the 1930s and 1950s. The Greater Burgan oil field, which comprises the Burgan, Magwa, and Ahmadi reservoirs, makes up the main portion of both reserves and production. Burgan is widely considered the world's second-largest oil field, surpassed only by Saudi Arabia's Ghawar field. Greater Burgan was discovered in 1938, but it did not become fully developed until after World War II. The Greater Burgan has been producing consistently since production began. Generally, production from the Greater Burgan is medium to light crudes, with API gravities in the 28° to 36° range. Although the Greater Burgan's recent production of between 1.1 and 1.3 million bbl/d accounted for about half of Kuwait's total production, Burgan could be further developed to produce as much as 1.7 million bbl/d. KOC is seeking to boost the Greater Burgan's capacity largely from the Wara reservoir through enhanced oil recovery methods such as seawater and carbon dioxide injection.

Other production centers in the southwest region of the country include Umm Gudair, Minagish, and Abduliyah. Umm Gudair and Minagish produce a variety of crude oil grades, which largely fall in the medium range, with gravities of 22° to 34° API. In January 2003, water injection began at Minagish to enhance oil recovery and offset natural production declines. According to MEES, Kuwait plans to continue employing EOR techniques in the fields in western Kuwait to maintain output of 500,000 bbl/d from the region.

Northern Kuwait holds the majority of Kuwait's larger fields apart from the Greater Burgan field. Kuwait's second-largest source of crude production is from the northern Raudhatain field that has a capacity of 450,000 bbl/d, according to IHS Energy. The Sabriya field, adjacent to Raudhatain, adds another 100,000 bbl/d. The frontier fields of Ratqa, the southern extension of Iraq's Rumaila structure, and the smaller Abdali field were both obtained after the new border was established in 1993, following the end of the Persian Gulf War. In August 2010, British company Petrofac signed a deal with KOC to boost production capacity at Raudhatain and neighboring Sabriyah fields. Also, Kuwaiti and Iraqi officials agreed in principle to jointly develop shared oil fields, as well as to allow IOCs to aid in such projects.

Project KuwaitIn an otherwise nationalized oil sector, Project Kuwait attempts to incentivize foreign investment to bring production capacity to 4 million bbl/d by 2020.

Project Kuwait is a focal point of Kuwait's aspirations to attain a production capacity of 4 million bbl/d. Proposed in 1998, Project Kuwait was a concerted effort to create proper incentives to attract foreign participation, particularly for the country's northern fields. The contract structure that resulted was challenged as unconstitutional, and the National Assembly has impeded progress of Project Kuwait for a number of years. Kuwait's constitution bars foreign ownership of the country's natural resources, which precludes the product-sharing agreements (PSAs) that provide the desired incentive for IOC investment. To allow IOC involvement, an incentivized buy-back contract (IBBC) arrangement was created, which does not involve production sharing or concessions.

The structure of the IBBC agreements allows the Kuwaiti government to retain full ownership of oil reserves, control over oil production levels, and strategic management of the ventures. Foreign firms are to be paid a per unit (or barrel) fee, in addition to allowances for capital recovery and incentive fees for increasing reserves. In May 2007, the Kuwaiti ruling family conceded the responsibility of approving each related IBBC for Project Kuwait to the National Assembly, which has caused further delays. Additionally, more performance-based incentives have been introduced using the enhanced technical service agreement structure.

The ETSA forged between Kuwait and Royal Dutch Shell in 2010 was designed to raise associated light oil and condensates from the Jurassic natural gas field and to enhance prospects for foreign participation. Parliamentary investigations of the ETSA with Shell have delayed progress to increase output from the Jurassic field over the past few years and have hindered investments from other international companies. KOC intends to raise light oil production at the Jurassic field to 350,000 bbl/d from current output of less than 200,000 bbl/d.

Apart from associated oil production at the Jurassic field, Project Kuwait aims to increase the country's oil production capacity primarily from four northern oil fields (Raudhatain, Sabriya, Abdali, and Ratqa) and targets nearly 1.1 million bbl/d of output from the fields, up from about 700,000 bbl/d in 2014. This addition will serve as a pivotal component to increase overall oil production capacity to 4 million bbl/d by 2020. KOC announced it plans to spend $15 billion to expand output from non-heavy oil formations in the Sabriya and Raudhatain fields by about 300,000 bbl/d. Heavy oil from the Ratqa field is a major component of Project Kuwait, and it is expected to provide 60,000 bbl/d by 2017 in the first phase, 270,000 bbl/d by 2020 in the second phase, and 270,000 bbl/d by 2030 in a third phase. KOC tendered bids for engineering and procurement contracts for the Ratqa field in 2014.

An unconventional source of potential production will come from the clean-up of the large pools of crude oil that have remained since the withdrawal of the Iraqi army after the Persian Gulf War in 1991. In February 2012, KOC awarded tenders to HERA Company of Spain, GS Engineering and Construction Corporation of South Korea, and TERI Company of India to aid in soil remediation, which could result in significant crude oil volumes. The entire operation will take a number of years and cost roughly $3.5 billion, paid for by the United Nations reparations fund. However, the first phase involves only three sites. During the Persian Gulf War, the Iraqi army set more than 800 wells on fire, and estimates indicate that as much as 5 million bbl/d were lost over the nine months it took to extinguish the fires, which resulted in the creation of thousands of crude oil lakes. Additionally, the crude lakes restrict access to producing areas and known reserves, which further restricts exploration and production.

Partitioned Neutral ZoneThe territorial disputes between Kuwait and Saudi Arabia led to the creation of the Partitioned Neutral Zone. The production of oil and natural gas in the zone is divided equally between the two countries.

The Partitioned Neutral Zone (PNZ) was established in 1922 to settle a territorial dispute between Kuwait and Saudi Arabia. The PNZ encompasses a 6,200 square-mile area that contains an estimated 5 billion barrels of oil and 1 trillion cubic feet (Tcf) of natural gas, according to OGJ. Oil production capacity in the PNZ was 520,000 bbl/d in 2013, all of which was divided equally between Saudi Arabia and Kuwait.

Onshore production in the PNZ centers on the Wafra oil field, which began producing oil in 1954. Wafra is the largest of the PNZ's onshore fields with approximately 3.4 billion barrels in proved and probable reserves. Wafra has related production facilities and gathering centers with South Umm Gudair and South Fuwaris. Onshore production in the PNZ has a capacity of 300,000 bbl/d, but it is in decline. A full-field steam injection EOR project led by Chevron is under development to offset field declines and boost production of the heavy oil play by more than 80,000 bbl/d during the first phase. The project is experiencing delays, and Chevron expects the front-end engineering and design to commence in 2015.

The production capacity of offshore fields in the PNZ is less than 300,000 bbl/d, and Khafji Joint Operations, the joint venture developing the offshore capacity of the PNZ, plans to increase production to 400,000 bbl/d by 2019, according to the Wall Street Journal. Production offshore originates from a handful of major fields–Khafji, an extension of Saudi Arabia's Safaniyah (the world's largest offshore field); Hout, which is also an extension of Safaniyah; and Durra, an extension of Iran's Arash and shared with Saudi Arabia. Production at Durra is pending resolution of boundary demarcation negotiations and plans for joint development between Kuwait, Saudi Arabia, and Iran. Kuwait exited the Khafji expansion project in 2013 as a result of the country's political debate over project funding.

Exports and consumption

Kuwait's domestic consumption has been increasing, but a majority of its oil production is exported to Asia.

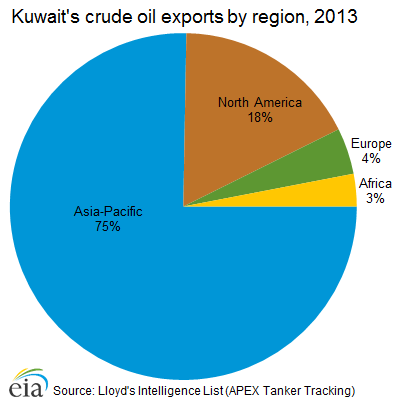

In 2013, Kuwaiti exports of crude oil were estimated at 1.9 million bbl/d, making Kuwait the sixth-largest exporter of crude oil among OPEC producers behind Saudi Arabia, the United Arab Emirates, Iraq, Nigeria, and Venezuela, according to tanker data from Lloyd's List Intelligence. Most Kuwaiti crude oil is sold on term contracts. Kuwait's crude exports are a single blend of all its crude types. The largest proportion is the medium Burgan crude, which is blended with heavier, sour crude from northern fields, as well as marginal amounts from Minagish and Umm Gudair. Kuwait's single export blend (called Kuwait Export) has a specific gravity of 31.4°API (a typical medium Mideast crude), and is generally considered sour, with 2.52% sulfur content. In 2013, the Asia-Pacific region received approximately 1.5 million bbl/d of crude oil. Exports to the United States totaled 334,000 bbl/d, and Europe received around 83,000 bbl/d, according to Lloyd's List Intelligence. The largest importers were South Korea and India. To secure more supply contracts with Asian consumers, Kuwait signed another 10-year contract to double the supply to China's Sinopec to 300,000 bbl/d starting in 2015.

With the majority of its crude oil export volumes headed to Asian markets, the most significant price benchmarks for Kuwaiti exports are Dubai Crude or Oman Crude or a combination of both, to which Kuwaiti oil exports are priced at a slight discount. As of the beginning of 2010, the price of Kuwaiti crude oil for U.S. customers was tied to the Argus Sour Crude Index (ASCI), a weighted average of various North American medium, sour crudes. European buyers purchase from a benchmark linked between a Brent weighted-average and Saudi Arab Medium.

Mina al-Ahmadi is Kuwait's main port for the export of crude oil. Kuwait also has operational oil export terminals at Mina Abdullah, at Shuaiba, and at Mina Saud, otherwise known as Mina al-Zour. Increased production generated by Iraq and the northern fields has necessitated the construction of a new terminal on Boubyan Island. This terminal is under construction and is slated to be online by 2015.

Kuwait consumes only a small portion of its total petroleum production. The country consumed a total of 467,000 bbl/d in 2013, leaving most of its production available for exports. According to OPEC, Kuwait exported 805,000 bbl/d of petroleum products in 2013, the highest level among OPEC members. However, domestic oil consumption has been steadily increasing, partially as a result of increased petroleum-fired electricity generation.

Refining

Kuwait maintains refining and marketing interests in Europe and looks to expand into Asia, particularly China, Vietnam, and Indonesia.

The OGJ reports nameplate refining capacity in Kuwait at 936,000 bbl/d in 2014. This production capacity is derived from three refinery complexes: al-Ahmadi, Abdullah, and al-Shuaiba. All of the refineries are located near the coastline, about 30 miles south of Kuwait City and are owned and operated by Kuwait National Petroleum Company (KNPC). The largest refinery, Mina al-Ahmadi, was built in 1949 and has a capacity of 466,000 bbl/d. Mina Abdullah and al-Shuaiba have nameplate capacities of 273,000 bbl/d and 190,000 bbl/d, respectively.

Kuwait Petroleum International (KPI) manages KPC's refining and marketing operations internationally. Its operations include approximately 4,000 retail stations across Belgium, Spain, Sweden, Luxembourg, and Italy. KPI has interests in two refineries, owning an 80,000 bbl/d refinery in Rotterdam, Netherlands and a 50-50 joint venture with Italian oil major ENI in the 240,000 bbl/d capacity refinery in Milazzo, Italy.

Kuwait is seeking to cultivate downstream interests in markets with high potential demand growth, the Asian market in particular, specifically China, Vietnam, and India. In China's Guangdong Province, KPC is negotiating a refinery and petrochemical joint venture with China's Sinopec. The plant will feature a 300,000 bbl/d capacity refinery, which will also have an ethylene steam cracker with the capacity to produce 0.8 million tons per year of ethylene and its derivatives. In March 2011, China's National Development and Reform Commission (NDRC) gave final approval to the project, making Kuwait the second Arab oil producer behind Saudi Arabia to have a major downstream facility in China. The project's equity shares are still under discussion, and it is unclear to what extent KPC will play a role. The refinery is under construction, although Sinopec delayed the commissioning date by a year to 2017.

Kuwait Petroleum International (KPI) joined with PetroVietnam and Japanese Idemitsu in April 2008 to construct a 200,000 bbl/d refinery in Nhi Son, Vietnam. The project began construction in 2013 and is expected online by 2017. KPI currently holds a 35% stake, and Kuwait has an agreement to supply the terminal with crude oil. To forge stronger ties with Indian purchasers, KPC proposed buying a stake in the Paradip refinery scheduled to come online by the end of 2014. The talks are at an initial stage, and no decision has been made.

Clean Fuels Project and Al-ZourIn June 2011, Kuwait's Supreme Petroleum Council approved two long-delayed projects: the Clean Fuels Project and the al-Zour refining facility. These two projects have an estimated combined cost of about $28 billion and will serve an increasing domestic oil demand, especially for the petrochemical sector, and for higher-quality products with lower sulfur content in Kuwait's traditional export markets.

The Clean Fuels Project (CFP) is slated to upgrade Kuwait's existing refineries and raise overall capacity to 800,000 bbl/d by 2018. The planned overhaul of Kuwait's refining sector includes building a new Al-Zour refinery, shutting down the al-Shuaiba refinery, and retiring old units and installing new components at the remaining refineries. A crude distillation unit will be taken out of commission at the Mina al-Ahmadi, and Mina Abdullah will lose a number of components, but its overall capacity will increase by 184,000 bbl/d.

The al-Zour refinery was originally put out for bids in 2008, but political opposition led to the cancellation of the bid round. This opposition forced KPC to compensate those companies who had spent resources preparing their bids, placing the entire project on hold. KNPC received the final approvals necessary to develop the Al-Zour project in 2012 and retendered the contracts in 2014. The new refinery is expected to add another 615,000 bbl/d of capacity by around 2020.

| Refinery | Current capacity (bbl/d) |

Planned capacity (bbl/d) |

|---|---|---|

| Existing LNG terminals | ||

| Mina al-Ahmadi | 466,000 | 346,000 |

| Mina Abdullah | 270,000 | 454,000 |

| Al-Shuaiba | 200,000 | 0 |

| Al-Zour | 0 | 615,000 |

| Total capacity | 936,000 | 1,415,000 |

|

Sources: OGJ, FACTS Global Energy, IEA, MEES, MEED |

||

Natural gas

Kuwait recently became a net importer of natural gas, leading the country to focus more on natural gas exploration and development for domestic consumption.

According to the Oil & Gas Journal, as of January 2014, Kuwait had an estimated 63 trillion cubic feet (Tcf) of proved natural gas reserves. Natural gas reserves have remained at the same level since 2006. Kuwait's intent to diversify its economy has spurred an extensive focus on natural gas exploration. Vast discoveries of nonassociated gas in the northern region of the country attracted interest from IOCs. However, contract structures and political uncertainty remain principal impediments to any rapid expansion of either reserves or production. Additionally, new natural gas discoveries are geologically more complex, mainly tight and sour natural gas deposits that require more sophisticated development and have higher capital costs.

Sector organization

Kuwait's natural gas sector, like the petroleum and other liquids sector, is also managed by Kuwait Petroleum Corporation. Kuwait is using technical service agreements to attract necessary international investment for natural gas development.

As in the oil sector, all of the natural gas resources are owned by the Kuwait Petroleum Corporation (KPC). The Kuwaiti constitution prohibits any use of production-sharing agreements (PSAs) that allow for an equity stake by an IOC in development projects; therefore, Kuwait is using technical service agreements (TSAs) to bring in IOCs to develop more difficult projects. In February 2010, Royal Dutch Shell signed an ETSA to develop the 2006 natural gas discoveries in northern Kuwait, known as the Jurassic fields, which contain 35 Tcf of reserves in place, the nature of which are too sour for local firms to develop.

Exploration and production

Kuwait plans to increase dry natural gas production to 3 billion cubic feet per day by 2030 to satisfy increasing domestic consumption and reduce dependence on natural gas imports during peak summer months.

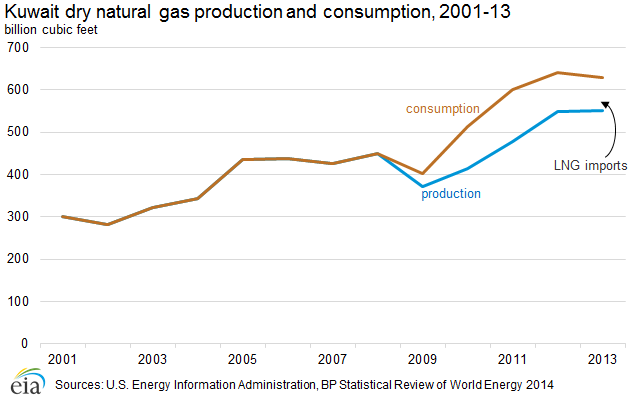

In 2013, Kuwait produced 1.5 billion cubic feet per day (Bcf/d), or 552 Bcf per year, of natural gas, the highest on record and up about 15% from production in 2011. Domestic natural gas supplies started rising after 2009 with the introduction of non-associated production and higher oil output in tandem with associated gas production. Given the predominance of associated natural gas in Kuwaiti production, domestic natural gas supplies have relied on OPEC crude oil production quotas.

Kuwait requires increasing supplies of natural gas for the generation of electricity, water desalination, and petrochemicals, as well as for the increased use for enhanced oil recovery (EOR) techniques to boost oil production. Kuwait is shifting its exploration efforts to focus on natural gas discoveries to reduce dependence on imports of liquefied natural gas (LNG) and to decrease the share of oil used domestically, particularly for electricity and desalination plants. KOC has announced a production target of 3 Bcf/d by 2030, double the current production level.

Associated natural gas production makes up the majority of Kuwait's overall production. In 2013, more than 1 Bcf/d was produced from associated gas, while nonassociated gas production amounted to only 150-200 million cubic feet per day (MMcf/d), according to IHS Energy. Production of nonassociated natural gas from the northern region of Kuwait is seen as the most promising source of future natural gas production growth. Given Kuwait's challenging fiscal and political climate, not much progress has been made in exploring offshore prospects, leaving Kuwait to focus on its natural gas discoveries in its northern region. KPC intended to produce about 1 Bcf/d of nonassociated gas from these fields by 2015, although this goal is likely to be pushed back to 2020 because projects have experienced delays, according to MEES.

The Jurassic nonassociated gas field was discovered in 2006, with an estimated 35 Tcf of reserves. This project has been described as the most difficult in the world, based on the geologic composition, the technical complexities it presents, and the fact that most of the gas quality is tight and ultra-sour. A first phase envisioned 170 MMcf/d of natural gas by 2008. However, it reached a production plateau of 140 MMcf/d, according to IHS Energy. The second phase, which is under construction and scheduled to come online by 2014, has a projected capacity of 500 MMcf/d. A third phase is expected to bring production capacity up to 1 Bcf/d, but political and technical difficulties have occurred. Shell is developing the Jurassic project with KOC through its 2010 ETSA, although the government has held up future phases of the project as the parliament investigates the contract terms.

The other prospect for nonassociated natural gas production is the Dorra gas field offshore PNZ. This field is shared by Kuwait, Saudi Arabia, and Iran. Kuwait and Saudi Arabia originally planned to begin production at Dorra by 2017, providing an additional 500 MMcf/d for each country, while Iran planned to develop its own side of the field. However, Kuwait and Saudi Arabia decided to delay project development in 2013 because there was disagreement over the allocation of resources and about where to bring the natural gas ashore. Also, political tensions between the Gulf States and Iran, which also lays claim to the field, are likely to preclude any near-term settlement of mutual development between the three countries.

Kuwait is also expanding its natural gas processing infrastructure to meet rising domestic demand. In 2014, Daelim of South Korea commissioned Kuwait's fourth and largest gas-processing train of the Ahmadi refinery, which as the ability to process 805 MMcf/d of associated gas and 106,000 bbl/d of condensate. This unit will give Kuwait an overall processing capacity of 2.4 Bcf/d for processing liquefied petroleum gas. A fifth train will boost capacity by an additional 800 MMcf/d to 3.2 Bcf/d and is currently in the planning stages. However, neither the current production plans nor the expansion of processing facilities is expected to meet the growing levels of domestic demand for natural gas.

Consumption and imports

In 2013, Kuwait consumed approximately 1.7 Bcf/d of natural gas, equivalent to 630 Bcf per year. Kuwait's electricity demand, fueled increasingly by natural gas, has outpaced domestic natural gas production during the summer months. This increased demand has resulted in the shutdown of refinery and petrochemical operations to make more natural gas available to generate electricity. Kuwait is seeking to diversify its electricity generation supply portfolio by replacing some petroleum products with more natural gas and renewables. Insufficient domestic natural gas supply has contributed to frequent blackouts and brownouts during peak demand periods. As such, Kuwait resorted to importing LNG as a stopgap measure during the summer months starting in 2009. In 2013, Kuwait imported about 210 MMcf/d (77 Bcf/y) of LNG, representing about 12% of the total natural gas supply, according to IHS Energy.

Kuwait signed supply purchase agreements with Shell and the energy trading company Vitol and received LNG supplies from 2009 through 2013. Kuwait took delivery of the LNG at the Persian Gulf's first regasification terminal, Mina al-Ahmadi GasPort, a floating facility that has the flexibility to supply LNG to Kuwait during periods of high seasonal demand. The regasification capacity of al-Ahmadi is 500 MMcf/d. When Kuwait's contract with Excelerate expired in 2013, Kuwait signed another five-year contract with Golar LNG to charter a larger floating LNG vessel with a capacity of 760 MMcf/d. The contract expires in 2019 when Kuwait hopes it can boost domestic natural gas production and establish a permanent land-based liquefaction terminal. The proposed onshore LNG plant could meet Kuwait's natural gas demand year-round. The Mina al-Ahmadi onshore terminal is designed to have a processing capacity of 1.5 Bcf/d.

LNG imports are largely from Qatar, with small amounts from Nigeria. Kuwait holds medium-term contracts with Shell and BP for cargoes and accepts cargoes from their international portfolios. Other imports are part of a short-term agreement with Qatargas or are spot cargoes.

Kuwait has also recently exhibited interest in supplies from the impending natural gas project in Southern Iraq. Shell, Mitsubishi, and Iraqi state-owned Southern Oil Company (SOC) are developing infrastructure to gather associated natural gas from Iraq's southern oil fields. A potential pipeline from Iran's South Pars gas field has been placed on hold, as political considerations make the project less likely. These prospective pipeline imports would still not eliminate the need for continued LNG imports.

Electricity

Kuwait's electric sector capacity has been slow to expand despite rapidly rising consumption rates over the past decade and persistent power shortages during peak demand periods.

Kuwait relies on fossil fuels, namely oil and natural gas, to generate its electricity. The country struggles to produce and import sufficient natural gas to meet peak electricity demand in the summer months, and as a result, depends on more expensive and heavy fuel oil and crude oil. Kuwait's economy relies heavily on oil export revenues; therefore, it has financial incentives to move away from burning oil for domestic power use. In 2011, oil accounted for more than 70% of Kuwait's power generation in 2011, while natural gas made up about 28%, according to IHS Energy.

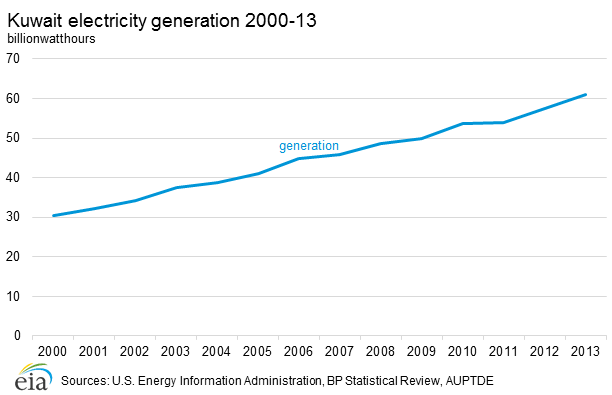

In 2013, Kuwait had an installed electric generation capacity of 15.7 gigawatts (GW), according to the Arab Union of Electricity, and the country generated electricity at a 44% capacity factor, resulting in an average output of nearly 7 GW. Peak demand in 2013 was 12.1 GW and has been increasing each year since 2004. The rate of growth of power generation capacity is not keeping pace with the rate of growth in demand which has averaged around 5% annually over the past decade. The Arab Union of Electricity expects that Kuwait's power generation will more than double in the next decade from 61 terawatthours (Twh) in 2013 to 142 Twh in 2024.

Kuwait's increasing population and gross domestic product levels and low electricity tariffs over the past decade have led to higher demand in the residential sector. According to the World Bank, Kuwait was the world's fourth-largest electricity consumer on a per capita basis in 2011. In the past decade, the development of Kuwait's electricity sector has stalled because of political factors and a lack of investment. The country is slow to implement generation capacity projects because of political infighting between the Emir and the National Assembly. Also, the lack of natural gas supply has contributed to the chronic shortages in electricity supply as Kuwait focuses on building gas-fired power generation. Formerly having one of the largest generation reserve margins in the Persian Gulf region before 2006, Kuwait is perpetually in a state of electricity shortage and experiences frequent blackouts and brownouts each summer.

Given the rapidly increasing power demand over the past decade, the Kuwaiti government unveiled an extensive development plan for the electric grid. Since 2007, the Kuwaiti government has commissioned approximately 5 GW in capacity through new combined-cycle gas-fired plants and several smaller expansions to oil-fired facilities; although, this is still insufficient to close the gap between electricity supply and demand. The Kuwaiti government plans to increase installed capacity to 25 GW by 2020 to meet anticipated peak demand of 22.5 GW and to have a reserve margin of more than 10%. Most of this planned capacity will be fueled by natural gas or oil. Kuwait does plan to generate 5% of its electricity from renewable sources by 2020 and 15% by 2030, primarily by using the country's solar and wind potential, according to a MEED Insight report.

To achieve the goals, Kuwait is employing more private capital through public-private projects (PPP), as well as independent water and power projects (IWPP). Kuwait was the last Persian Gulf country to incorporate the private sector into the development of its electric sector. The first evidence of private sector participation is the expansion project of the Al-Subiya power plant built by General Electric (GE) and Hyundai Heavy Industries of South Korea. In July 2012, GE and Hyundai completed the 700 MW expansion of the power plant to its nameplate capacity of 2,000 MW. The power plant is a combined-cycle facility, using primarily natural gas, with heavy fuel oil as a back-up fuel.

The Kuwaiti government is constructing the country's first independent power plant, Al-Zour North, with a consortium, (GDF SUEZ, Sumitomo, and Abdullah Hamad Al Sagar & Brothers) that owns 40% of the facility. The first phase of the gas-fired Al-Zour North facility has a generating capacity of 1.5 GW and is scheduled to come online by the end of 2016. The second phase will add another 1.5 GW and is in the tendering process. Total capacity for all four phases of Al-Zour North is 4.8 GW which, if constructed, is expected to meet anticipated electricity demand.

Besides Al-Zour North, two other power plants are under development to achieve the forecast capacity and bring an adequate buffer between peak demand and generation capacity. The Al-Abdaliya project is slated to be the country's first renewable power plant with a dual-fuel capability of a solar unit and a combined-cycle unit. Total capacity is 280 MW, with 60 MW coming from solar energy. The government is adding two smaller expansion plants with 500 MW each as a short-term solution to meet the rising power needs. In total, these projects will add 6.78 GW of capacity to the electric grid.

| Project | Generation capacity |

Fuel |

|---|---|---|

| Al-Zour South Upgrade | 0.5 GW | Natural gas |

| Al-Sabiya Expansion | 0.5 GW | Natural gas |

| Al-Zour North Phase 1 | 1.5 GW | Natural gas |

| Al-Zour North Phase 2 | 1.5 GW | Natural gas |

| Al-Khairan Phase 1 | 2.5 GW | Natural gas and oil |

| Al-Abdaliya | 0.28 GW | Natural gas and solar |

| Total additional capacity | 6.78 GW | |

|

Sources: Ministry of Electricity and Water, Middle East Economic Survey, Middle East Economic Digest |

||

Nuclear power

In 2009 Kuwait started plans to develop nuclear energy plants and announced its intention to establish a nuclear commission. In January 2010, the head of the National Nuclear Energy Committee announced a 20-year cooperative deal with the French Atomic Energy Commission to develop nuclear power in Kuwait. Kuwait was considering constructing four nuclear reactors, set to become operational by 2022. The country agreed to allow International Atomic Energy Agency (IAEA) inspectors into any future nuclear sites. However, following Japan's Fukushima nuclear disaster in 2011, Kuwait dissolved its National Nuclear Energy Committee and decided to suspend its plans to produce nuclear power.

Gulf Cooperation Council (GCC) grid

Facing rising electricity demand, the Gulf Cooperation Council is developing an interconnected power grid.

The member countries of the Gulf Cooperation Council (GCC) (Kuwait is a member) face rapidly increasing demand for electricity. As a result, the six Gulf countries (the United Arab Emirates (UAE), Kuwait, Qatar, Bahrain, Saudi Arabia, and Oman) commissioned a region-wide power grid. This three-phase project, completed in late 2012, connected the Northern System—Kuwait, Bahrain, Saudi Arabia, Qatar—to the Southern System—UAE, and Oman. Some analysts believe the GCC Grid has the potential to expand into North Africa and eventually link with Europe's power grids. Kuwait already has needed to import electricity from the Northern System, as it has experienced electricity supply shortfalls. In addition to meeting the growing electricity demands and sharing electricity reserve requirements in the Gulf countries, the integrated power grids will reduce power outages in the short term and increase power exchange across seasons and time zones.

Notes

- Data presented in the text are the most recent available as of October 24, 2014.

- Data are EIA estimates unless otherwise noted.

Sources

Agence France Presse

APS Gas Market Trends

APS Oil Market Trends

APS Review Downstream Trends

Arab Oil and Gas Journal

Arab Times

Arab Union of Electricity

Business Monitor International

Cambridge Energy Research Associates

CIA World Factbook

Dow Jones News Wire service

Economist Intelligence Unit

Energy Intelligence

FACTS Global Energy

Financial Times

IHS Energy

International Energy Agency

International Monetary Fund

Kuwait Petroleum International

Kuwait Times

Kuwaiti Foreign Petroleum Exploration Company

Kuwaiti News Agency

Middle East and Africa Oil and Gas Insights

Middle East Economic Digest

Middle East Economic Survey

Oil and Gas Journal

OPEC

Petroleum Economist

Petroleum Intelligence Weekly

PFC Energy

Platts McGraw-Hill Financial

Reuters

Saudi Gazette

Stratfor.com

Upstream Online

U.S. Energy Information Administration

Wall Street Journal

World Bank

World Gas Intelligence

The Energy Consulting Group home page